In financial forecasting, looking at the past helps predict what’s possible in the future. You can plan ahead, take informed action, and avoid losing your market advantage.

The finance department and other teams examine the relationships between variables to come up with more realistic financial plans.

Financial forecasting can be daunting, with a vast amount of financial data to analyze, multiple teams to consult, and a range of forecasting techniques to choose from.

Good news: Today’s forecasting tools and platforms minimize manual tasks and errors, easing financial planning.

For instance, you can use real-time forecasting software to sync new information across all projections with a click of a button. This ensures your financial plans remain feasible over time without modifying all reports individually over several days.

Trying to figure out what forecasting solutions to consider right now? We’ve compiled a bookmarkable guide that includes:

What Is Financial Forecasting For SaaS Companies?

Forecasting combines past financial performance data, market trends, and gut feeling to make short- and long-term projections.

Considering the rapidly changing nature of the Software-as-a-Service industry, financial forecasts are especially important for SaaS companies. For example, SaaS brands often deal with subscribers paying customers one month and unsubscribing or returning to a free plan the next.

Robust forecasts can help you generate best- and worst-case scenarios, which you can use to plan accordingly.

Why Use Forecasting Tools?

A financial forecasting tool lets you estimate financial performance in different business areas over time. Doing so allows you to allocate resources to facilitate growth and a positive cash flow.

As your knowledge and predictions’ reliability increase, you’ll become more confident in making crucial decisions.

The best forecasting software includes predictive templates, interactive dashboards, and complex algorithms that enable you to predict revenue, profitability, growth, and risk using proven statistical models.

