It can be challenging to translate complex engineering concepts to business leaders. If you frame things well, though, you can have more productive conversations that lead to greater alignment between engineering and the rest of the business.

With that in mind, I’d like to share some of my recommendations for discussing cost with your leadership team — and hope it might help you have stronger cost conversations.

What Are COGS In A SaaS Company?

Cost of goods sold (COGS) in a software-as-a-service (SaaS) company refers to the direct costs you incur when building and running subscription-based software services. COGS are also referred to as cost of sales.

These services are software-enabled and distributed over the internet, unlike traditional software companies that create a physical software copy and distribute it.

The thing is many SaaS companies over-report their COGS. That is likely because they are unsure what to include in their cost of goods sold reports. Some equate operating expenses (OPEX) with cost of goods sold (COGS), which is inaccurate and could have negative consequences, such as reducing your share price.

What is the difference between COGS and operating costs?

COGS reflect how much you spend on building and supporting the software services that your customers purchase. Meanwhile, operating costs represent the costs incurred to run and support your entire business, not just the software-enabled services you provide.

COGS also differ from cost of revenue in that the latter applies when you sell a physical product. Cost of revenue also includes indirect expenses such as the commissions you’d pay your sales staff and the shipping costs of raw materials.

What are the benefits of tracking SaaS COGS?

When you monitor your COGS, you have a better understanding of how much it costs to build and support a product or service. Tracking COGS has several more advantages, including:

- You can calculate your gross profit by subtracting COGS from revenue

- Calculating your gross profit can help you determine whether or not your organization is profitable and able to attract investors to finance growth

- You can find out what drives your cost of goods sold over time

- You’ll be able to identify whether an increase in COGS is due to growth or simply overspending

- Controlling your costs starts with understanding COGS

- Use COGS to determine if you are taking advantage of economies of scale to lower per-unit costs

- COGS tracking powers cost allocation, budgeting, and forecasting

- Measuring your COGS helps gauge your product’s or service’s efficiency so you can improve it

- The more you understand your COGS, the easier it becomes to make pricing decisions that are fair to your customers and also protect your margins.

So, what costs should you consider COGS in a SaaS?

SaaS COGS Examples: What Should You Consider COGS In A SaaS Company?

A SaaS company’s cost of goods sold includes:

- The cost of hosting applications like Amazon Web Services (AWS).

- Cloud costs such as Amazon EC2 and S3 bills, application performance monitoring (APM) fees, and infrastructure monitoring and security fees, etc.

- Payments for software licenses or subscriptions that directly support the development and running of the software-enabled service you depend on for revenue.

- Transactional costs, such as cost of travel and billing.

- Employee salaries, training, and onboarding costs incurred by customer support personnel who ensure that customers can use your software hassle-free.

- Expenses directly related to the creation and operation of your revenue source.

What should not be included in SaaS COGS

When calculating Cost of Goods Sold (COGS) for Software-as-a-Service (SaaS) businesses, it’s crucial to distinguish between expenses that directly contribute to delivering the service and those that do not. Here are key items that generally should not be included in SaaS COGS:

1. General Administrative Costs: Expenses related to management, finance, legal, and other administrative functions typically do not directly contribute to the production or delivery of the SaaS product. These costs are usually categorized separately as operating expenses (OPEX).

2. Sales and Marketing Expenses: While essential for acquiring and retaining customers, costs associated with sales commissions, advertising, and promotional activities are not directly tied to the production of the SaaS product itself. These costs also fall under operating expenses.

3. Research and Development (R&D) Costs: Although crucial for product innovation and improvement, R&D expenses are usually considered separate from COGS. They are treated as investments in future product enhancements rather than costs directly incurred to deliver the current service.

4. Depreciation and Amortization: While depreciation of hardware infrastructure may be relevant, accounting rules typically exclude depreciation and amortization of intangible assets like software development costs from COGS calculations. These are considered as non-cash expenses that spread the cost of assets over their useful lives.

5. Interest and Financing Costs: Expenses related to interest payments, bank fees, and other financing charges do not contribute directly to the production or delivery of the SaaS service. They are considered financial expenses and are typically excluded from COGS.

