2025 Report

The State Of AI

Costs In 2025

We surveyed 500 engineering professionals on the state of their AI costs in 2025. Here’s what we found …

Table Of Contents

- AI budget allocation and spending trends

- Tracking AI costs and measuring ROI

- The key factors driving AI spending

- The most used AI tools, platforms, and services

- The AI talent landscape: salaries, skills and staffing struggles

- Conclusion: AI innovation must be paired with cost intelligence

- Methodology

Artificial intelligence (AI) has become a cornerstone of modern business strategy,

powering innovation, efficiency, and growth across industries. From intelligent automation to machine learning at scale, AI is transforming how organizations operate and deliver value.

However, as AI adoption accelerates, a new challenge has emerged: managing the rapidly growing costs of AI in a scalable and intelligent way. Businesses must balance the transformative potential of AI with growing pressure to optimize spending, control cloud costs, and ensure long-term profitability.

To uncover how companies navigate this complex landscape, we surveyed 500 software engineers at the manager level and above across the U.S. This report explores how organizations are budgeting for AI, where they’re investing, and what’s standing in the way of achieving true AI return on investment (ROI).

Our findings reveal a heady but volatile dynamic. AI momentum and budgets grow rapidly, as do organizations’ confidence in its value — however, organizations report

misalignment, limited AI governance, and difficulty calculating AI ROI. As cloud-based AI tools consume the lion’s share of budgets, cost visibility and attribution have become essential. Without these, even the most ambitious AI strategies risk becoming unpredictable and unsustainable.

Key Takeaways

- AI spending is surging — average monthly AI budgets are set to rise by 36% in 2025, reflecting a major shift toward larger, more complex AI initiatives.

- Only 51% of organizations can confidently evaluate AI ROI, highlighting a growing visibility gap. At the same time, the dominance of cloud-based tools makes cloud cost visibility and attribution crucial for optimizing AI ROI.

- Organizations using third-party cost optimization tools report stronger ROI confidence, signaling the need for better observability.

- The most widely used AI tools are designed for automation, scalability, and cloud deployment — but without effective cost tracking, their profitability remains uncertain.

- Cloud computing and data engineering are the most in-demand AI skills, while high salary expectations and a lack of internal expertise to evaluate candidates are the greatest challenges in AI hiring.