The Best Forecasting Software And Tools For Finance Teams

1. CloudZero – Cloud cost forecasting solution for FinOps, engineers, and finance teams

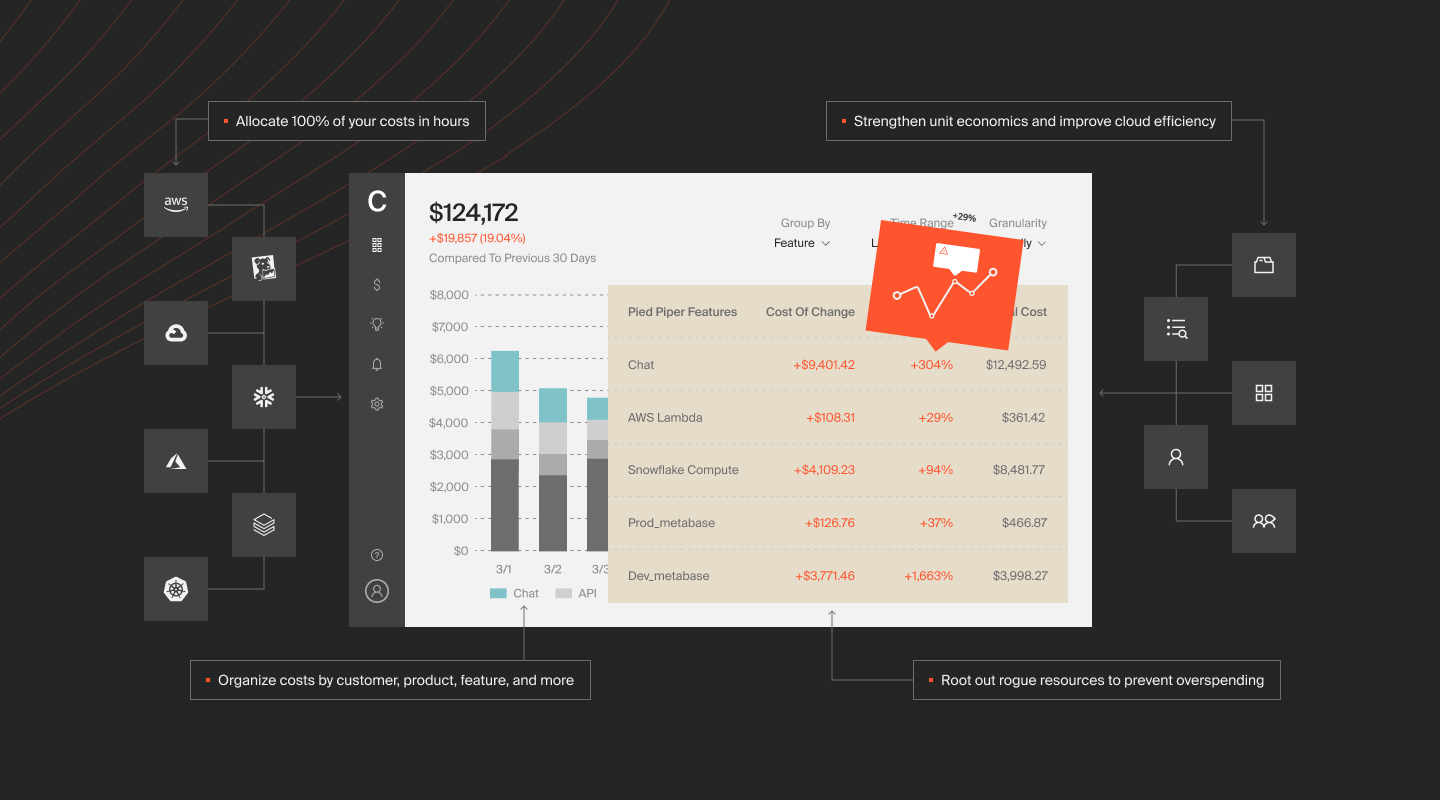

CloudZero empowers your teams with the tools and means to understand your costs in the cloud. It also includes reporting, reconciliation, and variance analysis with CloudZero Budgets.

CloudZero’s unique code-driven approach also helps you see the costs of tagged, untagged, and untaggable resources. More uniquely, you can track your costs per individual customer, product, software feature, project, team, and other metrics you care about.

By delivering this granular cloud cost intelligence, you can measure COGS and unit economics — and get the visibility you need to close the books, including tracking spending against your budget, modeling costs in real-time, and predicting costs over time. Your team will also receive cost anomaly alerts should costs deviate from your projection so you can prevent overspending.

Reading about CloudZero is nothing like experiencing it for yourself.  to see CloudZero in action.

to see CloudZero in action.

2. Anaplan – Enterprise-grade financial forecasting solution

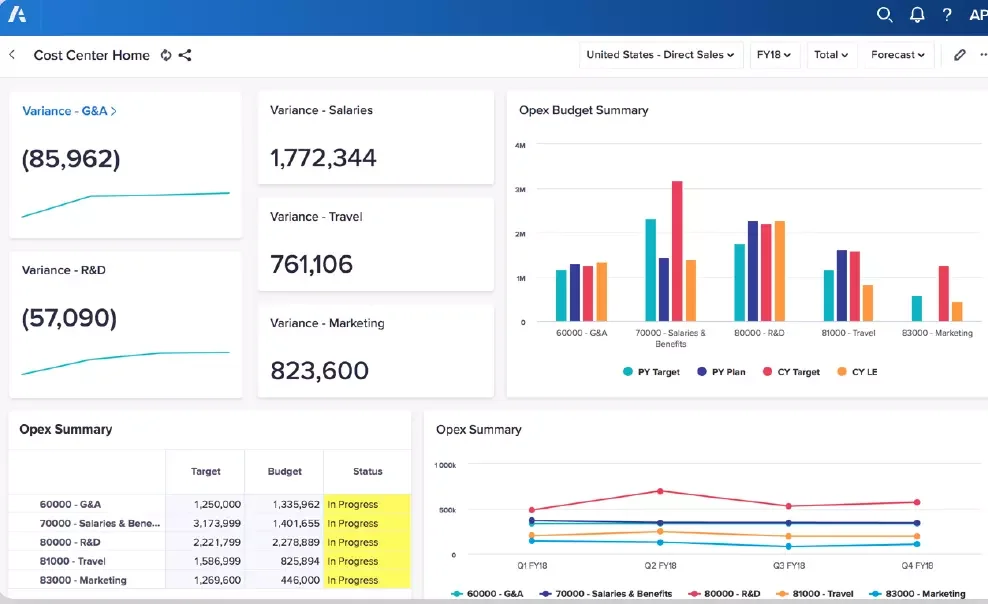

Anaplan uses real-time financial data from internal and external sources to deliver large-scale, multi-dimensional insights for planning. The platform facilitates organization-wide forecasting with tools for finance, sales, marketing, supply chain, IT, and HR.

Anaplan combines budgeting and forecasting capabilities that deliver robust financial planning insights, from modeling to operational planning. Changing the platform affects all other areas, updating all stakeholders on the current progress against your budget and forecast.