By excluding these items from the COGS calculation, SaaS companies can accurately assess the direct costs associated with delivering their services. This distinction is crucial for financial analysis, pricing strategies, and understanding the profitability of the core SaaS operations.

There are also no rules as to what to include in a SaaS P&L as COGS.

Challenges of determining your SaaS COGS

We see this and more SaaS cost visibility challenges more often now. They are reasons more SaaS companies are reporting weaker gross margins, and ultimately, insufficient profits to keep them afloat.

When you cannot trace costs back to a specific feature, customer, or project in your app, you may never know how much you spend on each.

As a result, you may struggle to:

- Set the right SaaS pricing based on how much you spend building, running, and supporting each app feature.

- Estimate how much discount you can offer without compromising your net profit.

- Decide the right time to review and update your subscription pricing with a specific customer(s), so you can improve your per customer gross margins, hence overall profitability.

- Invest in innovation without worrying about going over budget.

- Show C-suite and finance where and how you spent your engineering budget.

The COGS of each SaaS business will differ based on its unique business model, industry, compliance laws, and other factors. What do you do when your costs differ from the “standard” bunch?

How Do You Calculate SaaS COGS?

As a start, you need to see all your costs in the context of your business. Different companies have differing formulas for calculating COGS manually. A popular one is:

- Total Revenue – Gross Margin = COGS

Notice the difference between the SaaS COGS calculation method above and the following formula for calculating a conventional business’s COGS:

COGS = Inventory At The Start Of A Period + Purchases Made Over That Period – Ending Inventory

It is highly unlikely that you will keep inventory as a SaaS company, which is why you will rarely use this last formula.

You are more likely to have COGS similar to the ones in this table:

|

COGS Totals |

Company X |

|

Development |

$26,700 |

|

Customer support for the app |

$11,900 |

|

Application maintenance |

$3,500 |

|

Cost of subscriptions |

$1,650 |

|

Hosting |

$5,050 |

|

Licensing fees |

$2,300 |

|

Total cost of goods sold |

$51,100 |

Company X’s cost of goods sold equals $51,100 for the specific period these costs accrued.

What are some examples of best practices when calculating SaaS COGS?

Try the following:

- Consider only the total direct costs of a service or product over a given period

- You can usually reduce your tax liability by including necessary and ordinary company expenses in COGS

- Use business accounting software to help you figure out which COGS calculation method is most advantageous to your SaaS business

- Remember, when you deduct COGS from your gross revenue, you get gross margin, not net profit

- Rather than lumping all costs together, consider the cost per unit instead

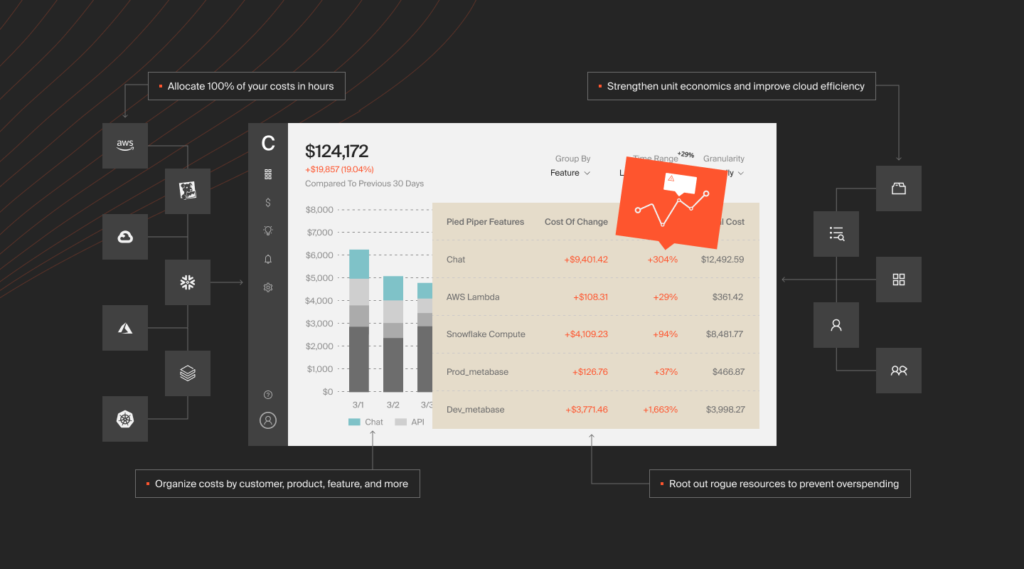

Sadly, most cloud providers lump all costs into one billing statement. As a result, it is very difficult to determine what cost you what, when, where, and why — reducing your cloud cost visibility.