01

AI budget allocation and spending trends

Monthly AI budgets are on the rise in 2025

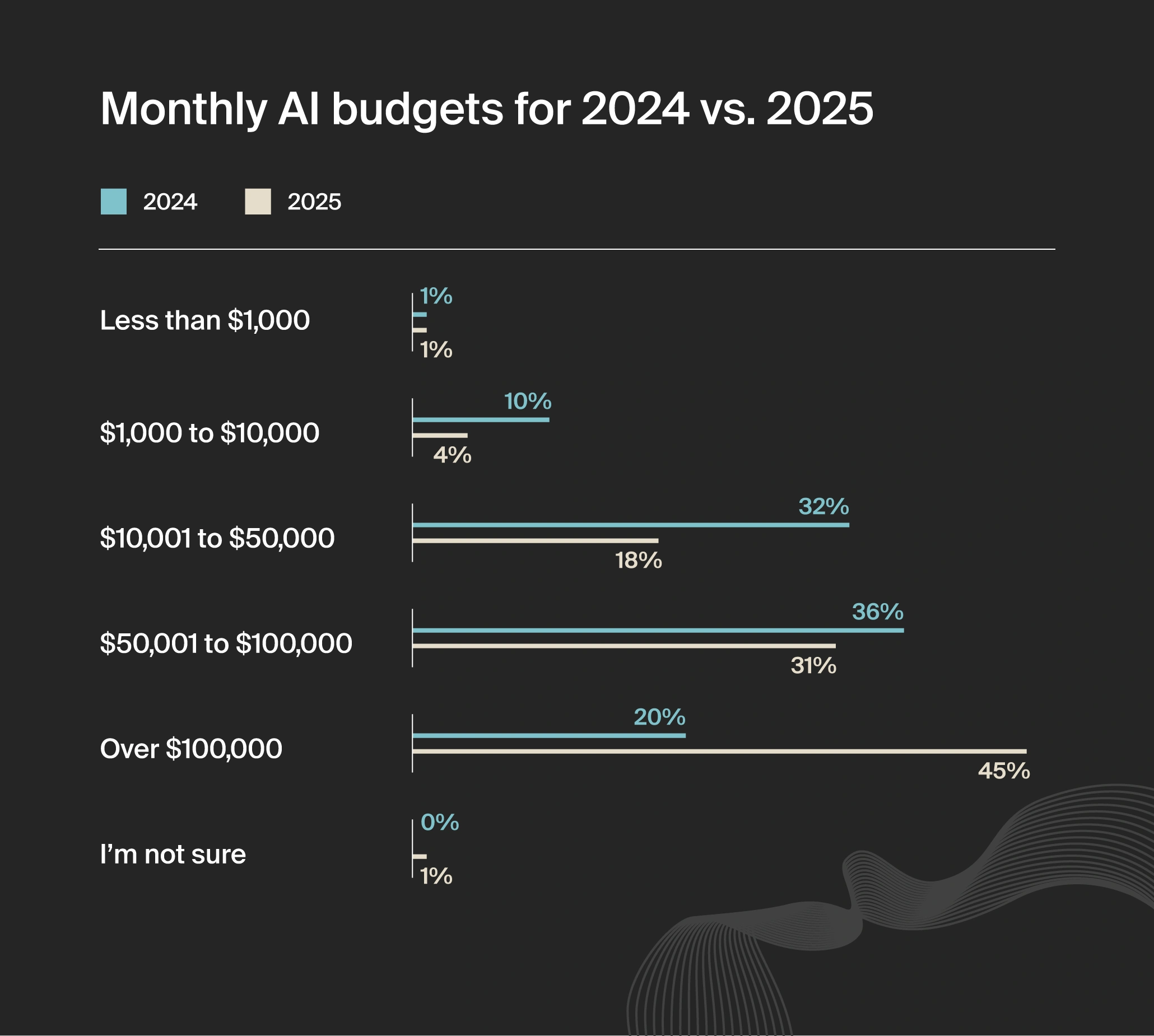

In 2024, the average monthly spend on AI was $62,964, which our findings suggest will rise to $85,521 in 2025 (a 36% increase). Notably, the proportion of organizations planning to invest over $100,000 per month in AI tools is set to more than double, jumping from 20% in 2024 to 45% in 2025.

This surge in spending suggests businesses are ramping up their AI initiatives to drive greater efficiency, fuel innovation, and maintain a competitive edge. But as budgets rise, organizations must face a critical question: Are we confident in the return we’re getting from our AI investments?

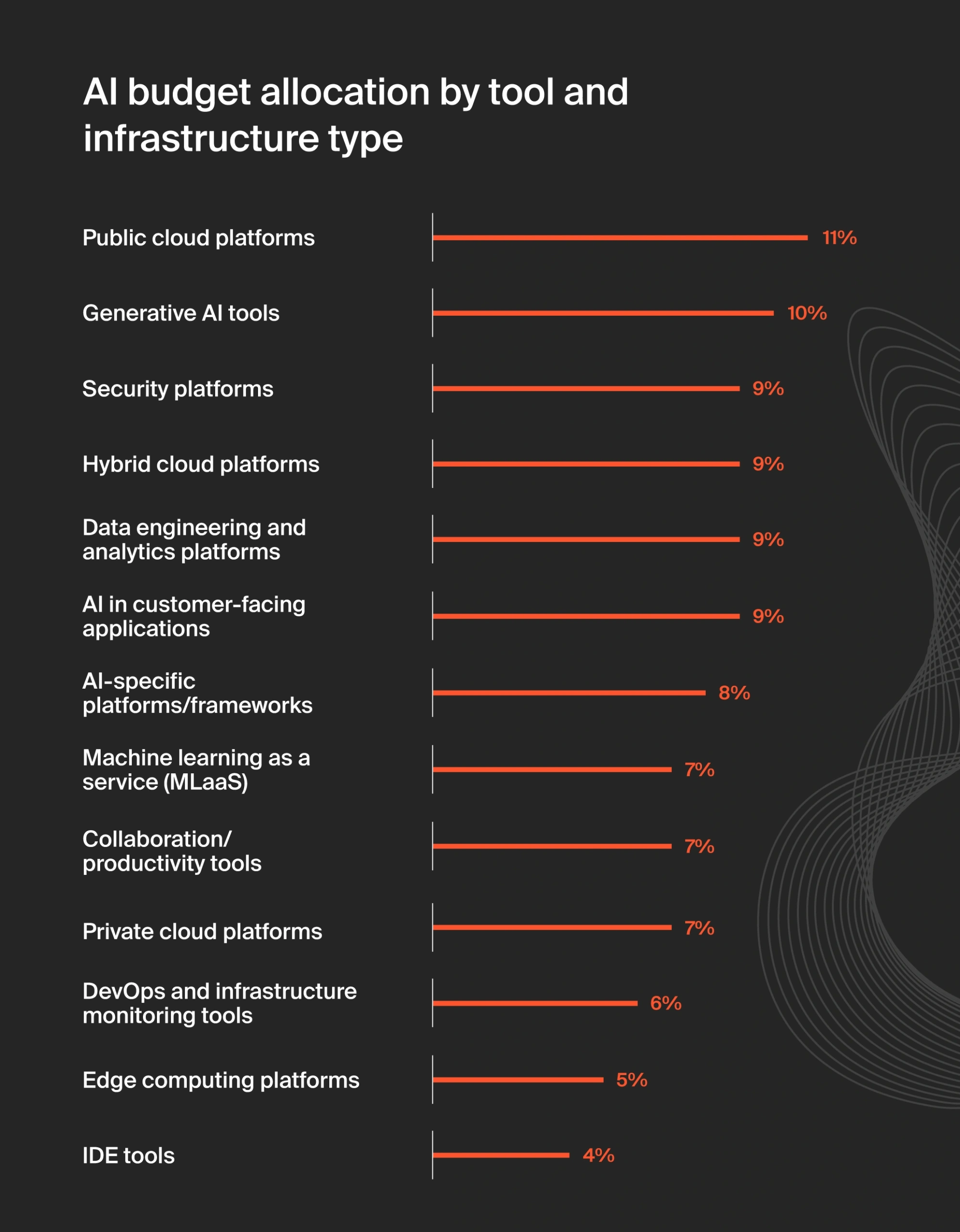

Public cloud platforms receive the highest AI budget allocation

Companies are strategically investing in AI, with public cloud platforms receiving the largest share of AI budgets (11%), showing their role in scaling AI workloads. Generative AI tools follow at 10%, reflecting their growing impact on innovation and operations.

Security platforms account for 9% of budgets, highlighting concerns around protecting AI systems. Hybrid cloud and AI-specific platforms see moderate investment, balancing flexibility with specialization.

When it comes to future AI budgeting, we know that the majority of companies intend to scale up their AI spend in 2025. But which areas in particular are they planning to prioritize for spending over the next 12 months?

