According to our new report, FinOps in the AI Era: A Critical Recalibration, 40% of companies now spend $10M or more annually on AI. Most can’t tell you if it’s working.

That’s not a budgeting problem. It’s a systems problem. And Donella Meadows wrote the playbook for understanding it.

A Quick Primer On Thinking In Systems

Meadows’ Thinking in Systems (2008) is one of those books that changes how you see everything. Like Goldratt’s The Goal or Brooks’ Mythical Man-Month, it gives you a lens you can’t un-see through.

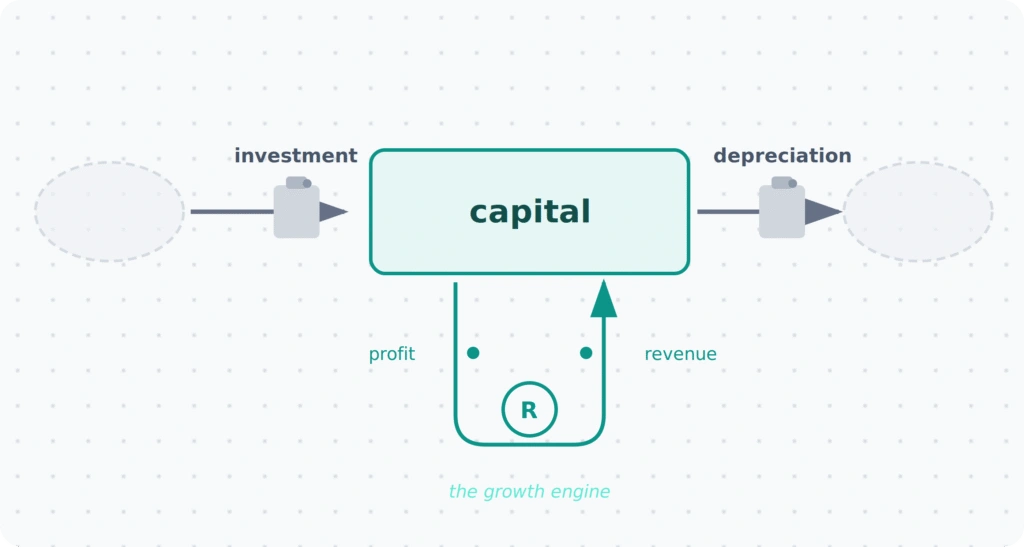

The core idea: complex systems are built from stocks (things that accumulate), flows (rates of change into and out of stocks), and feedback loops. A reinforcing feedback loop amplifies — growth begets growth, or decline accelerates decline. It’s the engine of compound interest and the engine of bankruptcy. Same mechanism, different direction.

The insight that matters for us: when two reinforcing feedback loops interact, the system’s behavior depends entirely on how they’re connected. Small differences in that connection produce wildly different outcomes — stability, oscillation, or collapse.

Sound familiar? It should. This is exactly what’s happening with AI investment.

Stock 1: The Capital Engine

Every healthy company runs on a reinforcing feedback loop. Capital funds product investment. Product investment generates revenue. Revenue becomes profit. Profit flows back into capital. Left alone, this compounds. It’s the growth flywheel — the engine that got your company to where it is today.

This loop has survived recessions, cloud migrations, and that one quarter where someone forgot to use up the Reserved Instances you prepaid. It’s resilient because the feedback signal is clear: invest, measure returns, adjust, repeat.

