You may have heard that keeping an existing customer is five times cheaper than acquiring a new one. But that isn’t always true. “Hidden costs” often accompany customer retention, loyalty, and increasing “share of customer”.

Could you be spending more on customer retention than on winning new customers?

This quick guide will walk you through the meaning of Customer Retention Cost (CRC), why it’s important to calculate it, and how to calculate it.

You’ll also learn how to cut customer retention costs without losing customers, so you can recoup your investment and increase your profit.

What Is Customer Retention?

Customer retention is a company’s ability to keep customers engaged and continue using its product over time. It measures how consistently customers renew, repurchase, or stay active without switching to an alternative.

In SaaS, retention means users keep renewing subscriptions and remain active in the product. Strong retention reflects good onboarding, stable product value, and a reliable customer experience that encourages continued usage.

Retention matters because it protects recurring revenue. When customers stay longer, you recover acquisition cost faster and generate healthier margins without repeatedly funding new sales cycles.

Retention also influences the overall health of the SaaS business. The Rule of 40 benchmark, where revenue growth plus profit margin equals 40% or more, depends heavily on low churn and high renewal rates. Strong retention improves both growth and margin, making it easier for SaaS companies to reach Rule of 40 performance.

What Is Customer Retention Cost?

Customer Retention Cost (CRC) is the cost you incur to keep a customer buying from you for as long as possible. CRC is the cost of customer retention over a specific time.

SaaS businesses typically track key metrics such as monthly recurring revenue (MRR), customer acquisition cost (CAC), churn rate, payback period, and lifetime customer value (CLV).

Additionally, most companies invest heavily in reducing their churn rate. Chances are, your company does this as well in the following activities.

What Does Customer Retention Cost Include?

Customer retention costs include all of the costs to maintain and support that customer.

Retention costs include:

- Providing training/tutorials and professional services for customer success.

- Costs related to customer service, such as salaries for customer service agents, renewal team members, engineers, and executives. Some SaaS companies treat customer service costs as Cost of Goods Sold (COGS) rather than as customer retention costs.

- Various examples of customer loyalty programs.

- Account management team’s costs.

- Programs and tools for customer engagement, such as chatbots, and the adoption of new features.

- Customer usage of your product, software, features, etc.

Why Is It Vital To Measure Customer Retention Cost?

It has historically been easier to cross-sell or upsell to an existing customer than to a new prospect. You can increase a customer’s lifetime value by keeping them for longer.

The shift to Software-as-a-Service (SaaS) requires businesses to keep customers for as long as possible to maximize profitability.

For businesses that rely on recurring revenue, nurturing, growing, and meeting customers’ needs are critical to ensuring consistent renewals.

That’s not all.

- By evaluating your investment in a customer over time, you can determine if it is sustainable.

- By determining the cost of retaining a customer, you can set the price for your services and products. By evaluating CRC at renewal time, you can determine whether you should reevaluate a particular customer’s contract.

- Find out which features should be moved to a higher SaaS pricing tier to encourage customers to upgrade their subscriptions and preserve your margins.

- Explore how your CRC can be optimized without compromising customer experiences.

- A high CRC without increasing customer retention may indicate a product-market-fit problem. In general, the higher the retention costs, the lower the margins and profits because each subsequent sale is actually less profitable.

- Low customer retention costs can indicate that your retention techniques are working. It might also motivate you to invest more in customer retention to improve loyalty.

- CRC can help identify the true Lifetime Customer Value (by comparing the cost of keeping a customer with the value they return over their lifetime).

Customer Acquisition Cost Vs. Customer Retention Cost: What Is The Difference?

Customer Acquisition Cost (CAC) is the amount a company spends over a given period to win a new customer, while Customer Retention Cost (CRC) is the amount a company spends after signing up that customer.

A business can use CAC to determine when it will recoup the costs of sales and marketing used to acquire a new customer. CRC is useful for determining if it makes sustainable profits from keeping all or specific customers.

So, how do you calculate CRC?

How To Calculate Your Customer Retention Cost

You need to add up all sales and marketing costs for both new and existing products and services for your current customers over a set period. Depending on how much visibility you want, you can add up all investments monthly, quarterly, or annually.

But, is there a Customer Retention Cost formula?

