01 Executive Summary

Cloud costs are exploding. AI workloads alone can burn through six figures overnight. If you’re not actively managing spend, you’re hemorrhaging money.

FinOps promises to fix this mess by getting engineering, finance, and business teams to actually talk to each other about cloud spend. But most organizations are still struggling to make it work.

This guide will help you and your team evaluate modern FinOps platforms based on where your organization is in its cloud journey, especially as environments become more complex and the stakes get higher.

From deciding whether to build or buy to knowing what to prioritize in a platform, this guide is designed to help you more confidently navigate the FinOps landscape in 15 minutes or less.

02 The Problem Landscape: Cloud Spend Is Everyone’s Problem

Your cloud bill isn’t just eating your budget. It’s eating your margins, your roadmap, and your competitive edge. According to the State of FinOps 2025, the top challenge cited by FinOps practitioners (for the third year in a row) is getting engineers to take action on cloud cost data.

This points to a deeper issue: while organizations are flooded with usage and billing data from multiple cloud providers, that data is often fragmented and lacking business context.

The problem isn’t that engineers don’t care, it’s that most teams haven’t equipped them with the context needed to make smart, cost-effective decisions. Every day, engineers decide how money is spent through the code they ship and the infrastructure they choose. Every decision around compute, storage, and network impacts the bottom line.

Most FinOps tools are dinosaurs. Built for static VMs, they’re useless against Kubernetes clusters that spawn thousands of containers by lunch. Asking engineers to optimize spend with those tools is like asking them to order from a menu with no prices, then being flabbergasted when everyone picks the surf-and-turf and the bill comes back higher than expected.

Fixing this takes more than visibility. Teams need a platform that automatically consolidates, normalizes, and enriches cloud data with business context, tying usage to products, teams, customers, and units of value. It means surfacing cost data when decisions happen, not three months later in a retroactive spreadsheet.

And it’s not just about saving money. Cloud efficiency is often a proxy for software quality. With the right guardrails and real-time feedback, engineers naturally build systems that are scalable, secure, and cost-effective. In that environment, FinOps becomes a lever for innovation, and not just control.

03 The Solution Landscape: Making Sense Of The FinOps Market

Today’s FinOps landscape offers no shortage of tools to track, analyze, reduce, and optimize cloud costs. Organizations can choose from free native tools offered by cloud providers, DIY approaches that combine scripts, spreadsheets, and homegrown reports, or standalone FinOps platforms built specifically for this use case.

AWS Cost Explorer and Azure Cost Management? They’re fine if you enjoy spreadsheet archaeology and explaining to your CFO why you can’t tell them what that $200K spike was for. They rarely offer deep allocation capabilities, meaningful business context, or the ability to manage costs across multiple providers.

DIY solutions start as “just a few scripts” and end with your best engineer babysitting a Frankenstein system instead of building product.

As CloudZero’s SVP of Engineering Bill Buckley puts it:

“This is a forever job. You don’t build a platform, turn it on, and watch it run happily for years. It takes unceasing vision, innovation, and maintenance for it to remain an excellent solution to an ever-complicating problem.”

As companies mature in their FinOps practices and face rising costs from data-heavy and AI workloads, many find these early solutions no longer meet their needs.

- Allocation accuracy, especially in shared or ephemeral environments like Kubernetes

- Unit economics visibility, such as cost per product, feature, or customer

- Cross-functional collaboration, where engineering, finance, and product teams need access to shared insights, not just point-in-time data exports

That’s where purpose-built FinOps platforms come in. These tools consolidate and normalize cloud data, inject business context, support multi-cloud environments, and empower teams with role-specific views, anomaly detection, forecasting, and more, all without the overhead of building or maintaining the infrastructure yourself.

With so many options in the market, it’s easy to feel overwhelmed. But if your organization is starting to outgrow the basics, or is tired of stitching together half-measures, it may be time to consider a purpose-built FinOps platform that can scale with your needs.

In the next section, we’ll break down the key criteria to help you find the right one.

04 Evaluation Criteria For FinOps Platforms

Picking the wrong FinOps platform means another year of cost overruns, finger-pointing, and explaining to the board why your cloud bill keeps growing faster than revenue.