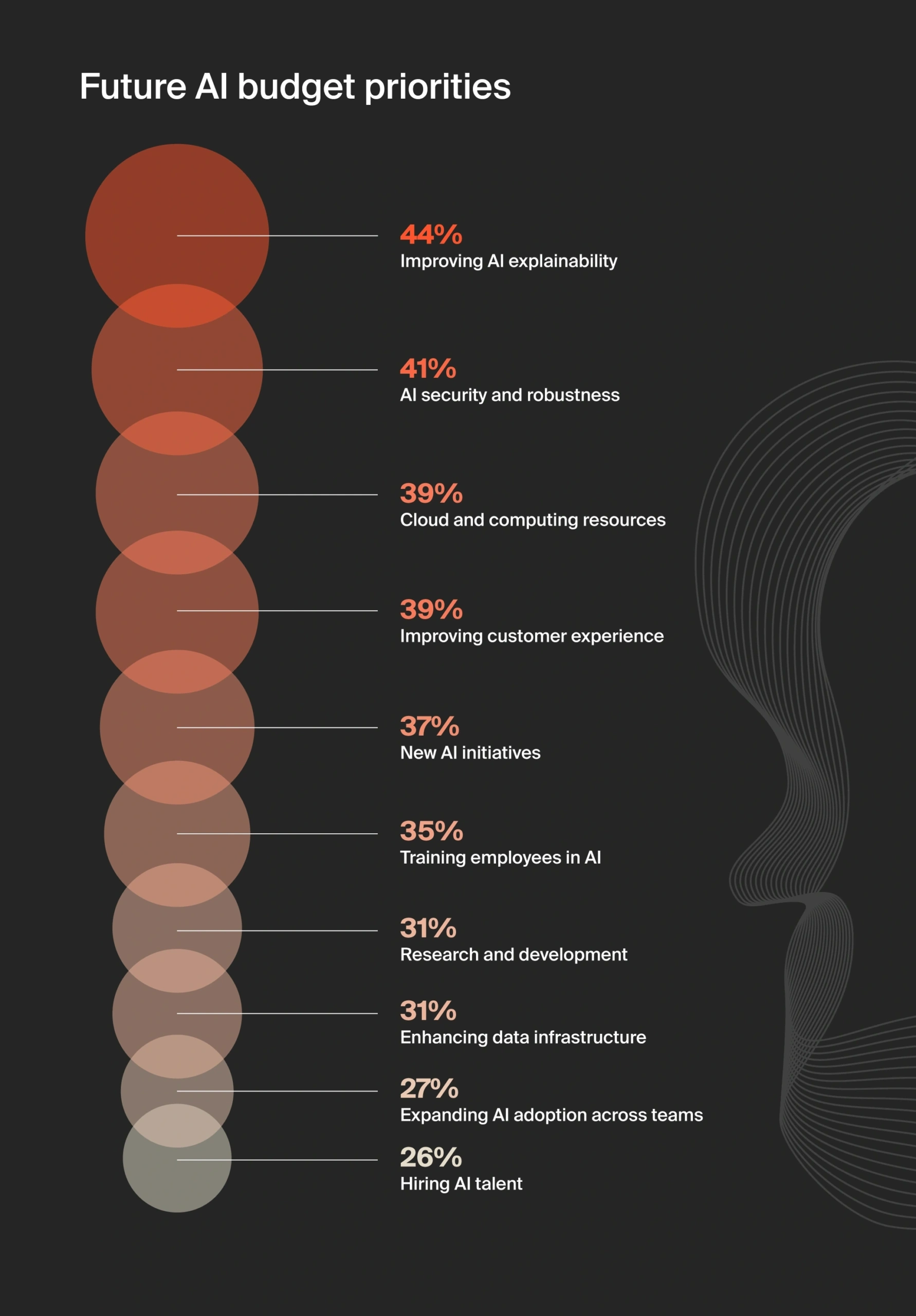

Nearly half of companies plan to prioritize AI explainability

In 2025, 44% of organizations plan to invest in improving AI explainability, aiming to boost transparency and accountability in AI systems, making AI models more understandable to users by clarifying how decisions are made. This investment often takes the form of hiring specialized talent and integrating third-party tools that provide model interpretability.

Beyond explainability, the top areas organizations plan to prioritize in thecoming year include AI security and robustness (41%), cloud and computing resources (39%), and improving customer experience (39%). These focus areas signal a broader shift toward more responsible, transparent, and scalable AI deployment.

While explainability leads the pack, the overall distribution of budget priorities suggests a relative parity across categories, organizations are committing investment across a wide range of AI capabilities, indicating a holistic approach to AI maturity.

Large enterprises are prioritizing new AI initiatives, while smaller companies focus on cloud resources