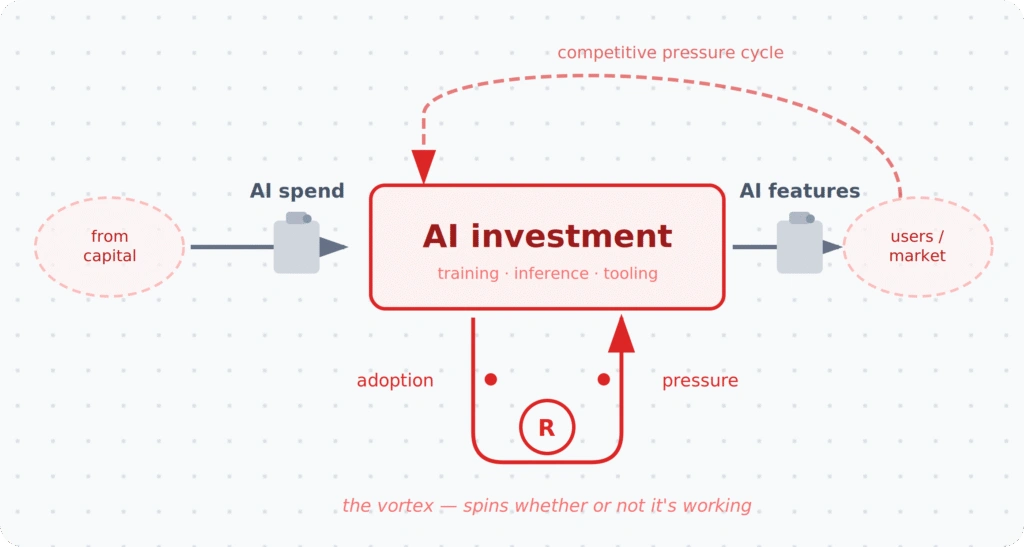

Stock 2: The AI Investment Vortex

AI investment has its own reinforcing loop. And it’s a dangerous one.

Competitors ship AI features. Customers expect AI. You invest. Your competitors invest more. Repeat. Internally: ship an AI feature, users adopt it, usage scales, costs scale, invest more to keep up.

Here’s the structural problem: this loop is self-reinforcing independent of whether it generates business value. It feeds on competitive pressure and user adoption, not profitability. As one CloudZero customer put it: their AI feature was the fastest-adopted in company history and the least profitable. Leadership’s response? “There’s no way we’re turning this off.”

The vortex spins whether or not it’s working.

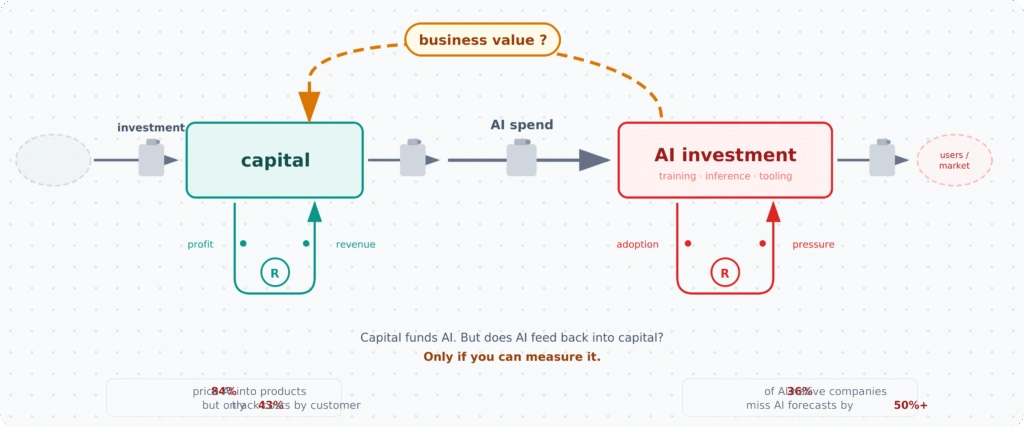

Where It Gets Dangerous

Now connect the two stocks. Capital funds AI investment — that’s an outflow from Stock 1 into Stock 2. But does AI investment feed back into capital? Only if it converts to measurable business value.

This is where Meadows’ framework earns its keep. The relationship between these two loops produces three possible outcomes:

Stability. The loops are coupled. AI investment generates value that flows back into capital. You invest, measure, see returns, and adjust. The system balances. This requires granular visibility — tracking AI costs by customer, by transaction, by feature. Organizations that can do this are ahead. Most can’t.

