1. Signs You Need To Hire Your First FinOps Professional

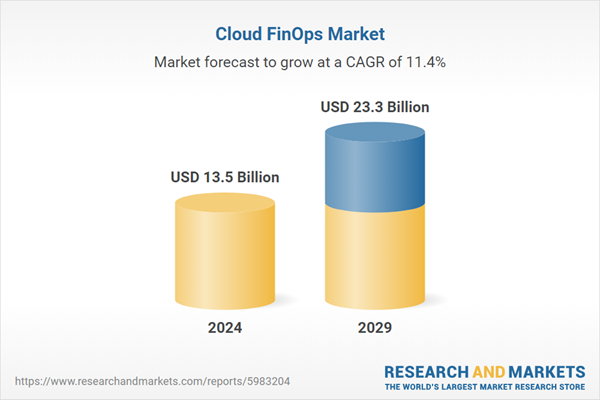

FinOps is booming as a function. The global cloud FinOps market will grow from $13.5 billion in 2024 to $23.3 billion in 2029 — a compounded annual growth rate (CAGR) of 11.4%, according to Research and Markets.

That’s in response to sharp increases in cloud spend. About $723 billion is expected to be spent on public cloud services in 2025, up from $596 billion the year before according to a Gartner report.

That urgency isn’t just anecdotal. 94% of IT leaders say they’re still struggling to optimize cloud costs, according to a global report released in September 2025. The research, commissioned by Crayon, reinforces how widespread this pain is.

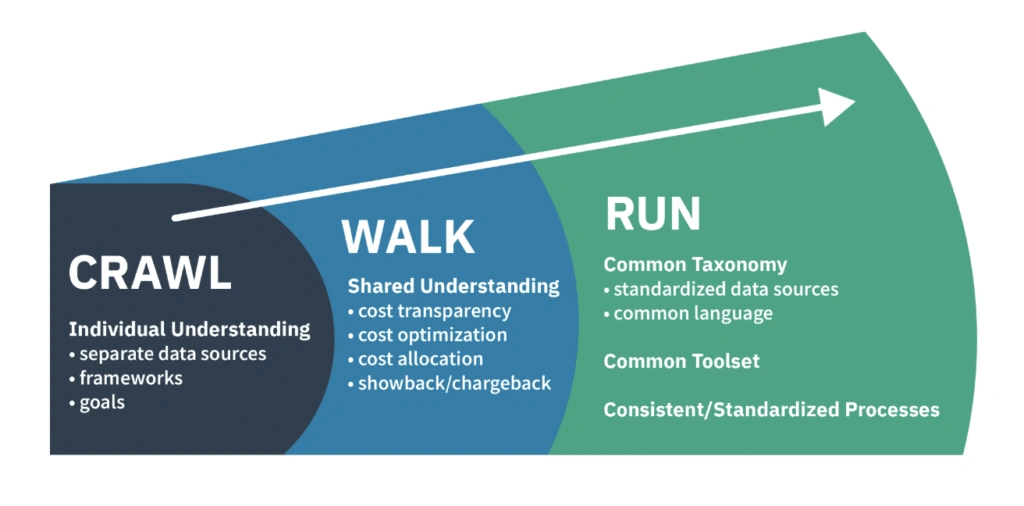

Those kinds of numbers can’t be ignored. Organizations need someone to manage all that stuff. This means an upsurge in dedicated FinOps roles and responsibilities — and the overall FinOps function — as companies face mounting pressure to optimize cloud costs without slowing innovation in line with the FinOps Foundation’s Crawl-Walk-Run ethos.

Important note: hiring a dedicated, certified FinOps practitioner will usually correlate with an investment in a cloud cost optimization platform as part of your company’s maturation. This ideally means attracting candidates who have already been in the buyer’s seat for such a platform at other organizations.

2. Making The Business Case Internally

You already know you need a dedicated FinOps professional and need to know how to hire one, but first how do you get buy-in from stakeholders?

In short, when getting others on board, you must translate abstract benefits into specifics. Instead of vague terms like “efficiency,” highlight concrete examples. Show exactly how a FinOps hire could catch and prevent expensive spikes and wasteful cloud spend through better visibility, clearer tagging, or preemptive cost alerts using a powerful software (such as CloudZero).

Need talking points to get started? Consider the following examples for different personas in your company (in short, speak in a language that makes sense to that specific persona):

For a VP Engineering / Head of Engineering / CTO:

“Right now, our engineering team spends 10+ hours a month manually analyzing cloud costs instead of building features. A dedicated FinOps pro would free up engineers’ time, prevent surprise overspending, and turn those lost hours into productive work.”