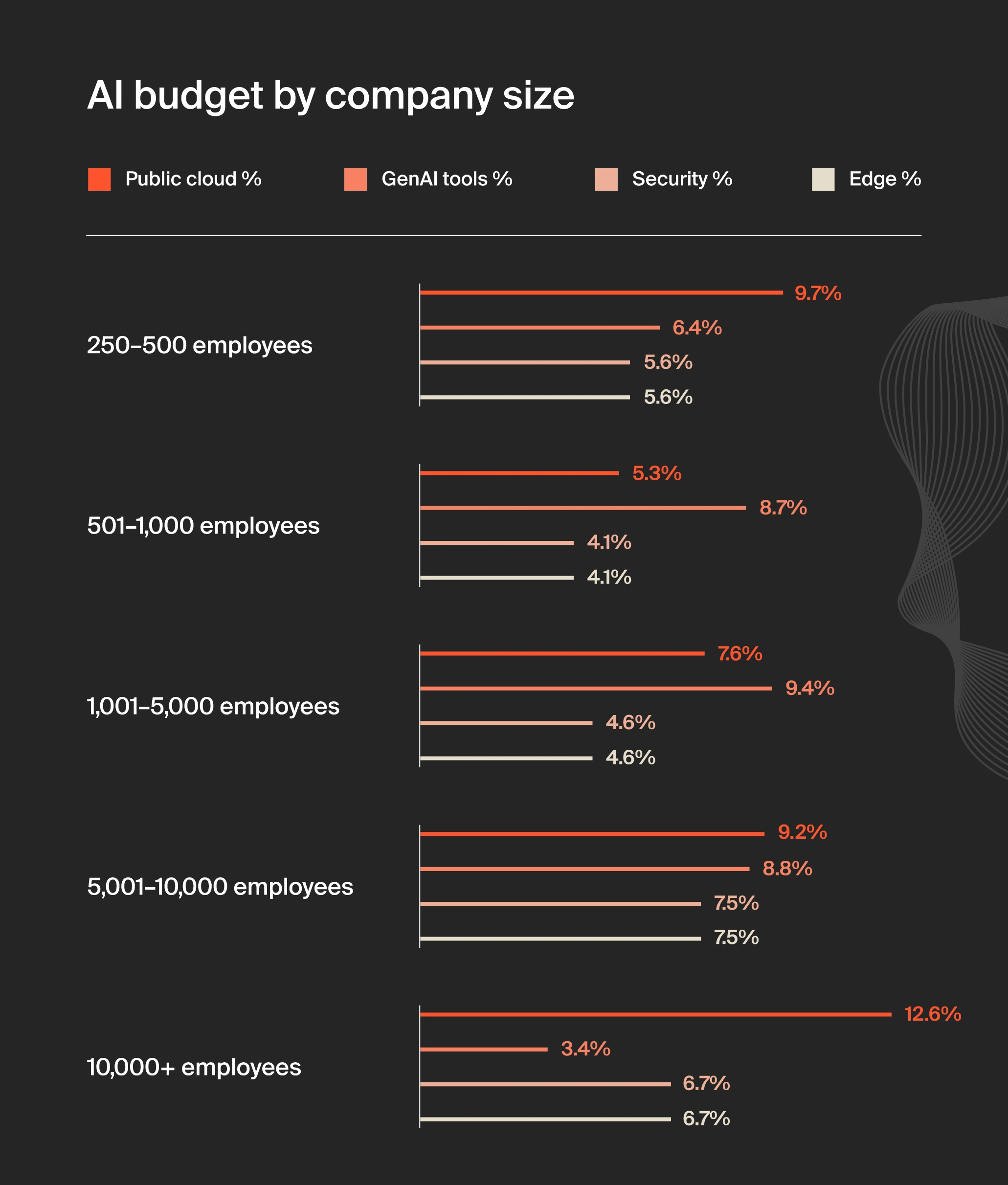

The focus of future AI investments varies significantly depending on company size.

Larger companies (10,000+ employees) are particularly focused on scaling AI adoption, with half prioritizing new AI initiatives and 43% investing in training their employees in AI. This reflects their strategic emphasis on expanding AI capabilities across the organization.

In contrast, mid-sized companies (1,001 to 10,000 employees) are channeling substantial resources into cloud and computing infrastructure, with 54% investing heavily in scalable AI solutions to support their growing needs.

Smaller companies (250 to 500 employees) are also focused on cloud and computing resources, but at a lower rate of 38%.

Key takeaways

$85,521

Average monthly spend on AI

36%

Average increase in year-to-year

AI spend

43%

Organizations planning to spend $100,000 or more per month on AI

12%

Of AI budgets are allocated to public cloud platform

02

Tracking AI costs and measuring ROI

As AI adoption grows, managing costs is becoming more complex. Cloud computing, model training, and AI applications can drive expenses up quickly, requiring more than simply tracking spend. Yet, for many organizations, accurately tracking these costs and evaluating AI return on investment (ROI) remains a major challenge.

Why ROI measurement is difficult

Understanding AI-driven revenue is key for businesses to justify investments, assess effectiveness, and prioritize high-return projects. However, accurately measuring ROI remains a challenge for many companies. Common obstacles include:

- Difficulty in isolating AI’s impact from other business factors

- Difficulty attributing AI costs to the correct sources

- Long implementation timelines before seeing tangible results

- Hidden costs such as cloud expenses and maintenance

As a result, only 51% of organizations strongly agree they can track AI ROI effectively, even though 91% claim overall confidence in their ability to evaluate it. This gap between perception and precision reveals a need for more robust cost attribution and tracking methods.