Here are a few helpful formulas:

- Average CRC per customer = Total CRC of all customers / Number of active customers in that period

- Average lifetime CRC per customer = Average CRC per customer X average customer lifetime

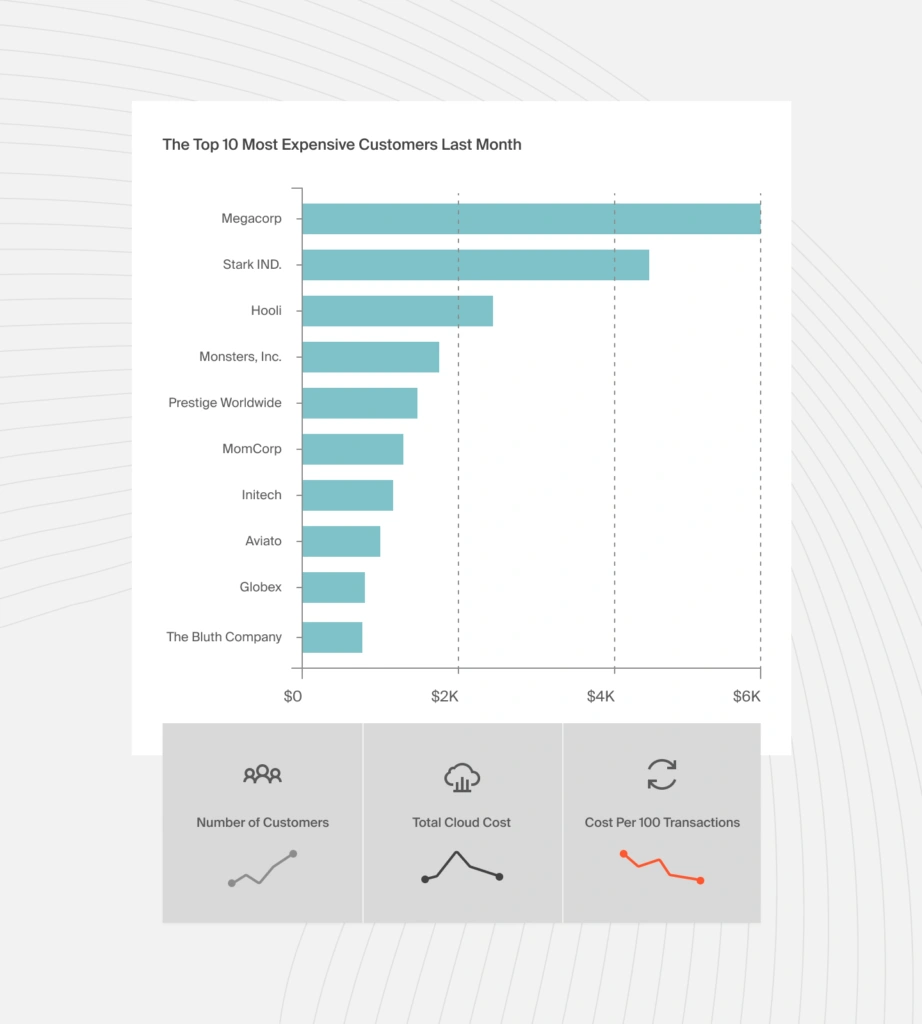

This method, however, does not show how much you spend to support a specific existing customer. Instead, it equalizes customer retention costs across the board, which is grossly inaccurate.

That approach makes it hard to determine your most expensive or least profitable customers. In addition, it is challenging to decide on the discount rate to offer a customer whose retention cost is low relative to their revenue.

A smarter approach is to calculate CRC on a case-by-case basis.

You can use cost per customer to determine if you are making enough from each customer to keep them.

A cost intelligence platform can help you measure cost per customer, allowing you to make informed decisions on contract renewals, pricing tiers, and go-to-market strategies.

That leads us to the next question most organizations ask.

Will CRC Decrease Over The Lifetime Of A Customer?

Over time, a customer’s CRC may decrease as their confidence in your product or service grows, theoretically requiring less input from you to retain their business. However, we don’t recommend factoring in a reduction in CRC over time.

Here are a few reasons why:

- Continuously improving your customer experience and competitiveness will keep your customers coming back.

