This year’s AWS re:Invent was a blur of GPUs, LLMs, and infrastructure roadmap reveals — but for those listening between the keynotes, another story was unfolding.

Between hallway chats, booth conversations, and live polls, a signal emerged from the noise: FinOps is growing up. Mature cloud teams aren’t just managing costs — they’re asking smarter, more strategic questions about value, forecasting, and engineering accountability.

It also became clear that AWS is doubling down on AI in 2026 — even though it missed internal AI growth targets this year. This renewed commitment, despite early challenges, signals that AI isn’t a temporary spike in spending — it’s becoming a long-term line item FinOps teams must understand, allocate, and justify.

Here are six big signals we collected from the floor:

1. Forecasting Is The Next Frontier

In a poll of highly experienced FinOps practitioners — most operating at enterprise scale — forecasting was the runaway winner for the future of cloud cost management.

This reflects a growing interest to shift FinOps from reactive reporting to proactive financial modeling — especially as AI-driven infrastructure and variable workloads grow more robust and unpredictable.

Conversations at the booth reinforced this. Teams relying on homegrown tools or AWS Cost Explorer said the same thing: we can explain the past, but we can’t predict the future. Forward-looking models are becoming the missing link. One executive told us they’re interested in cost per transaction as a forecast for annual growth in addition to explaining the bill.

Takeaway: Forecasting isn’t a nice-to-have. It’s becoming central to strategic planning.

2. AI Spend Is Outpacing Cost Accountability

AI dominated the show floor, of course. FinOps conversations weren’t far behind — and in fact, went hand-in-hand with AI. One common pattern: C-level leaders are approving AI investments quickly, while the people responsible for explaining the bill are left scrambling.

From multi-cloud AI teams using only Cost Explorer to those building their own AI tools on top of Bedrock, the message was clear: visibility is lagging. Finance teams are starting to ask questions, but tagging, shared costs, and opaque pricing make AI spend hard to justify.

Several architects, engineers, and product leads flagged lack of visibility into GPU and network costs as a growing blocker — and a few noted that AI-related charges aren’t even showing up clearly in existing tools.

With AWS doubling down on AI in 2026, visibility isn’t just a technical need — it’s now a financial imperative. If teams can’t break down GPU and LLM costs, they’ll lose control of margins fast.

On a side note, however, CTO Erik Peterson shared in a recent webinar that AI can simultaneously be the fastest-growing *and* least profitable feature in your business — for the time being — and that’s OK. For the time being.

Takeaway: The speed of AI innovation is outpacing FinOps readiness. That gap is closing fast.

3. “Engineering Profitability” Is A Message That Lands

Engineering profitability hit a nerve. It gave teams a way to connect technical effort with financial outcome — and it resonated with engineers who’d never been part of margin conversations before.

Dozens of teams told us they’re searching for ways to talk about cloud costs in language that lands — with finance, with leadership, or with engineers who don’t naturally think in dollar terms. “Cost per product,” “cost per feature,” “cost per customer” — these phrases kept surfacing.

Takeaway: Linking cloud usage to business impact is no longer optional; it’s now an imperative. It’s the only way to align across engineering and finance.

4. Teams Want to Tie Spend to Value — And They’re Looking For Tools That Help

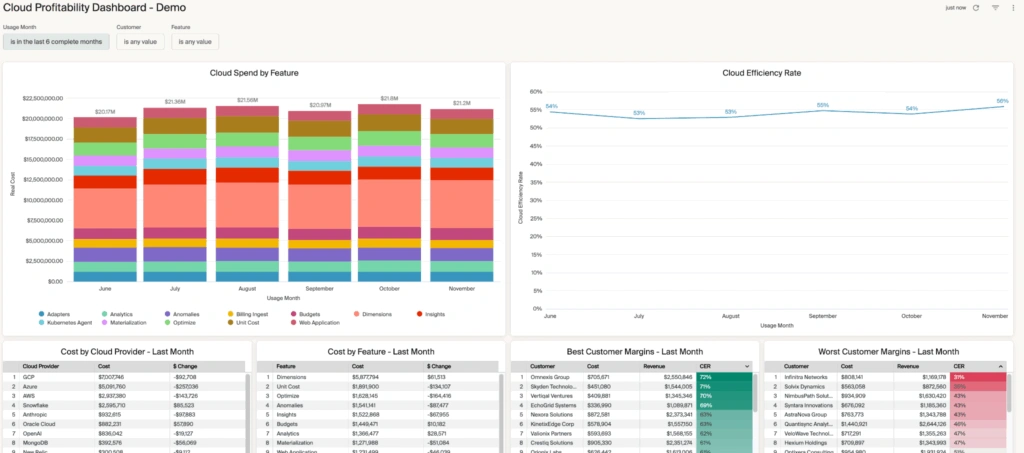

The most photographed image at the booth wasn’t a cloud bill or a savings chart — it was our cloud profitability dashboard breaking down cost by feature, efficiency over time, and customer-level margins.

This resonated hugely with attendees — especially platform teams supporting internal apps, AI services, or cross-functional tooling, who’ve traditionally struggled to show value beyond a shared bill.

Teams also said they’ve been struggling with this exact challenge using spreadsheets, native tools, or old-school cost management platforms. One summed it up well saying that they can easily share a total bill, but can’t share what it actually costs to support a specific product or a specific customer.

Takeaway: The appetite for value-based metrics like cost per job, per API call, or per feature is stronger than ever. Dive deeper into this with our newly updated Cloud Unit Economics guide for 2026.

5. Benchmarking And External Context Are In High Demand

Another popular topic? Benchmarking. Teams don’t just want internal dashboards — they want benchmarks. What’s normal for this workload? Where do we stand on margin, per-customer cost, or AI efficiency compared to peers?

They don’t just want internal visibility — they want external context too.

This came up again and again in booth conversations too:

- “What’s normal for this kind of app?”

- “How do other teams allocate shared costs like this?”

- “Can we use this to guide pricing discussions or justify AI investment?”

Takeaway: FinOps is evolving from mere cost tracking to competitive intelligence. Our monthly Cloud Economics Pulse, which tracks cloud spend by provider and service, and proportion of AI/ML as a percentage of total spend, is especially informative here. You can see what AI/ML spend looks like up to December, for instance:

6. FinOps Maturity Is Still Wildly Uneven — And That’s OK

Despite the advanced crowd, the range of maturity was wide. Some teams were already knee-deep in unit economics, while others were still trying to understand why their tags were broken or how to allocate costs across 100+ AWS accounts.

Even some large-scale organizations were still using only Cost Explorer, or juggling multiple cloud providers with no unified visibility. Several teams said they’re “just getting started” with chargeback, budgeting, or engineering engagement.

There was also clear interest from newer or mid-stage companies trying to get ahead of cost issues before they scale — especially in high-growth AI and SaaS segments.

Takeaway: The FinOps journey still starts with visibility — but it doesn’t end there.

Final Thought: From Visibility to Value

This year’s FinOps conversations at re:Invent made one thing clear: mature cloud teams aren’t just looking for savings—they’re looking for strategy. They’re done just tracking costs. Now they want to forecast growth, benchmark efficiency, and tie every dollar spent to a business outcome.

If 2024 was about tagging, savings plans, and visibility, then 2025 is shaping up to be about accountability, forecasting, and tying spend to impact.