Tooling gaps undermine cost visibility

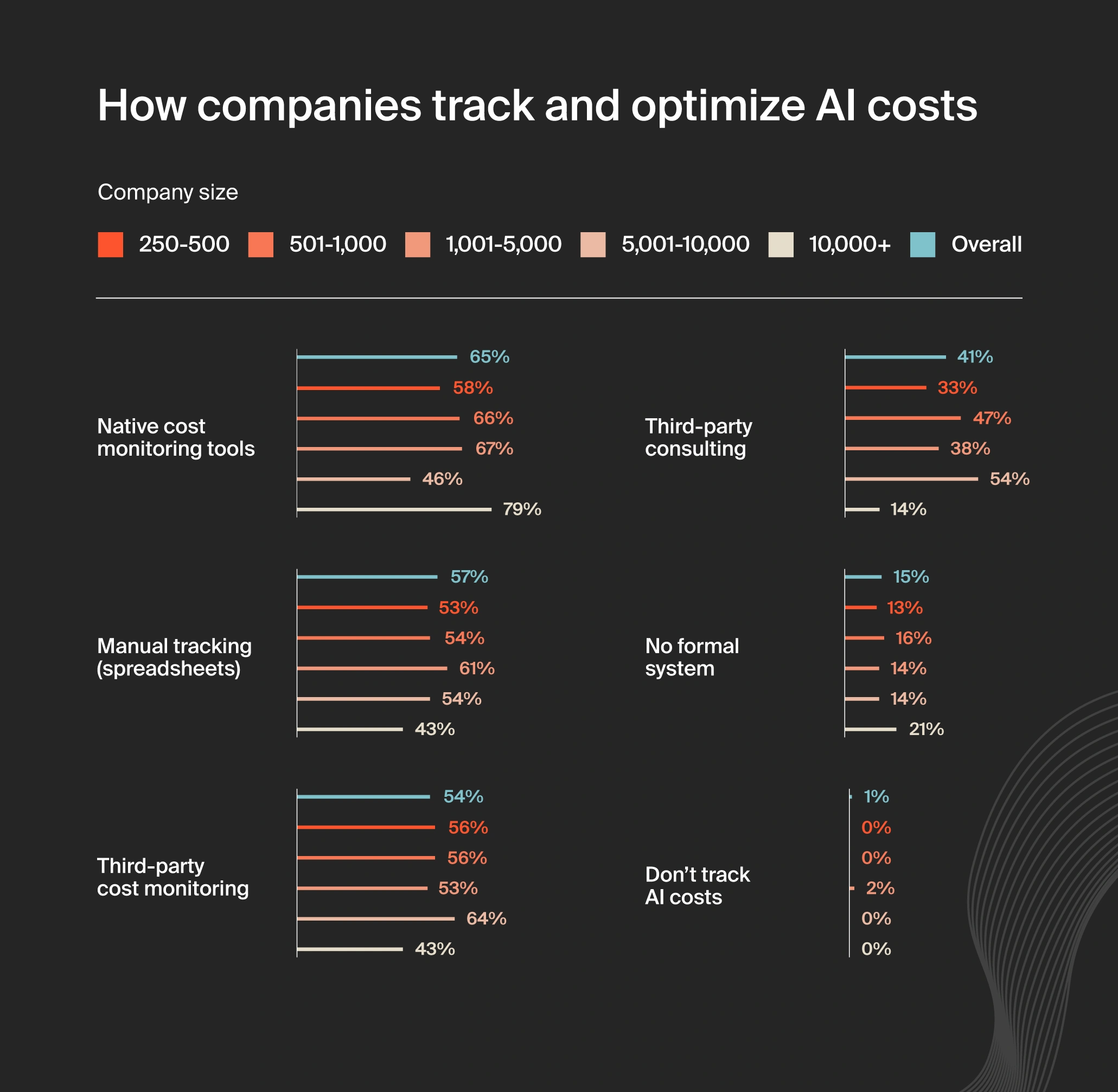

We found some big variations in how companies track their AI spending depending on their size.

While large companies lean heavily on vendor-native tools (79%), many lack the granular cost attribution that third-party platforms provide. Without complete cost allocation (to get cost per feature, product, team, customer, microservice, etc.), it’s impossible to know exactly who or what is driving which costs and, by extension, how to hold them accountable.

We also found that 21% of larger companies don’t have any formal cost-tracking systems in place — meaning they stand the risk of overspending on AI without clear visibility into where their budget is going. Meanwhile, mid-sized companies are the biggest users of third-party cost monitoring tools (64%).

Manual tracking prevails — but at a cost

While 65% of companies use native tools and 54% use third-party platforms, many still rely on spreadsheets (57%) or consultants (41%) as core cost management methods. Further, a concerning one in six (15%) companies admitted to not having any formal cost-tracking system in place.

This points to a clear opportunity: organizations should move beyond reactive methods and adopt scalable cost visibility systems to control spending, improve efficiency, and maximize ROI.

Confidence in ROI correlates with cost optimization tools

More than 90% of companies using third-party platforms, like CloudZero, reported high awareness of AI-driven revenue. This enables them to directly compare revenue and cost, resulting in highly reliable ROI calculations.

On the other hand, organizations without any formal cost-tracking system in place are far less confident in their ability to accurately evaluate the ROI of AI initiatives. 41% indicated that they only “somewhat agree” that they can do this, highlighting the importance of adopting formal, reliable cost-tracking systems to accurately evaluate ROI.

Key takeaways

15%

Companies with no AI cost tracking in place

57%

Manually track AI costs

90%

Confidence in cost tracking when using third-party systems

03

The key factors driving AI spending

In this section, we’ll explore the primary factors influencing AI spending. Understanding these key drivers will provide insight into why organizations are prioritizing AI and how they are allocating their budgets to maximize value.