- Investing in releasing new features leads to upsells and cross-sells (more revenue from existing customers).

- Occasionally, new decision-makers and influencers join your customers’ teams, and you may need to encourage them to renew their subscriptions.

Trying to reduce customer retention costs at any cost can damage your customer relationships. You could instead optimize your CRC to protect your margins and profit.

Below are some tips.

How To Improve Your Customer Retention Rate

How do you retain customers at the lowest cost? And, how do you cut customer retention costs without losing customers? Try these tips:

Understand customer goals early

Retention improves when you know what customers want to achieve. Use onboarding surveys and kickoff calls to clarify goals. Early alignment reduces customer retention costs by preventing confusion and reducing the need for repeated support cycles.

Remove activation barriers

Activation is the first predictor of retention. Offer simple setup guides, short videos, and in-app walkthroughs. Faster activation reduces support volume and improves cost per customer.

Collect feedback continuously

Use NPS, micro-surveys, and customer interviews to understand expectations and friction points. This input strengthens your SaaS retention strategy and highlights opportunities for better product fit.

Review usage patterns regularly

Identify usage cliffs or features customers avoid. These patterns show where users struggle and where SaaS CRC rises due to extra support or complexity.

Improve onboarding with training

Offer live sessions, guided training, or interactive tutorials for complex features. Strong onboarding decreases customer retention cost by reducing repeated help requests.

Expand self-service resources

Clear documentation and in-app guidance help customers solve issues independently. Self-service support directly contributes to reducing retention cost.

Engage customers before they churn

Use product analytics to detect early warning signs. If engagement drops, reach out. Early intervention stabilizes usage and lowers overall customer retention cost.

Use cost intelligence to measure true CRC

Teams need visibility into onboarding effort, support volume, and product usage to understand how to calculate CRC. Cloud cost intelligence platforms like CloudZero help measure CRC accurately and apply the CRC formula to real customer behavior.