Not all platforms are created equal. They vary widely in depth, focus, and usability, making it essential to choose a solution that aligns with your organization’s goals and operating model.

To make a confident, high-impact choice, evaluate each platform based on the capabilities that matter most to your specific organization.

To get you started, the following section provides eight essential criteria that we’ve drawn from industry best practices, shaped by years of insights from real-world buyers, customer feedback, and evaluation frameworks used by top-tier analyst firms.

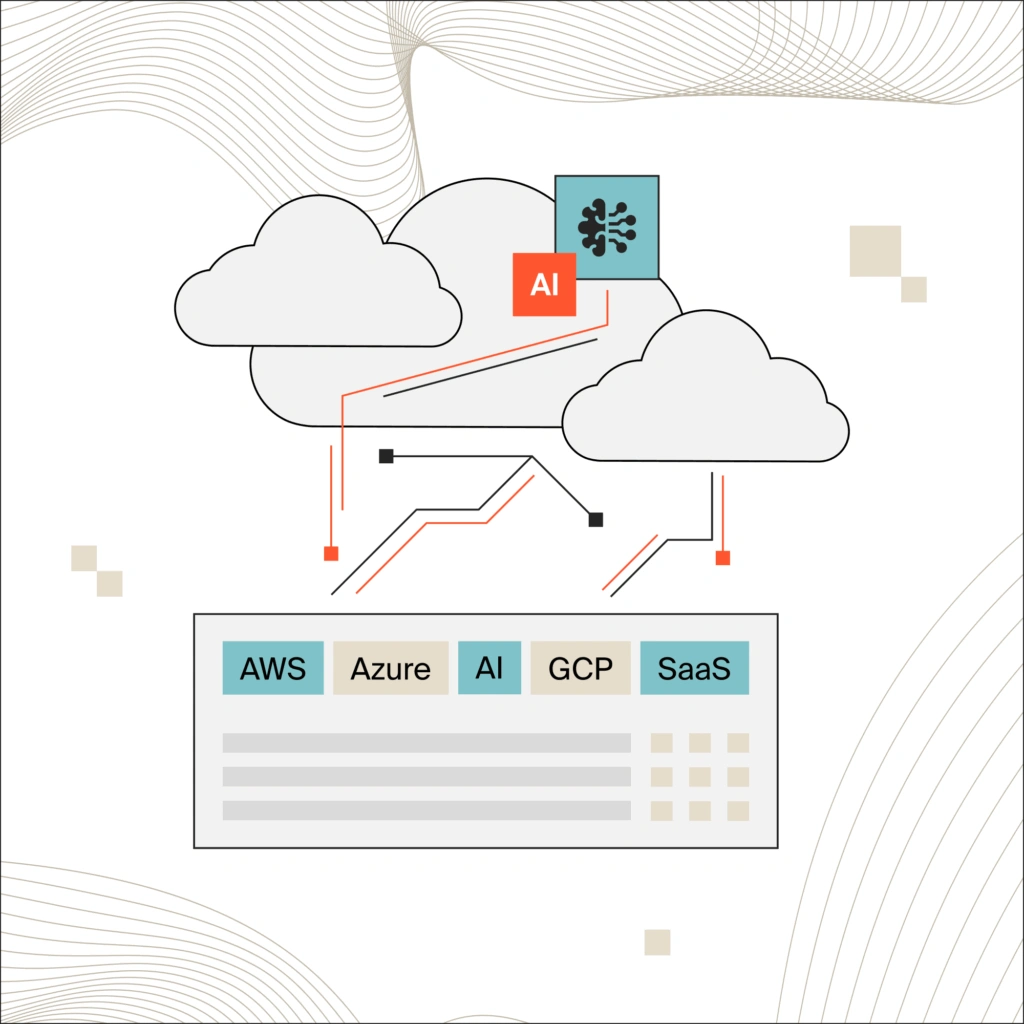

1. Cloud Platform Support

A strong FinOps platform starts with comprehensive data coverage. Without deep and accurate cloud cost ingestion, features like optimization, allocation, and forecasting won’t deliver meaningful results. The platform you choose should bring together cost and usage data from all major cloud providers, including IaaS, PaaS, and key SaaS vendors, and normalize that data into a unified view.