3. Vena – Excel-based financial forecasting tool

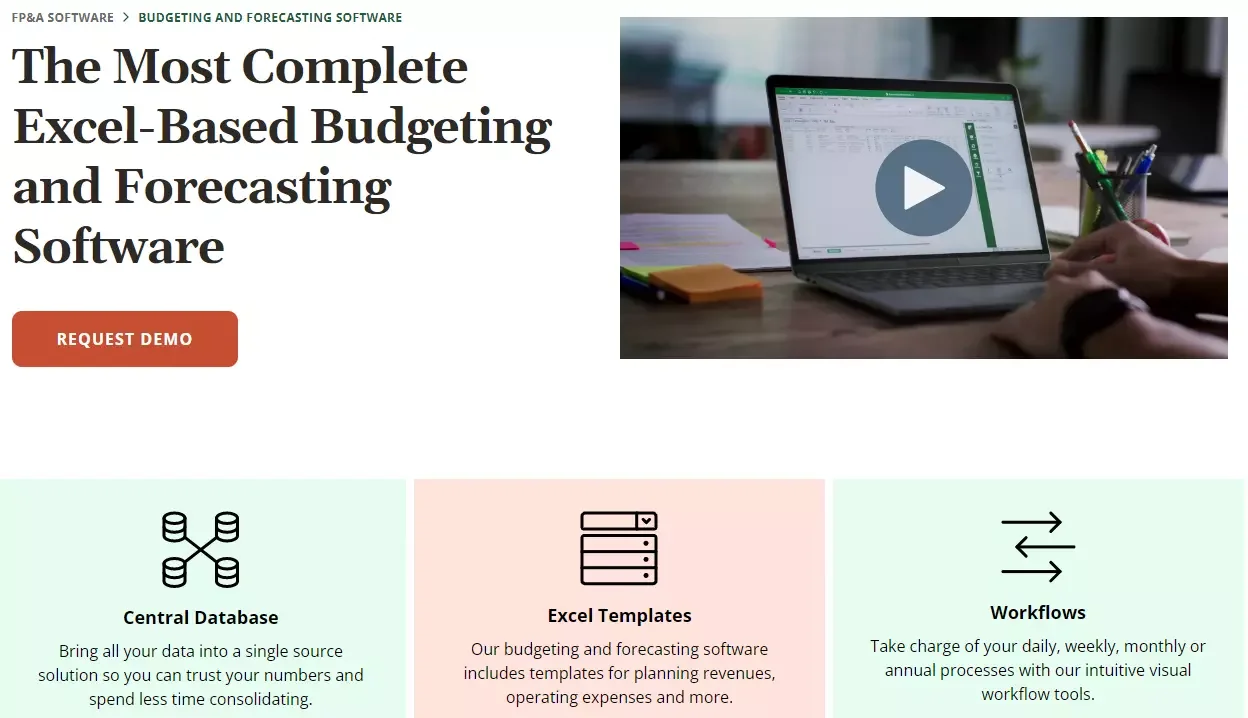

With Vena, you get a financial planning and analysis tool that’s more user-friendly than traditional spreadsheets — and some other forecasting tools on this list. It is a cloud-based solution that enables you to consolidate all your financial data into a single source of truth for planning.

The solution includes budgeting and allocating funds, cash flow planning, and tax provisioning across the business. It also offers what-if analyses, financial close management, and drill-throughs, all accompanied by an intuitive Excel-like interface at any scale.