More companies are investing in AI for internal efficiencies rather than market differentiation

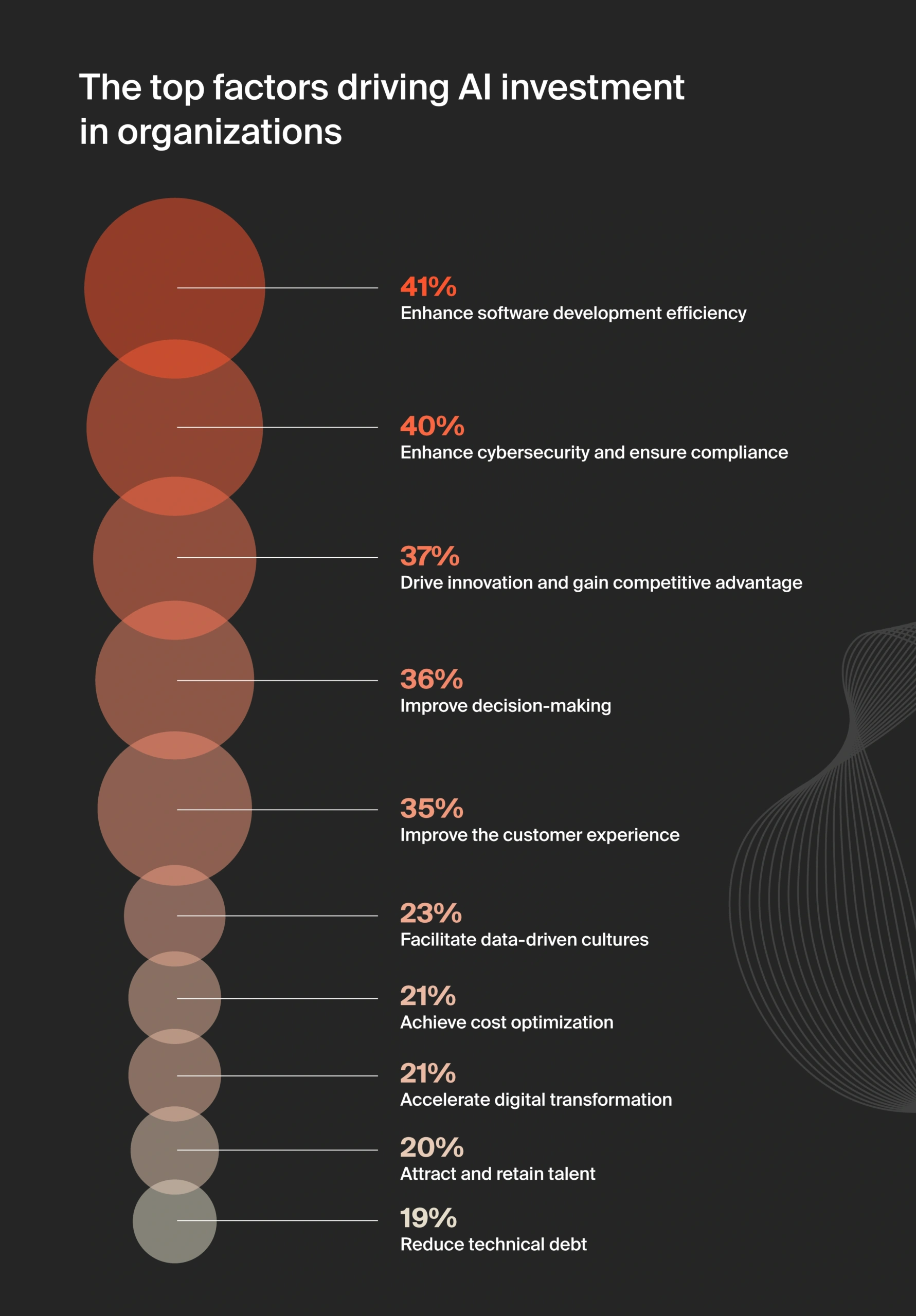

We found that the top three reasons organizations are investing in AI in 2025 are:

- To enhance software development efficiency (41%)

- To enhance cybersecurity and compliance (40%)

- To drive innovation and competitive advantage (37%)

These drivers indicate a strong focus on productivity, security, and market differentiation.

More organizations are prioritizing AI investments for internal efficiencies rather than for competitive advantage. This focus on operational improvements aligns with findings that 92% of respondents believe AI enhances team workflow and efficiency, and 87% rely on AI tools to perform their jobs effectively.