And there’s more…

Understand Your Cost Per Customer With CloudZero

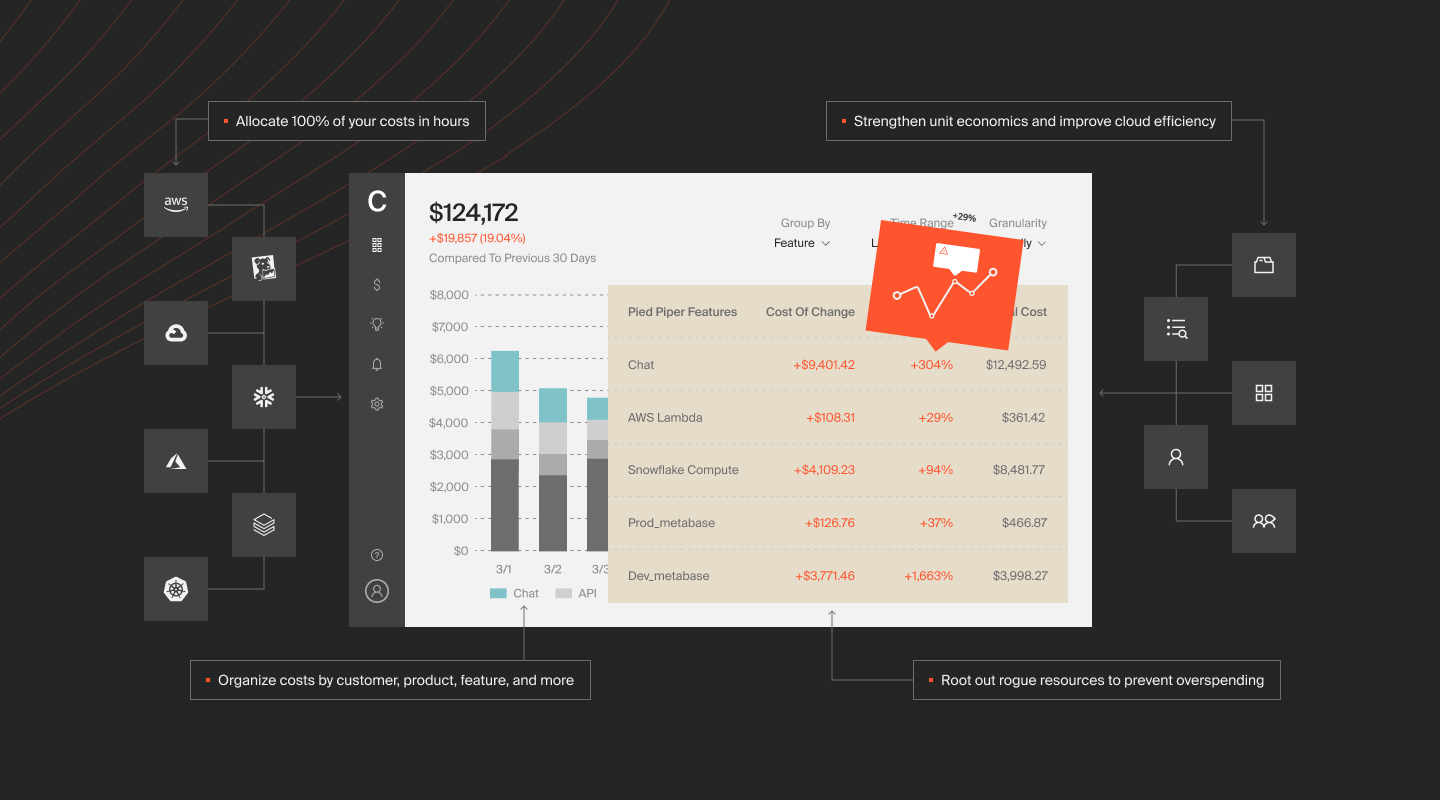

CloudZero enables you to connect the dots between cloud spend and your business. While other solutions offer reporting and dashboards that answer, “how much did we spend in total or on average?”, CloudZero also enables you to answer, “why did we spend that and where did it go, really?”

Was it because we onboarded a new customer? Did our team push new code? Or did some clever UX changes increase usage of this feature?

You’ll see this in the form of immediately actionable per-unit cost insights; cost per customer, per team, per project, per feature, per product or service, per environment, and more.

By default, you’ll get at least 12 of these cost dimensions. But you can create custom ones, such as cost per feature per customer, to track your cloud spend; however, it is most relevant to your business.

CloudZero delivers this level of granularity like no other cost platform; hourly, per-unit, and mapped to the specific people, products, and processes that drove the costs. This way, you can tell exactly who, what, and why your cloud costs are changing — and actually be able to do something about it.

Plus, CloudZero will be your single source of truth. You can manage your AWS, Azure, GCP, and Oracle Cloud costs, as well as costs of Kubernetes, Snowflake, Databricks, MongoDB, New Relic, Datadog, and more platforms. You can do all of that on a single dashboard, so it’s easier to compare them.