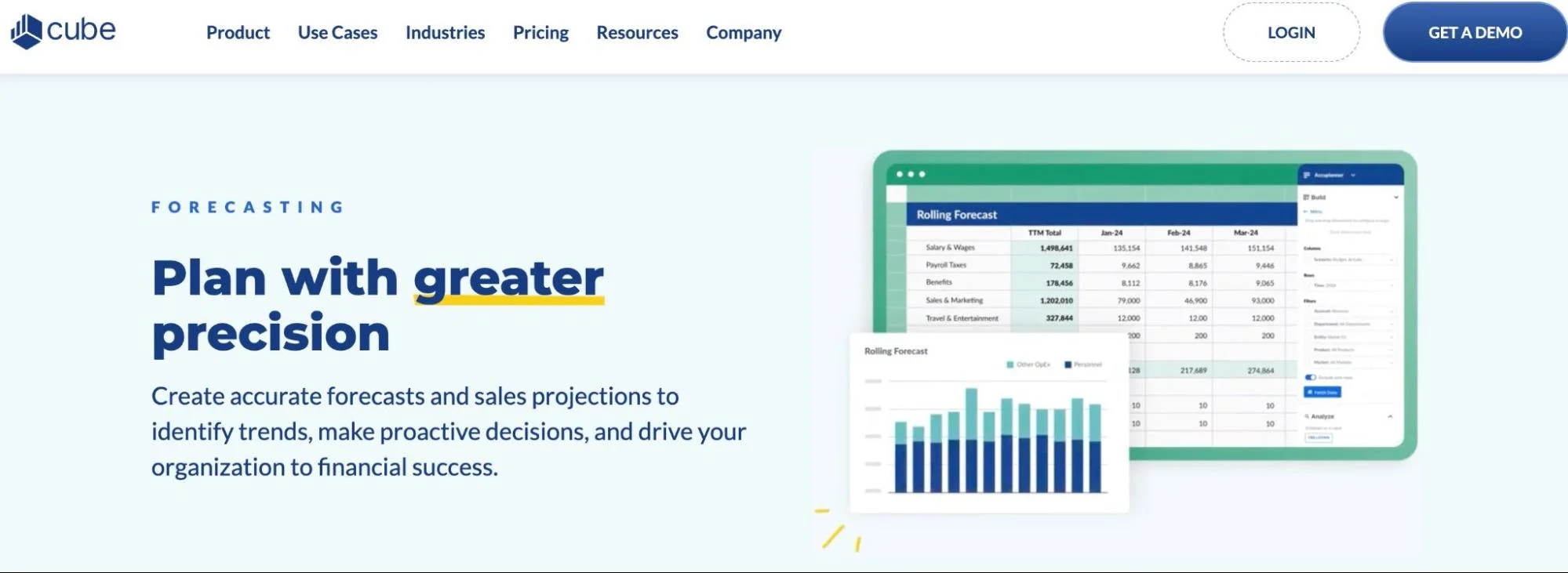

4. Cube – Intuitive corporate budgeting and forecasting platform

Cube provides robust financial modeling, consolidation, and validation solutions to businesses of various sizes. It also emphasizes financial data security, controlling access to data through file permissions, and ensuring that templates only allow users to enter data in designated areas.

With Cube’s FP&A tools, you can collect up-to-date financial data from multiple sources, including ERPs, CRMs, and HRIS.

Your team will be up and running within 10 days. The tool will integrate seamlessly with all your favorite financial management tools (such as Excel, Salesforce, Tableau, Xero, Snowflake, and Quickbooks).

5. Oracle Essbase – Cloud and on-premise financial forecasting platform

Unlike other top forecasting tools here, Oracle’s Essbase provides financial planning and analysis tools for on-premises use. It delivers advanced scenario modeling, over 100 pre-built calculation functions, and multidimensional expressions (MDX) query language support.

The forecasting solution has a background in enterprise financial analytics, enabling you to model complex hierarchical relationships with various levels and rollups. You can also work with multiple data sources, transform spreadsheets into ready-to-use financial forecasting assets in seconds, and test the models at any business scale and structure.

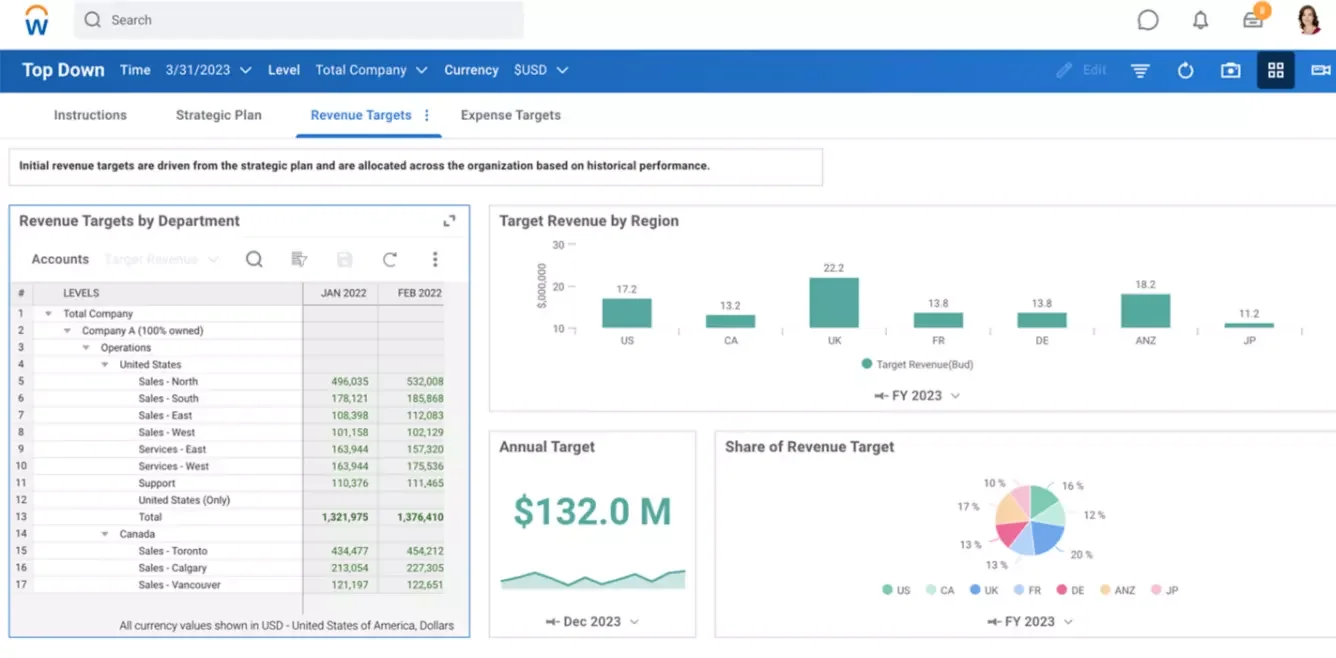

6. Adaptive by Workday – Enterprise forecasting solution

Adaptive offers various forecasting tools for different business structures, goals, and cost centers.