When you don’t have a clear understanding of where your cloud spend is going, you might not know where you can optimize — such as cutting your AWS bill by reducing unused resources, or using more resources for the same fees.

The good news is that you can use a cloud cost intelligence platform like CloudZero to understand your spend and align costs to features, products, customers, teams, and more.

CloudZero combines COGS with unit economics, enabling you to visualize and map the true cost of supporting each segment of your business. The following are examples of unit costs:

- Cost per customer so you can tell the average costs per customer, letting you know if you charge each customer enough to cover the cost of supporting them, for example.

- Cost per feature so you can tell how much each feature costs versus how much it returns.

- Cost per team and project, so you can improve its efficiency.

So, now you have your COGS. But what do you do with them?

How Can You Use SaaS COGS?

Understanding COGS is important in calculating SaaS gross margins, which typically range between 60-90%. So SaaS COGS should be between 10-40%. Many SaaS businesses end up over-reporting their SaaS cost of goods sold to avoid misrepresenting costs to investors.

COGS can also help you calculate the gross profit of your SaaS business. From there, you can estimate the surplus revenue you have to cover your operating expenses, like rent, sales, and marketing.

You can also use the data to conduct a SaaS COGS benchmark. Comparing key SaaS business metrics and practices to industry peers and standards may allow you to determine how to improve gross margins, and ultimately net profit.

Investors also look out for COGS in SaaS P&L to gauge profitability, hence the attractiveness of a SaaS company.