This is crucial as cloud environments grow more diverse and decentralized. Whether you’re working with multi-cloud strategies, hybrid infrastructure, or AI-powered systems that rely on specialized compute like GPUs, your platform needs to keep up.

Look for tools that can ingest large volumes of data, process updates in real or near-real time, and surface insights that align with your organization’s operating model.

Without this, you’re paying someone $150K a year to copy-paste between three dashboards and still missing 30% of your costs.

When assessing potential FinOps platforms, look for one that can:

- Ingest costs from all relevant IaaS providers (AWS, Azure, GCP, etc.)

- Ingest costs from PaaS and SaaS services to give a full cloud picture

- Consolidate and normalize data across clouds for unified reporting

- Scale alongside your organization’s cloud footprint without performance issues

- Process and surface data in real or near-real time to support fast decisions

2. Optimizing Spend

FinOps is not just about seeing where your money goes. It’s about knowing what to do about it. Visibility without action leads to endless dashboards and no real savings. That’s why cost optimization is a must-have capability for any FinOps platform. It’s the bridge between understanding your cloud spend and actually reducing it.

Modern infrastructure is highly dynamic. Resources spin up and down by the hour. Usage patterns shift between environments. Engineers make architectural decisions in real time, often without direct cost feedback. A good FinOps platform should surface optimization opportunities automatically and make them actionable, ideally in the same tools and workflows your teams already use.

This goes beyond spotting idle instances or rightsizing VMs. It includes identifying underutilized storage, flagging excessive data transfer, and tuning expensive jobs, including AI or GPU-intensive processes.

The best platforms not only recommend what to fix but help you route those actions to the right teams, track results over time, and build cost awareness into your engineering culture.

When evaluating platforms, look for solutions that can:

- Offer granular, hourly cost granularity to identify optimization opportunities

- Provide automated savings recommendations across compute, storage, and workloads

- Allow manual creation and tracking of custom optimization initiatives

- Route recommendations automatically to owners or teams for remediation

- Track cost avoidance and track avoided costs and actual savings over time

3. Detecting Cost Incidents

One misconfigured autoscaler just cost you $50K. By the time you found it, the damage was done. This happens somewhere every week. That’s why real-time anomaly detection is essential, not optional, for any serious FinOps platform.

Traditional monitoring tools focus on performance or uptime. FinOps platforms need to monitor cost behavior with the same level of rigor. You’re not just looking for unexpectedly high bills, but usage that strays from your expected patterns or baselines based on historical usage, project behavior, or known scaling patterns.

This is especially critical in environments with frequent deployments, short-lived infrastructure, or high cost volatility such as AI model training or autoscaling pipelines where usage can surge unexpectedly and costs follow fast.

The right platform doesn’t just detect anomalies. It puts them in context, shows you where they started, and helps you act quickly, ideally before the bill arrives. That means custom thresholds, intelligent baselines, alerting integrations, and seamless workflows for root cause analysis and resolution tracking.

When assessing this capability, look for platforms that can:

- Alert immediately when unusual spending patterns emerge

- Let users customize thresholds to match business context

- Provide clear tracing from anomaly to root cause

- Integrate with Slack, email, or other tools to notify the right people

- Tie into existing workflows and ticketing systems for resolution tracking

4. Allocating & Reporting

You can’t manage what you can’t measure. And you can’t measure what you haven’t allocated. Accurate cost allocation is the foundation of any FinOps practice. It creates accountability, informs decision-making, and connects cloud costs to the things your business actually cares about: teams, features, customers, or whatever your business values most.

But allocation is also one of the hardest problems in cloud cost management. Cloud services don’t arrive neatly tagged or attributed. Shared resources like Kubernetes clusters, data pipelines, or AI infrastructure often serve multiple teams or functions. As environments scale, the complexity of assigning cost back to the right owners only increases.

A strong FinOps platform should handle this complexity automatically. It should let you build flexible allocation rules, support evolving reporting needs, and fill in the gaps where tagging falls short.

More importantly, it should translate technical cost data into meaningful business insights that finance, product, and engineering teams can all understand and act on.