The platform tightly couples its budgeting and forecasting capabilities, from rolling forecasts and scenario planning to top-down/bottom-up budgeting and zero/incremental-based budgeting techniques.

It incorporates real-time data daily/monthly/quarterly/long-term forecasts and connects all your financial planning tools for easier projecting. Besides, Anaplan features a web-based interface, seamless collaboration, and the power of cloud modeling despite its Excel-like experience.

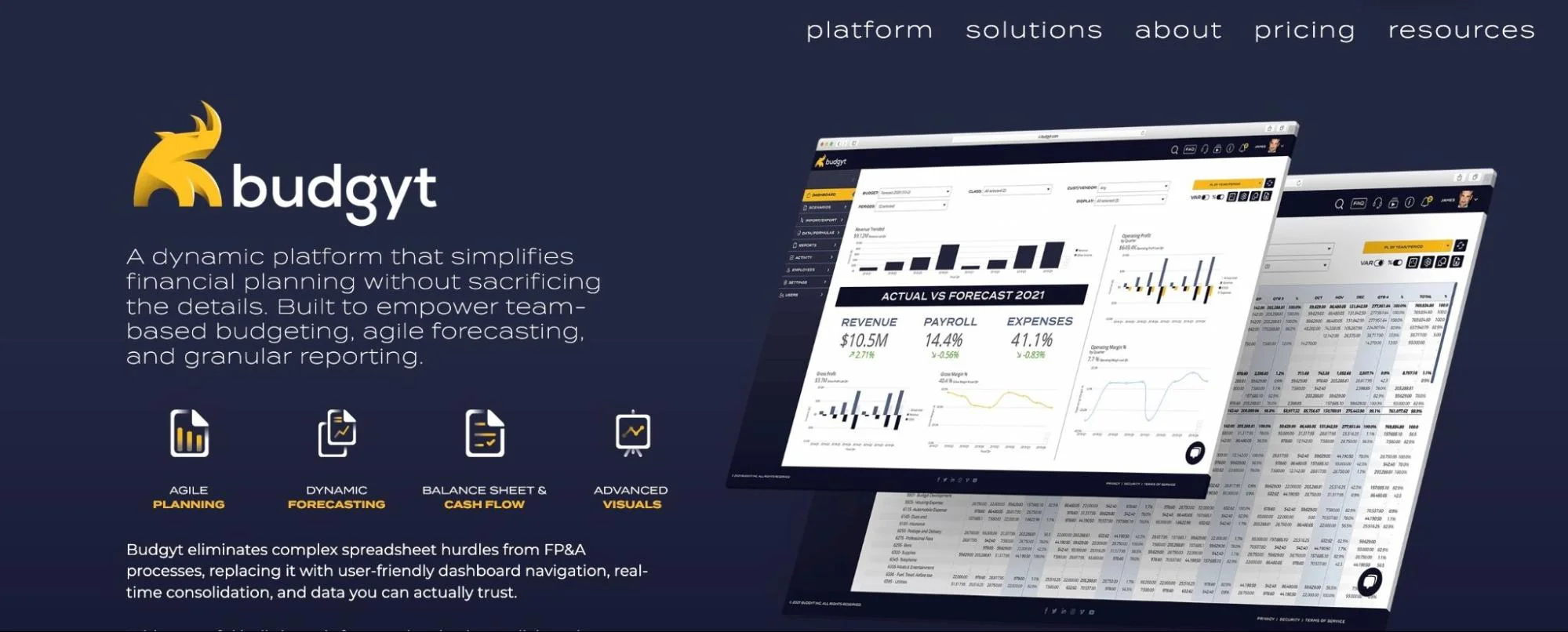

7. Budgyt – Granular forecasting tool

If you are looking for a forecasting solution that delivers transactional-level analysis, Budgyt simplifies forecasts without hiding the details. The tool replaces a raw Excel-like experience with user-friendly navigation, real-time consolidation, and budgeting collaboration.

It mainly emphasizes cash flow and balance sheet forecasting. You can also limit who accesses what view or can make changes that roll into the budget.

Budgyt also lets you filter the activity log with various filters to countercheck specific insights.