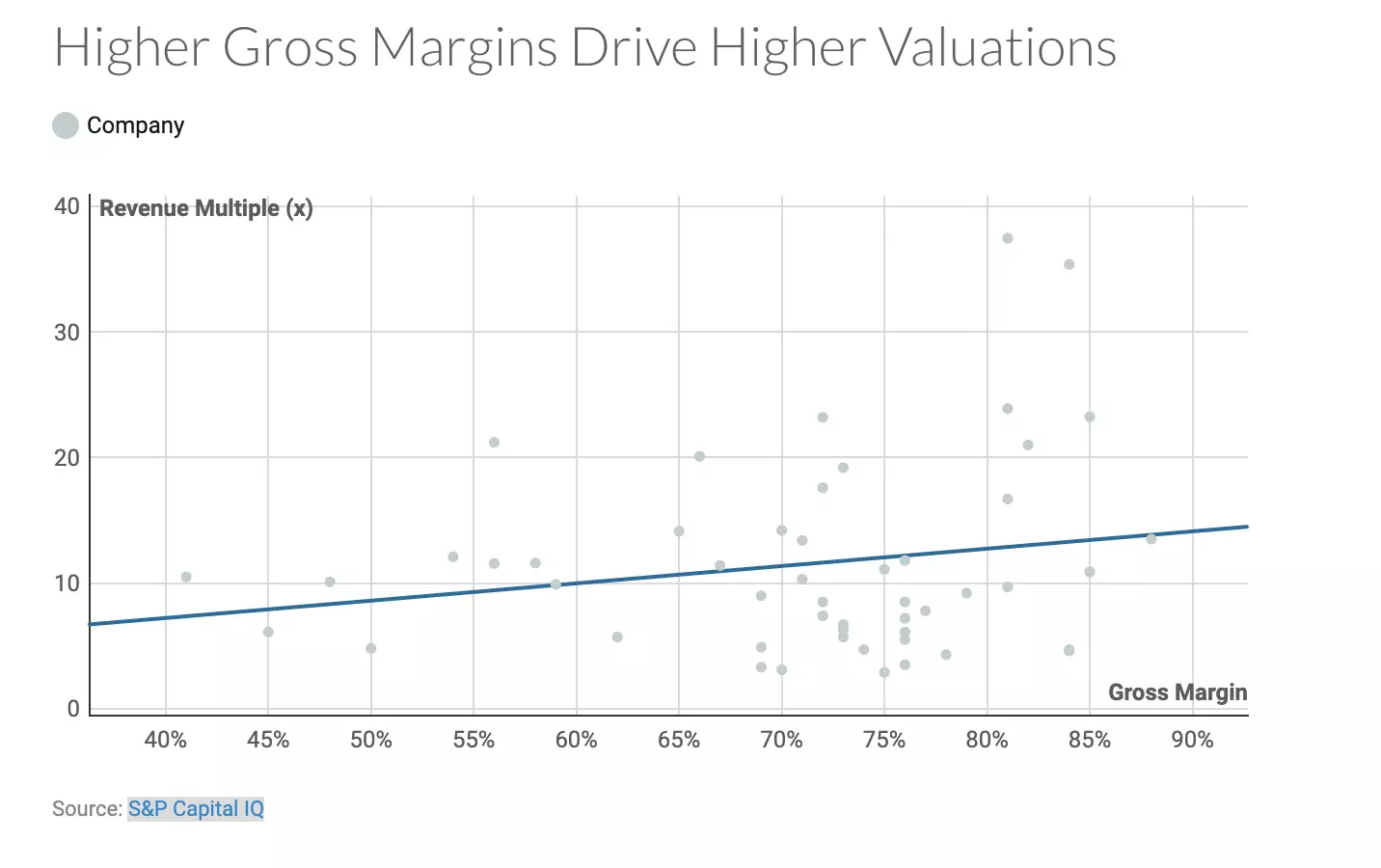

Higher gross margins lead to a higher valuation, which can boost the amount you can get during a funding round, as you can see here.

Net profits often fall when gross margins are weak. Low-profit margins make it harder to fund R&D and innovation. Furthermore, you may not have enough left over to fund marketing and sales campaigns that can help you attract more and higher-value clients.

Many companies in the SaaS sector assume gross margins will increase as they scale. That’s not necessarily true.

It might be tough to optimize your SaaS COGS as a larger company if you have trouble understanding and allocating them now. It could mean being unable to report higher gross margins that would increase your valuation, attract investors, and make it easier to service operating costs.

How To Help C-Suite Understand SaaS COGS

Here’s the thing. Adding new functions, minimizing downtime, and improving existing features are all priorities for engineers.. The board, finance, and investors want to know whether input X will increase profits and recurring sales.

So, what steps should the engineering team take to align with finance? And in what ways do you help SaaS executives understand SaaS COGS so they can provide the resources you need to innovate?

1. Speak the language of business

Engineers are used to communicating technical metrics, whether it’s explaining why uptime has improved or advocating for a fresh approach to a roadmap initiative. Instead, break down engineering costs in a way that helps your executive team make sense of your costs.

For example, an executive team or board of directors does not care how much Amazon S3 costs or how architectural choices from years ago resulted in the current cost structure.

They want to know things like:

- How much does it cost to run each application? What are the most expensive features of the application? What features do customers (internal and external) actually use?

- How do costs correlate to different engineering teams?

- How much does it cost to host individual customers and business use cases? For example, how much do customers at a particular service tier cost to support?

- How profitable is each product?

- How can we reduce costs? Which trade-offs must be made?

- What is our unit cost (e.g., cost per message, transaction, etc.?)

Then talk about the potential roadblocks that might come up.

2. Discussing trade-Offs and risks

In most cases, giving your executive team a list of projects to improve COGS or margins won’t be enough since they won’t have the context they need to support your decision — and know whether you’re recommending the right strategy.

As an engineering leader, it’s your job to remove that uncertainty by providing important context about trade-offs and risks.

We like to group projects with easy-to-understand groupings like “no-brainer” and “moonshot” projects. If a project takes several staff days and saves 10% on your bill, it’s a no-brainer — and your executives will almost certainly agree.

However, some projects are more speculative, so you aren’t sure what kind of savings they’ll yield. These project might reduce your COGS by half, but they might also be a dead-end. Those are your moonshots.