Oscillation. The loops are loosely coupled. You invest heavily in AI, can’t measure the return, keep going on faith, hit a capital constraint, slam the brakes, fall behind competitors, panic, and restart. Boom-bust. Our new benchmark report found that AI-native companies have the best monitoring infrastructure and the worst forecast accuracy — 36% miss their AI spend predictions by 50% or more. They’re riding the oscillation.

Collapse. The loops are fully decoupled. The AI vortex drains capital faster than the capital engine replenishes it. Because competitive pressure keeps the AI loop spinning, it doesn’t slow down when capital shrinks. It just consumes. This is “strategic unprofitability” that was never actually strategic — it’s unquantified leakage at terminal scale.

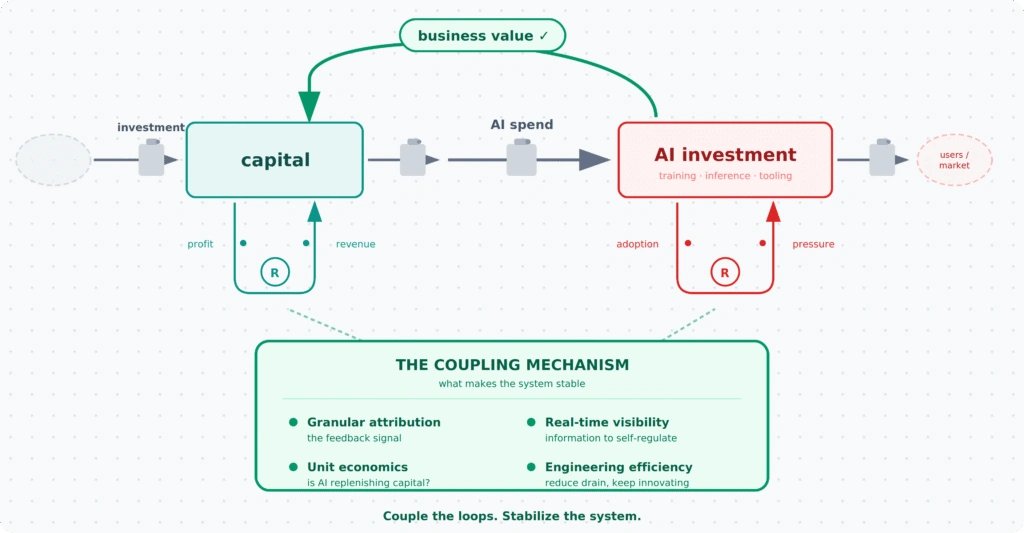

The Coupling Mechanism

So what determines which outcome you get? Feedback. Information flowing from the AI investment stock back to the capital stock, telling the system whether the investment is working.

That feedback mechanism has a name. It’s FinOps — specifically, granular cost attribution and unit economics.

Our benchmark data makes the gap painfully clear: 84% of organizations price AI into their products, but only 43% track costs by customer. Only 22% track by transaction. That’s a system with a broken feedback loop. You’re investing without knowing if the investment is returning value. The vortex spins on, decoupled from reality.

Coupling the Loops

Meadows taught us that the most dangerous systems are the ones where reinforcing loops run without feedback. AI investment is exactly that kind of loop — self-reinforcing, pressure-driven, and structurally decoupled from business value.

The fix isn’t spending less on AI. It’s coupling the loops:

Granular attribution connects AI spend to business outcomes — the feedback signal. Unit economics measures whether the AI stock is replenishing the capital stock. Real-time visibility gives the system the information it needs to self-regulate. Engineering efficiency reduces the drain rate without slowing innovation.

The organizations that will thrive aren’t the ones spending the most on AI. They’re the ones whose systems can see whether that spending is regenerating value — or consuming it.

We have the data to show where most organizations stand today. Read the full report now.