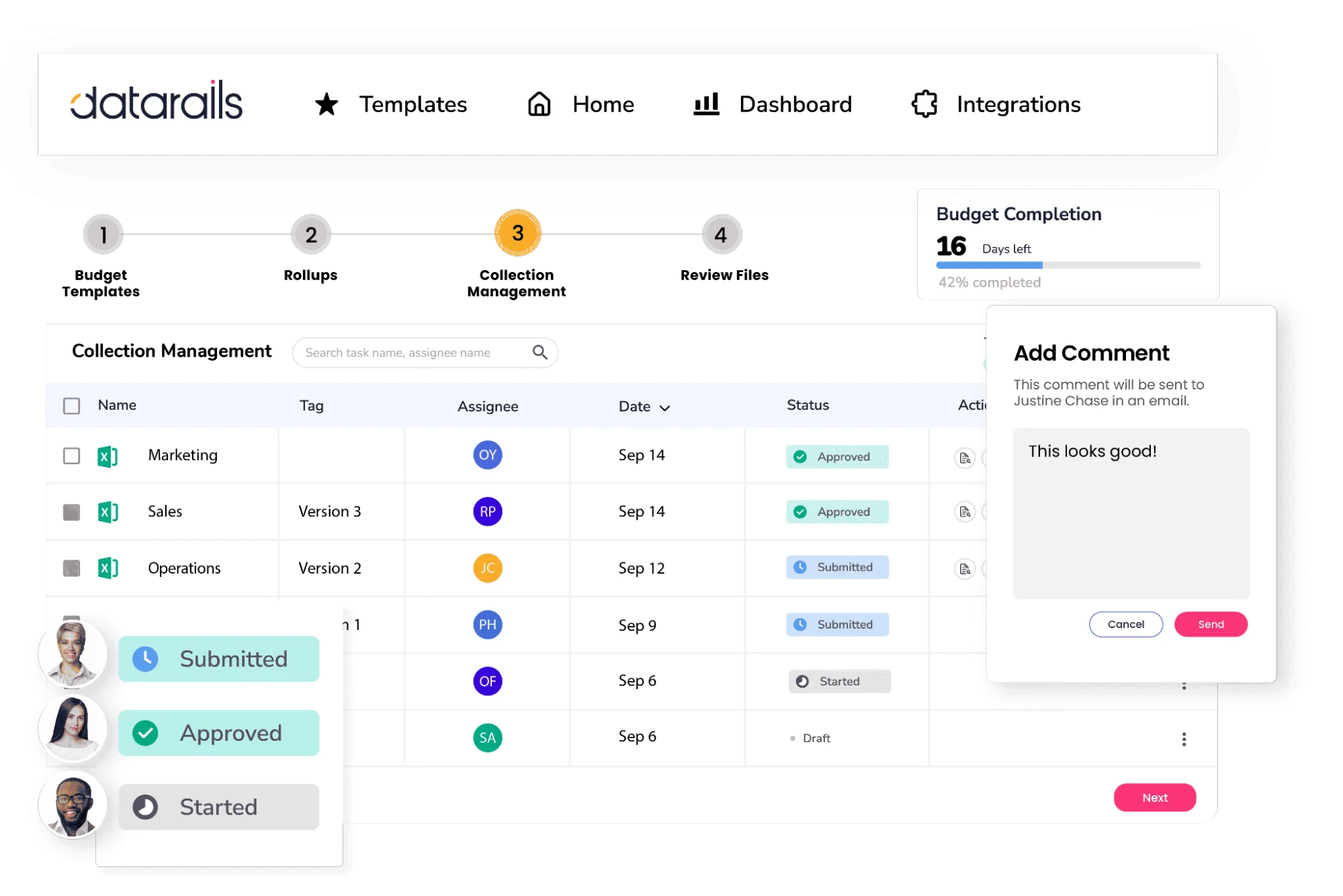

8. Datarails – Comprehensive FP&A tool for forecasting

Datarails enables you to consolidate, analyze, and estimate revenue and costs across your company using up-to-date projections. Using Databricks’ scenario planning, you can evaluate how changes in your financials will affect business outcomes in multiple possible futures.

Datarails then incorporates other FP&A capabilities to ensure you can reasonably estimate what’s next and prepare for it.

Once you consolidate and validate your forecasting data, you decide whether to share insights with stakeholders using rows and columns or a visual dashboard. In either case, you can zoom into your data in real-time for specific answers.