For example, describe the human resource costs and the roadmap items that might be at risk. You should also express any uncertainty you have about the approach you plan to take. When you’re only 50% sure your changes will affect costs and performance, it’s better to say so proactively than to embark on your plan only to report lackluster results.

Every engineering initiative will not be a success. Business leaders rely on engineering for information when deciding which risks are worth taking.

If your engineering team spends three months re-architecting the application and there’s a 50% chance they’ll save $1 million per month, should they do it? Is it worth it to improve performance by 50% while increasing costs by 30%?

Even with the best data, there will always be some uncertainty. It’s essential to convey uncertainty accurately by presenting potential risks and benefits as part of any decision-making process. This will allow leadership to make an informed decision.

3. Make sure you have GTM context

Margin improvement goes beyond technical system improvements. To ensure the products you build are priced and packaged correctly, get input from your GTM team leaders, such as your CRO or head of product.

One of the most important things you can do is present your cost and utilization data, mapped to the business units they care about.

Taking this approach allows your team to work together to maximize margins — and shows your team potential revenue growth areas they may not have thought of otherwise.

For example, let’s say you work for a SaaS company that offers a messaging platform, and you allow your customers to backup messages for free, but you identify that storage costs are 30% of your COGS.

You will want to use this data to discuss whether you should start charging extra for storage — or whether you could reduce the cost of storage with an engineering solution.

Your business can benefit greatly from these sorts of conversations. Not only can you grow your margins and provide direction to your business — but finding a solution that doesn’t involve engineering can help keep new feature delivery on pace so that you can stay competitive.

4. Don’t wait for the crisis

Engineering leaders who can have successful conversations about COGS don’t wait for a crisis. Cost data is something engineering leaders need to pay attention to continually, and neither engineering leaders nor the exec team should wait for crunch time to have a conversation about it.

If you want to become an expert in cost data, you need to pay attention and use it frequently in your decision-making.

These are ultimately business decisions. Effective executive teams use data to support their choices. You need to show, with data, how the technical decisions your organization has made are associated with your business results and goals.

The team also needs to have enough information about costs, risks, and trade-offs to make their own contributions, even if they do not know how your technical system works and wouldn’t know which way is up on an AWS bill.

Cloud Cost Intelligence Can Help

Having trouble connecting technical decisions with business results?

CloudZero’s Cloud Cost Intelligence platform automatically aligns cloud spend to the metrics businesses care about like COGS, cost per feature, customer, product, team, environment, and more.

With CloudZero, engineering teams can see exactly what AWS services cost them the most and why. Finance teams can finally get the cost insight they need to make informed decisions, such as setting prices based on cost per customer, ensuring profitability for their business.

Companies like Drift, Remitly, MalwareBytes, and Upstart use CloudZero to understand their per-unit costs.

Want to see CloudZero in action for yourself?  .

.

Frequently Asked Questions About Cost Of Goods Sold

Can you account for COGS without revenue?

Theoretically, the cost of goods sold should not exist if there are no sales of goods or services. Rather, you’d need to record the costs associated with the product or service in the inventory asset account, entered as a current asset on the balance sheet.

What are the components of COGS for SaaS companies?

COGS includes the direct costs of creating and delivering a SaaS service or product. SaaS COGS include hosting costs for your production environment in the cloud, software licensing fees, software implementation costs, site reliability wages, and customer support staff costs.

Does COGS affect operating income?

Yes. Your SaaS operating income is what remains after you deduct COGS and other operating expenses out of your sales revenues. Finance charges, taxes, and interest costs are not considered.

What is the difference between COGS and Cost of Sales?

Cost of sales is not the same as COGS. COGS is a measure of only the direct costs of creating and delivering a SaaS product or service over a given period, whereas cost of sales accounts for both direct and indirect costs over the same period.

What is the SaaS margin on COGS?

A SaaS gross margin is the revenue you have after subtracting your cost of goods sold (COGS) divided by the total revenue. A higher SaaS Margin on COGS indicates more efficient cost management and greater potential for profitability.

What should the ideal COGS be for SaaS?

Most people view a healthy SaaS business model to have a gross margin of 80-90% which which would put an ideal COGS at just 10-20%. However, it is not uncommon for COGS to reach a greater percentage, depending on how complex the product is. However, anything past 40% would not be ideal.