For a CFO / VP Finance / FP&A Leader:

“Last quarter, we missed our cloud budget by 18% because no one was tracking usage anomalies in real time. A FinOps hire could help us avoid these unexpected overages by setting up automated cost monitoring and early warning systems.”

For a Cloud Infrastructure Lead / Platform Engineering / DevOps Manager:

“We’re currently paying for over 200 unattached EBS volumes — resources we’re not using but still being billed for. A FinOps pro would help identify and eliminate this kind of waste systematically, saving thousands each month.”

For anyone who’s listening:

“A dedicated FinOps practitioner, equipped with a leading cloud cost platform like CloudZero, doesn’t just bring ‘efficiency’ — they uncover real, material savings. Think: $492K saved by shutting down unused monitoring from an old proof of concept, $288K from decommissioning an obsolete Lambda function, or $684K from right-sizing AWS Config.”

That last quote isn’t a made-up example. It’s an actual, real-life experience from one of CloudZero’s customers as a first step towards optimizing cloud spend.

In short: If you want to convince stakeholders, show the real ROI with a value proposition that makes sense for that specific persona.

3. Role Definitions: Titles And Levels

As FinOps matures, roles become more specialized — but in many companies, early FinOps hires wear multiple hats. Here are three primary FinOps roles, their core responsibilities, reporting lines, and typical KPIs:

FinOps Specialist (individual contributor)

FinOps Specialists are hands-on practitioners who handle reporting, forecasting, cloud cost analysis, anomaly detection, and optimization. They work closely with finance, engineering, and operations to surface insights, improve cost efficiency, and drive action.

- Common job titles: FinOps Analyst, Cloud Cost Analyst, Cloud Financial Analyst, FinOps Engineer, Cloud Optimization Engineer

- Works with: FP&A, engineering leads, cloud platform teams, procurement

- Reports to: Finance, Engineering, or CloudOps leadership depending on org structure

- KPIs: Forecast accuracy, reporting precision, cost savings, optimization actions, waste reduction

Manager, FinOps (team and/or program leader)

FinOps Managers own the program. They define processes, align stakeholders, and drive accountability for cloud spend. They translate cloud financial strategy for leadership and technical teams and often manage one or more specialists.

- Common job titles: FinOps Manager, Cloud Economist, Cloud Financial Strategist, Cost Optimization Manager

- Works with: Senior finance, product leadership, engineering, procurement

- Reports to: VP Engineering, Finance, or CTO

- KPIs: Forecast maturity, cost-to-value alignment, process adoption, savings impact

Head of FinOps (executive leadership)

The Head of FinOps sets strategy, leads cross-functional cost governance, and ensures cloud investments align with business priorities. They drive cultural adoption of FinOps and oversee large-scale optimization efforts.

- Common job titles: Director of FinOps, VP Cloud Optimization, Head of Cloud Cost Management

- Works with: Executive leadership (CFO, CTO, COO), procurement, security, engineering

- Reports to: CTO, CFO, or COO

- KPIs: Organization-wide cost efficiency, FinOps maturity, strategic savings, policy compliance

4. How Much Do FinOps Practitioners Make?

FinOps practitioner salaries in the United States are wide-ranging, from $72,500 for those in the 25th percentile up to $189,000 for top earners.

The average FInOps practitioner pulls in just north of $100K annually, according to ZipRecruiter:

| Annual Salary | Monthly Pay | Weekly Pay | Hourly Wage | |

| Top Earners | $189,000 | $15,750 | $3,634 | $90 |

| 75th Percentile | $106,000 | $8,833 | $2,038 | $51 |

| Average | $100,669 | $8,389 | $1,935 | $48 |

| 25th Percentile | $72,500 | $6,041 | $1,394 | $35 |

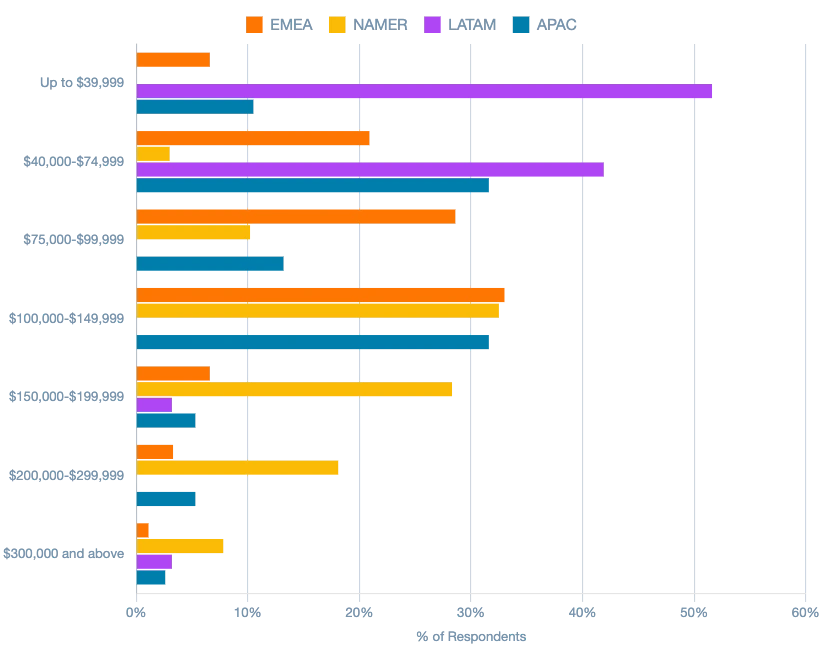

Elsewhere, salaries range widely. North America-based FinOp professionals make the highest salary out of any region — although salaries generally trend with other tech-based professions, according to a 2023 report from the FinOps Foundation:

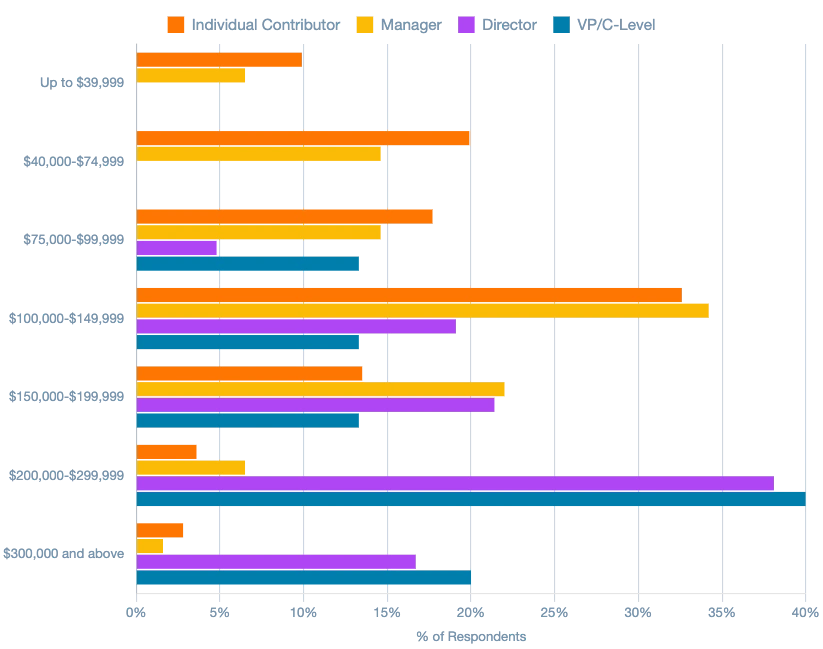

These salary bands, of course, vary wildly as one moves up and down the FinOps ladder. Those in individual contributor or manager roles tend to cluster in annual salary brackets up to $149,000, whereas directorial and VP/C-level positions tend to pull in north of $200,000-$300,000 or more (all US currency).

5. What Makes A Great FinOps Practitioner?

Who can do FinOps at a consistently high level? Great FinOps professionals sit at the intersection of engineering, finance, and operations, translating complex cloud usage into clear, actionable insights. Their goal is simple but crucial: to ensure every cloud dollar spent drives real business value.

As cloud costs move from back-office line items to board-level concerns, organizations need FinOps expertise to bring clarity, accountability, and control to increasingly complex environments — whether it’s managing multi-cloud setups, scaling AI workloads, or navigating dynamic infrastructure.

What sets strong FinOps hires apart isn’t just technical skill or financial acumen — it’s their ability to bridge the gap between teams that don’t naturally speak the same language. They help engineers think in cost terms, help finance understand technical realities, and create processes that make cloud spending predictable, transparent, and strategically aligned.

Again, as mentioned above: The ideal FinOps hire will also already have been in the buyer’s seat for FinOps platforms at other organizations, because they will ultimately not just cut costs but also drive revenue in your company.

Top performers will enable smarter, collaborative decisions, sharper forecasts, and faster, more sustainable growth — and they will be even more equipped to do so with a powerful FinOps platform.

What skills do great FinOps practitioners have? Let’s look:

Technical and financial competencies

Hard skills — specific technical and financial capabilities — are fundamental to FinOps roles.

1. Cloud fluency

Strong FinOps hires know cloud infrastructure and, crucially, how it costs. They recognize misconfigurations like improper autoscaling and have fixed issues caused by untagged or idle resources.