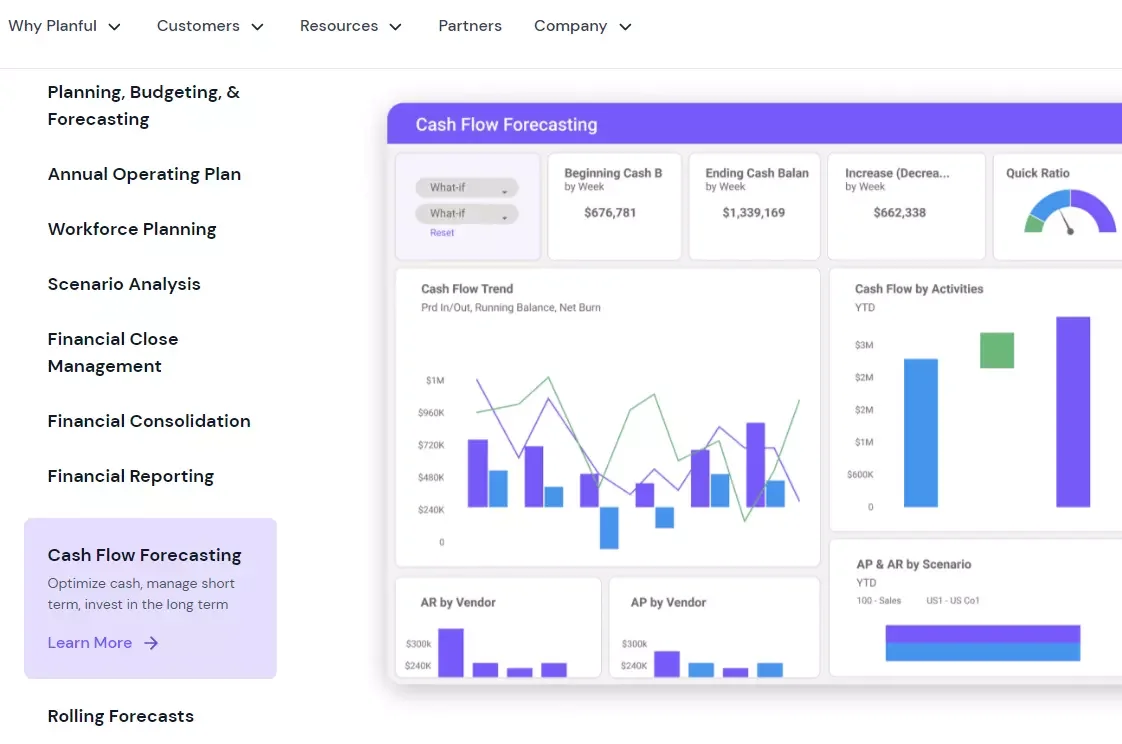

9. Planful – Cashflow forecasting solution

Planful helps financial analysts minimize slow and manual planning with scalable and AI-enhanced operational and financial planning tools.

You can use Planful for scenario analysis and generate cash flow and rolling forecasts. Compared to days or weeks with other forecasting methods, these take only a few clicks in Planful.

The platform also delivers solutions for HR, sales and marketing, and accounting, enabling you to manage your financial plans across the organization from a single source of truth.

Using built-in templates and financial intelligence, Planful also enables you to automatically store, categorize, and present your data based on accounting attributes.

10. Prophix – Role-based financial planning software

Prophix creates and evolves rolling forecasts quickly and easily by combining live actuals, historical forecasts, carry-forward capabilities, and applying assumptions at any level. You can make accurate forecasts by combining data from multiple sources.

The flexible tool pulls actual, anticipated, and forecast data into one location. This means you can apply your latest assumptions and quickly quantify market trends without manual data entry or referencing other sources.

You can also update forecasts, approve them, and modify them via the feature-rich Prophix web interface or the familiar Microsoft Excel experience.

11. Oracle Hyperion – Large-scale financial performance planning platform

This enterprise forecasting tool improves financial predictability by simplifying operational and financial processes. Oracle Hyperion Planning combines planning, budgeting, and forecasting to deliver financial intelligence you can analyze from different angles.

You can then align or drill down your reports to capture answers across teams, regions, lines of business, and cost centers across your large organization.

The platform also works within the Oracle Cloud, on-premises, in your local data center, or a combination of these.

13. Drivetrain – Scenario planning and predictive insights

Drivetrain offers advanced scenario modeling and predictive analytics. It integrates with existing data sources, automating projections and delivering actionable insights to decision-makers.

The platform’s AI-driven tools also enable users to create “what-if” scenarios quickly, helping businesses prepare for potential risks and opportunities.

13. Jirav – Workforce, sales, and revenue forecasting tool

Jirav uses a driver-based modeling engine to power its financial planning function. It lets you use both historical and current projected business activities to model how your business decisions affect your cash flow up to 60 months out.

Besides, Jirav provides growth plans, scenario testing, and planned versus actual performance metrics for startups and growing businesses. Combine this with its full range of FP&A tools, and you will have a financial forecasting solution you can leverage for medium-term forecasts.