Top three reasons organizations are investing in AI

41%

To enhance software development efficiency

40%

To enhance cybersecurity and compliance

37%

To drive innovation and competitive advantage

04

The most used AI tools, platforms, and services

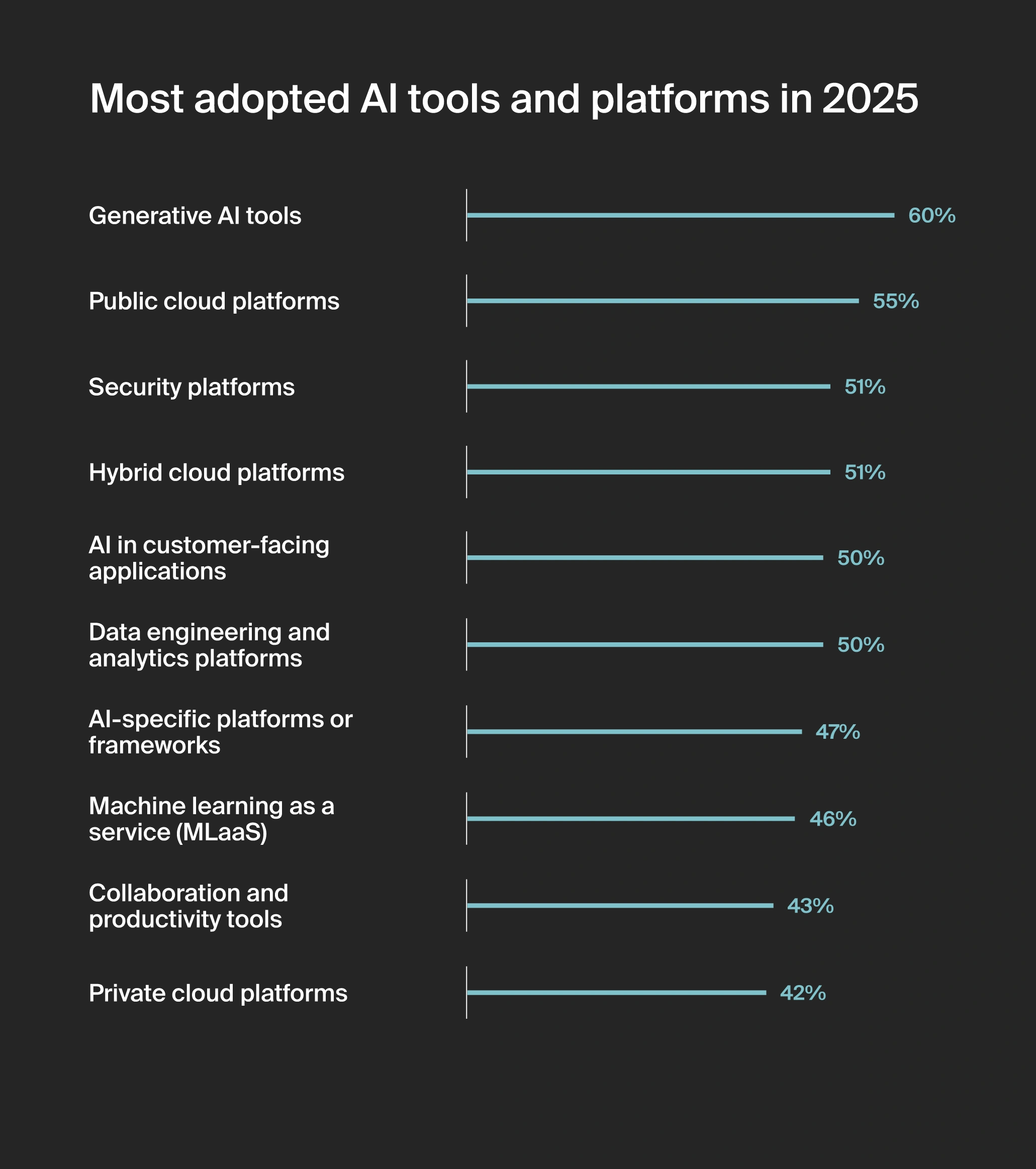

Cloud-based AI development dominates. The tools most commonly adopted are built for scalability, automation, and rapid deployment, which means they’re typically hosted in the cloud.

This reflects the foundational role cloud infrastructure plays in modern AI strategies. Its scalability and compute power are essential for running advanced models and processing massive datasets. But while cloud services are indispensable, they also introduce complexity.

As shown in our 2024 State of Cloud Cost report, 58% of companies believe their cloud costs are too high, a concern that only intensifies with AI adoption.

Cost attribution, allocation, and real-time visibility aren’t just nice to have — they’re essential. Without them, organizations risk overspending, under-optimizing, and losing strategic control over their growing AI investments.

Generative AI tools: Widespread but expensive

Generative AI is the most widely used category (60%), but it can also introduce the highest costs due to compute-heavy inference, tokenized API pricing, and retraining overhead. Companies must carefully monitor these expenses across features and business units.

Public and hybrid cloud usage is widespread — but cost efficiency varies

More than half of organizations (55%) use the public cloud, while 51% rely on a hybrid cloud setup.

Cloud is the backbone of AI. However, overprovisioning, idle resources, and poorly optimized configurations remain common. Without proactive optimization, cloud costs become a tax on innovation.

Security and compliance: a costly necessity

Over half (51%) of organizations are investing in AI-driven security tools for threat detection, compliance monitoring, and data protection — critical for safeguarding modern infrastructure, especially as cloud-based AI workloads grow more complex and exposed to risk.

As investment in AI security grows, so does the risk of inefficiency. Companies must be cautious of overlapping tools, redundant configurations, and compliance workflows that silently drive up costs. Balancing robust protection with cost-effective operations is essential, especially in heavily regulated industries where both technical and financial stakes are high.

Customer-facing applications and data engineering tools are major AI cost centers

Half of the organizations surveyed invest in AI-powered applications (such as chatbots) and data analytics solutions, both of which can generate high cloud costs due to large-scale processing and inference workloads.

These tools require significant computing power to analyze vast amounts of data in real time, often leading to unpredictable expenses.

Key takeaways

60%

Have adopted generative AI tools

55%

Have adopted public cloud platforms

51%

Have adopted security platforms

05

The AI talent landscape: salaries, skills and staffing struggles

Here, we’ll explore the data on the salary ranges for AI developers and professionals within organizations.

AI adoption is driving job creation — but also driving concerns of job losses

AI is reshaping the workforce, with 89% of companies reporting new roles emerging from automation and productivity gains, yet 62% remaining concerned about job displacement. This shows the need to balance innovation with reskilling to navigate the evolving job landscape.

Cloud computing and data engineering are the most in-demand skills for AI roles

When it comes to skills, cloud computing (57%) and data engineering (56%) are most in-demand.

Cloud computing is in highest demand in larger companies (5,001+ employees), peaking at 71% for the 5,001 to 10,000 employee range. Meanwhile, data engineering is most sought after in mid-sized firms (501 to 5,000 employees) but less so in larger firms. As AI investments grow, expertise in cloud platforms and data engineering is key to optimizing performance and integration.

AI salaries are soaring, with most AI professionals earning between $100,000 and $200,000

Most AI professionals earn over $100,000, with 26% earning between $150,000 and $200,000. Salaries are typically highest in large enterprises, but smaller companies often offer competitive pay to attract talent, especially in the $125,000 to $200,000 range.