When evaluating platforms, prioritize those that can:

- Allocate 100% of cloud costs across dynamic, shared, and high-variation environments

- Support historical analysis across changing allocation models

- Allow easy updates to allocation rules as reporting needs evolve

- Enable multi-tiered allocation (e.g., cost per feature per customer)

- Automatically generate and send reports tailored by stakeholder, team, or unit

5. Budgeting & Forecasting

Forecasting isn’t a quarterly finance chore anymore. It’s a daily input into engineering, product, and operations. As cloud usage becomes more dynamic, budgets need to flex with it. That’s why FinOps platforms must go beyond static reports and support real-time forecasting, variance analysis, and alerting that keeps teams ahead of surprises.

One of the biggest challenges teams face today is cost volatility. Usage patterns can swing wildly due to autoscaling, unpredictable demand, or compute-intensive tasks like model training or batch processing.

These spikes are often hard to predict but easy to overspend on if you’re not tracking closely. A strong FinOps platform should help you identify these patterns early, factor them into your forecasts, and keep teams aligned on the financial risks and trade-offs involved.

A good budgeting and forecasting engine does more than project next month’s bill. It helps you model different scenarios, anticipate cost drivers like new product launches or infrastructure migrations, and give budget owners visibility into how their decisions affect spend.

This is especially important in environments with decentralized teams and highly variable usage, where cost volatility can come from autoscaling, experimental services, or compute-heavy tasks like training AI models. In these cases, even small changes can trigger large shifts in spend, making proactive planning critical.

It’s also about creating a culture of proactive planning rather than reactive cost control. That means empowering teams to track spend against their own budgets, model outcomes before shipping code, and understand the financial impact of their choices all without waiting on end-of-month spreadsheets.

When assessing platforms, look for solutions that can:

- Set, monitor, and update budgets for projects, teams, or departments

- Generate forecasts based on historical spend data and patterns

- Model different cost scenarios to plan for product or infra changes

- Trigger alerts as actual spend approaches budget thresholds

- Support decentralized budgeting and team-specific tracking

6. Administration & Usability

Even the most powerful FinOps platform is useless if no one wants to use it. Adoption depends not just on features, but on how intuitive, accessible, and adaptable the platform is to your organization’s workflows. Usability isn’t a nice-to-have — it’s make-or-break.

Different teams need different views. Finance wants budget rollups. Engineers want to see cost by service or deployment. Product managers may want visibility into spend tied to features or customers. A great platform should support all of these perspectives through customizable dashboards, flexible permissions, and role-specific workflows without requiring a degree in cost data to operate.

Administration matters too. As organizations grow and more teams engage with cloud cost data, managing access, workflows, and integrations becomes increasingly complex.

The right platform should make it easy to onboard new users, maintain data quality, and connect with other systems in your stack from ticketing tools to BI platforms.

When evaluating usability, look for platforms that can:

- Offer a single, intuitive interface that’s easy to learn and navigate

- Enable customizable dashboards and workflows for different roles

- Let admins define roles and permissions for controlled access

- Make cost data ingestion and integration with providers seamless

- Provide APIs to extract and reuse data in other business systems

7. Support & Services

Choosing a FinOps platform isn’t just a product decision. It’s a partnership. Even the best software needs great onboarding, education, and support to deliver real value.

Especially in complex environments or during early stages of FinOps maturity, the right vendor support can accelerate adoption and help teams avoid costly mistakes.

Look for vendors that treat your success like their own. That means providing a dedicated point of contact, clear onboarding plans, responsive support channels, and helpful documentation. The best platforms also invest in customer enablement with training, playbooks, and real examples from teams like yours that goes beyond how to use the tool and gets into how to drive better outcomes.

As your FinOps practice grows, your needs change and your platform should keep up. The strength of the support you receive will often determine whether your team continues to grow in confidence and capability or stalls out when faced with roadblocks.

When assessing support, prioritize vendors that can:

- Assign a designated FinOps Account Manager (FAM)

- Provide a joint success plan and onboarding support

- Offer thorough, accessible product documentation

- Include a FinOps education library or resource hub

- Deliver support across multiple channels (email, Slack, Zoom, etc.)