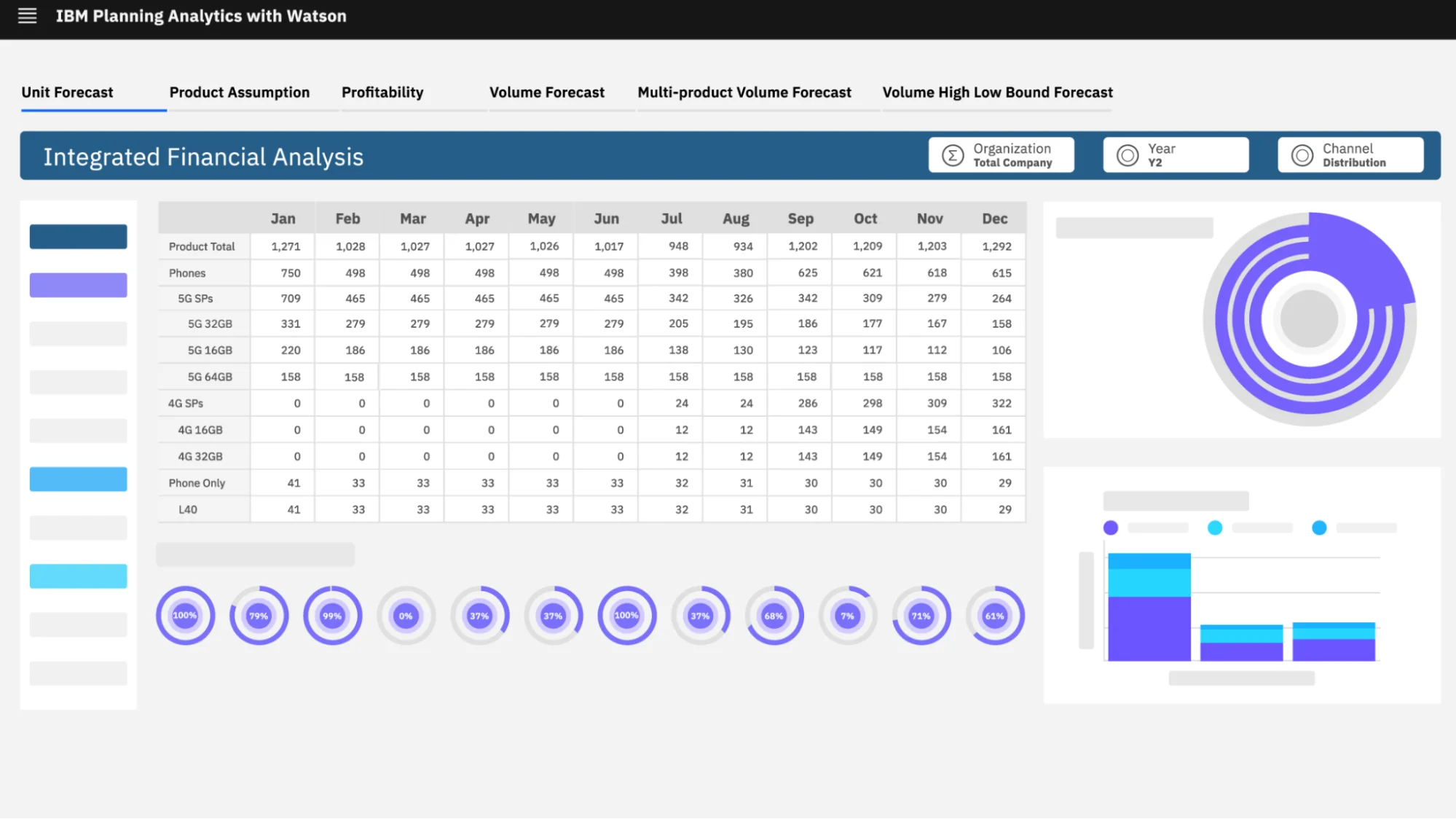

14. IBM Planning Analytics With Watson – ML-powered forecasting

As a world leader in artificial intelligence (AI), deep machine learning (ML), and data analytics, IBM leverages these advantages to power its financial planning, budgeting, and forecasting tools.

A native Microsoft Excel add-in makes the tool intuitive, while the ability to generate forecasts beyond the current fiscal year makes it stand out.

The platform incorporates profitability and cash flow modeling to assess performance by a customer, product, channel, and model changes. This means you can shift your resources to prioritize the most profitable areas.

15. Centage – Cash flow, P&L, and balance sheet forecasting

Centage’s Planning Maestro leverages scenario analysis, planned vs. actual, and other forecasting tools to deliver fast and scalable insights.

You can use it to compare multiple scenarios and their impact and analyze what you can do now to avert problems down the road. It supports rolling updates for 12- and 18-month periods.

With Planning Maestro, you can create accurate, consistent, and centralized P&L, balance sheet, and cash flow statements without duplicating any work or calculations.

Along with the overview for quick glances, you can drill down into detailed data for deeper insight, including variances and financial risks.

The Next Step: Take The Mystery Out Of Cloud Computing Costs With CloudZero

With CloudZero, you can untangle, understand, control, and predict your cloud costs — without endless manual tagging in AWS, Azure, or GCP.

CloudZero empowers you to:

- Know what, who, and why your cloud costs are where they are now — and how they may change.

- See cost drivers with context to know where to go next. For instance, you can view your cost of supporting an individual customer and see if you are earning a healthy margin or need to review your contract with them.

- Forecast how onboarding several similar customers could impact your costs.

- Receive noise-free alerts whenever your costs are trending abnormally or are about to cross a pre-defined threshold.

- Track people, products, and processes that drive your costs with budgeting and forecasting.