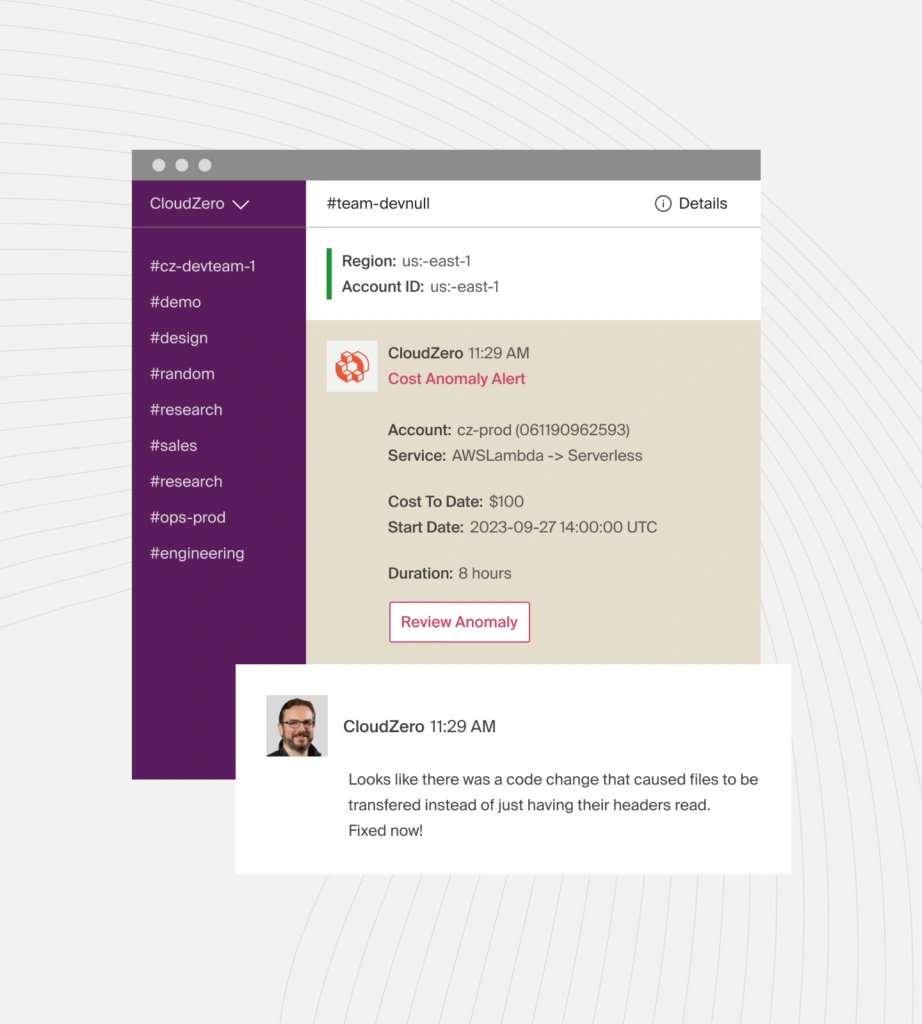

And to ensure you get no surprise costs, we’ll send you timely, noise-free, and context-rich cost-anomaly alerts to your Slack or email. This means the right people on your team can quickly identify what and where to fix to prevent cost overruns.

These and more capabilities, such as 100% cost allocation, budgeting, and forecasting, are the same tools our customers, like Drift (saved $4 million so far), Seat Geek (saved 6-8 hours per cloud cost question), and SmartBear (raised revenue after understanding cost per customer), have used to save money on cloud services.

By passing on these savings to your customers, you can lower your prices even further without eroding your margins. Or you can use the savings to improve your product or service further. Both are sustainable ways to retain customers.

Yet reading about CloudZero is nothing like seeing it in action for yourself.  to experience CloudZero first-hand.

to experience CloudZero first-hand.

Frequently Asked Questions About Customer Retention

Here are answers to some of your customer retention FAQs.

What is Customer Retention Cost (CRC)?

Customer Retention Cost is the total amount a company spends to keep a customer active, successful, and renewing. CRC includes onboarding, support, account management, product usage, and customer success activities over time.

How do you calculate customer retention cost?

CRC is calculated by adding all retention-related expenses for a period and dividing by the number of active customers. For deeper insight, calculate CRC per customer instead of averaging, so you can identify high-cost accounts and margin risk.

How is CRC different from Customer Acquisition Cost (CAC)?

CAC measures the cost of winning a new customer. CRC measures the cost of keeping them. CAC affects the payback period, while CRC affects margin and profitability after onboarding. Both are required to assess customer lifetime value.

Does CRC decrease over time?

CRC can decrease as customers become familiar with your product, but this is not guaranteed. New stakeholders, changing needs, product updates, and increased support usage often keep CRC stable. SaaS teams shouldn’t assume long-term CRC reduction.

How do I know if my retention cost is too high?

Compare CRC against revenue, margin, and customer lifetime value. If CRC grows faster than renewal value, or if supporting a customer costs more than they pay, retention becomes unprofitable. This often signals product-fit or pricing issues.

What drives CRC up in SaaS?

High-touch onboarding, complex implementations, heavy support requests, custom features, and low product adoption increase CRC. Engineering interventions, performance issues, or data-heavy product usage also raise underlying infrastructure costs.

What’s the link between CRC and the Rule of 40?

The Rule of 40 compares revenue growth and profit margin. High retention and sustainable CRC improve both metrics, helping SaaS companies to reach Rule-of-40 performance. Efficient retention has a direct impact on long-term SaaS health.

How does CRC influence pricing and discount strategy?

If CRC is high, discounts or underpricing can erode margin. Understanding CRC per customer helps determine fair pricing, renewal rates, and upgrade paths. It also reveals when certain features should be placed on higher tiers.