8. Business Outcomes

Nobody cares about your dashboards. They care whether you cut waste by 30% and can finally answer “what does this customer cost us?”

You’re not buying a tool. You’re investing in a capability to cut waste, move faster, and align spend with priorities.

The best FinOps platforms help you shift from reactive cost control to strategic cost management. That means enabling teams to make smarter infrastructure choices in real time, connecting cost data to business metrics, and reducing the manual overhead required to generate insights. When done right, FinOps is a force multiplier, helping you ship better software, move faster, and stay financially sharp.

This is the ultimate test of any platform: Does it make your people more effective? Does it improve how you operate? And does it help you translate cloud investment into business value?

When assessing outcomes, look for platforms that can:

- Deliver capabilities that reduce waste and lower total cloud costs

- Save engineering, finance, and ops teams time on reporting

- Increase visibility and decentralize FinOps via flexible notifications

- Empower engineering teams with intuitive, actionable interfaces

- Enable stakeholders to make faster, data-driven decisions

05 Running A Smart FinOps Platform Evaluation

Once you’ve identified the short list of platforms you’re considering and the evaluation criteria, the trial process itself can make or break your ability to make the right choice.

Below are a few best practices, drawn from FinOps-specific realities and SaaS buying norms, to help you run a confident, structured evaluation.

Note: Download your copy of the FinOps Platform Evaluation Scorecard to compare vendors based on these criteria.

1. Involve The Right People Early

Include someone who can access or interpret cloud billing data from the sources you plan to evaluate. Whether it’s someone on the DevOps team, a cloud architect, or an engineering leader, real-world testing will stall if you can’t connect directly to the cost data sources.

2. Bring Consistent Data

To understand how a FinOps platform will perform in your environment, it’s critical to evaluate using real data at a realistic scale and level of complexity. Some vendors limit trial data scope, often to mask performance or usability gaps.

Depending on your environment, scale may or may not be a concern, but it’s important to decide what data volume and complexity you want to test before evaluations begin. Once defined, hold all vendors to the same standards. Avoid cherry-picked demos or narrow ingestion setups that don’t reflect your real-world use cases or ensure an apples-to-apples comparison. Consider including:

- 6–12 months of historical cost data

- A representative mix of cloud providers (not necessarily all providers, but the top 1-3 most important)

- The volume and granularity of unit metrics you care about (e.g., per customer, product, or transaction)

3. Test for Collaboration, Not Just Features

FinOps success requires cross-functional adoption. Ensure the platform supports the workflows and access needs of your finance, engineering, and product teams. Better yet, have each group test the platform through the lens of their daily workflows.

4. Evaluate Vendor Responsiveness

FinOps success requires cross-functional adoption. Ensure the platform supports the workflows and access needs of your finance, engineering, and product teams. Better yet, have each group test the platform through the lens of their daily workflows.

5. Document Your Questions & Edge Cases

During evaluations, you’ll uncover nuances such as your tagging hygiene, multi-cloud setup, or custom cost reporting needs. Document these and consistently pose them to each vendor. This keeps your comparisons grounded in your actual context, not in a generic feature matrix.

06 In Conclusion

Before jumping into vendor comparisons, take a step back and reflect on what success looks like for your organization.

Ask yourself:

- Are we just trying to survive this quarter’s budget review, or do we actually want to know if our cloud spend is generating ROI?

- Do we have the resources and appetite to maintain strict tagging hygiene, or do we need a platform that works around imperfect tags?

- Are we equipped to track and manage the cost of AI workloads, including training, inference, and GPU usage?

- Are we trying to get better allocation for complex infrastructure like Kubernetes?

- Do we have the organizational will to build a culture of continuous cost awareness?

- How important is it for us to track unit metrics like cost per customer or feature?

Your answers to these questions should shape the way you evaluate FinOps platforms. We’ve created the FinOps Platform Evaluation Scorecard to give you a structured, experience-backed starting point. But it should be just that – a starting point.

Download it, adapt it, and make it your own. Adjust the criteria, weigh what matters most, and use it to cut through the noise with clarity and confidence.

Your cloud spend may not shrink, but your ability to manage it strategically can grow fast. This guide, and the scorecard that comes with it, are here to help you get there.