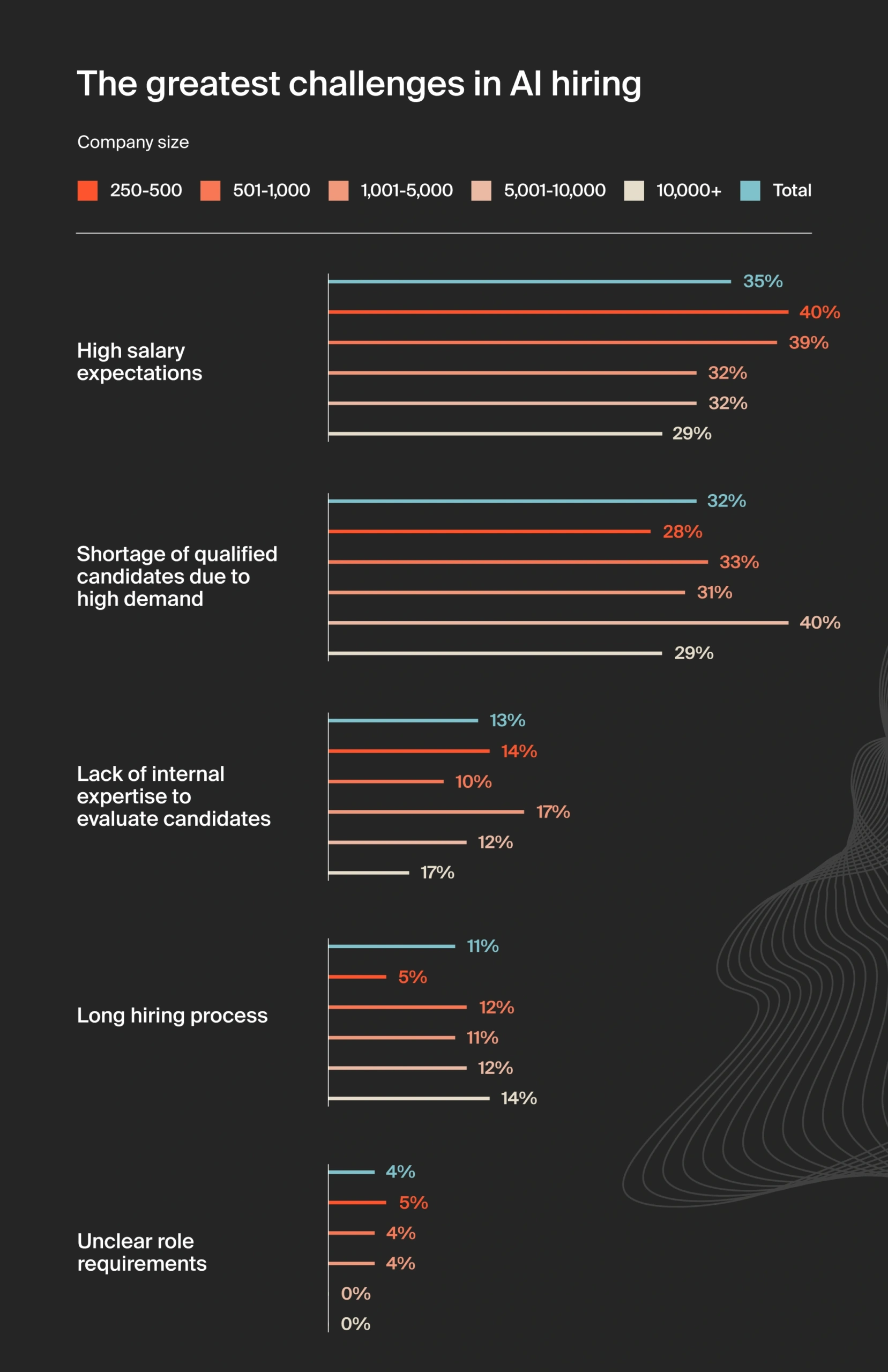

The greatest challenges in AI hiring

One of the greatest challenges in AI hiring is high salary expectations. Smaller companies struggle with this the most, with 40% facing this issue, while only 29% of larger firms report the same challenge.

There also appears to be a shortage of qualified candidates due to high demand, especially for mid-sized companies, with 40% struggling to find skilled professionals.

Thirdly, a key hiring challenge is the lack of internal expertise to assess AI candidates, particularly in companies with 1,001 to 5,000 employees (17%), compared to 14% in smaller firms and just 7% in much larger companies.

Conclusion:

AI innovation must be paired with cost intelligence

AI is a transformative force. But transformation without control is unsustainable.

Without effective cost governance, even the best AI initiatives can become financially inefficient. Our report highlights the need for organizations to go beyond tracking AI spend to actively optimizing it through real-time visibility, cost attribution, and actionable insights. With cloud-based AI tools comprising nearly two-thirds of AI budgets, cloud cost optimization is crucial to prevent overspending and losing control of investments. Cost isn’t just a metric. It’s the most strategic lever for sustainable AI growth. By adopting smarter cost management tools and practices, organizations can scale AI responsibly, measure ROI with confidence, and eliminate financial waste before it happens.

Cost isn’t just a metric. It’s the most strategic lever for sustainable AI growth.

By adopting smarter cost management tools and practices, organizations can scale AI responsibly, measure ROI with confidence, and eliminate financial waste before it happens.

Methodology

All data is taken from a survey of 500 U.S. software engineers, senior managers and above in firms with 250 to 10,000 employees. The survey was carried out in March 2025. All percentages have been rounded to the nearest percent.

Financial Control And Predictability In The Cloud

Eliminate wasteful spending, ship efficient code, and innovate profitably — all in one platform.