- Tools: AWS, Azure, GCP, Terraform, Kubernetes

- Concepts: Pricing models, tagging, autoscaling, reserved instances

- What to look for: Practical experience analyzing cloud infrastructure and examples of improving cost visibility.

2. Financial acumen

FinOps aligns cloud spend with business value. Candidates should forecast costs, analyze variances, model unit economics, and drive accountability through chargeback or showback.

- Tools/Concepts: Budgeting, forecasting, variance analysis, unit economics, chargeback/showback models

- What to look for: Experience in budgeting or FP&A and clear examples aligning cloud spend with business outcomes.

3. Data and analytics skills

FinOps professionals rely on data to identify cost anomalies and opportunities. Candidates should comfortably query billing data, visualize trends, and deliver actionable insights.

- Tools/Concepts: SQL, Looker, Tableau, Excel, Power BI, Python

- What to look for: Experience creating dashboards or reports and concrete examples of troubleshooting cost anomalies using analytics tools.

4. Communication and stakeholder management

Effective communication defines FinOps success. Candidates must clearly explain cost drivers to diverse audiences — executives, finance teams, and engineers alike.

- Concepts: Cross-functional alignment, executive reporting, stakeholder education

- What to look for: Proven ability to influence across teams, with examples of improving cost transparency and education.

5. Process and lifecycle knowledge

Great candidates see FinOps as an ongoing discipline. They embed cost optimization into daily processes and drive continuous improvement.

- Concepts: FinOps lifecycle (Inform → Optimize → Operate), governance workflows

- What to look for: Experience operationalizing FinOps processes, with examples of embedding continuous improvement into existing workflows.

6. Tech proficiency

FinOps hires should understand major FinOps platforms or native cloud billing tools and quickly adapt to new ones. Experience building internal tools is a plus.

- Tools/platforms: CloudZero, native CSP tools (AWS Cost Explorer, Azure Cost Management, GCP Billing)

- What to look for: Direct experience with FinOps tooling and clear examples demonstrating adaptability to new technologies.

In short, hire for range, not perfection. Don’t expect candidates to excel in all areas. Focus on those who show depth in two or three competencies and basic fluency elsewhere. Generalists typically fit early-stage needs, while specialists shine in mature FinOps teams.

And now, the soft skills:

Soft skills and mindset competencies

Technical skills are critical, but mindset can also separate good FinOps hires from great ones. The best practitioners don’t just manage costs — they challenge assumptions, align teams, and drive smarter decisions at scale.

1. Curiosity and collaboration

Great FinOps pros ask “why” and explore connections between architecture, cost, and outcomes. They collaborate closely with engineering, finance, and product teams to build solutions that cross silos.

- What to look for: Examples of uncovering hidden cost drivers and collaborating cross-functionally to address them.

2. Comfort with ambiguity

FinOps can be messy — unexpected cost spikes and messy, incomplete data are common. Strong candidates stay calm, think systematically, and confidently navigate uncertainty without needing perfect answers.

- What to look for: Experience handling ambiguous scenarios, with clear examples of maintaining composure and methodically solving problems.

3. Efficiency-driven thinking

Great FinOps hires focus beyond cost savings to overall efficiency. They find bottlenecks, streamline workflows, and enable teams to move faster and smarter, not just cheaper.

- What to look for: Concrete examples of improving processes or enabling teams to achieve lasting efficiency gains.

4. Willingness to challenge assumptions

Top FinOps talent diplomatically pushes back on assumptions — whether from engineers over-allocating resources or finance teams with unrealistic forecasts. They rely on data to influence better decisions.

- What to look for: Proven experience challenging decisions constructively, supported by examples of data-driven influence and empathy in tough conversations.

Not everyone is built the same

Again, FinOps candidates can’t realistically be expected to show all of the above capabilities (if you do come across them, congratulations — you’ve just found a unicorn!).

What you’re looking for is someone who can demonstrate capability in most or all of these areas and shows a willingness to deepen their expertise. In many cases, “hired” is better than spending many months searching for perfect candidates who may not be out there.

6. How To Evaluate FinOps Candidates (Questions And Flags)

A huge part of learning how to hire FinOps professionals consists of evaluating candidates to determine if they can do the job well and if they’re a good fit for your company. Interviewing is, of course, one of the best ways to do that.

When interviewing candidates for FinOps roles, assess both technical capability and interpersonal skills through scenario-based and behavioral questions. Below are key themes, sample questions, and clear examples of good and bad candidate responses:

Scenario-based questions

Q: “How would you help an engineering team reduce AWS EBS costs?”

- What this reveals: You’re testing for hands-on cloud cost knowledge and the candidate’s ability to collaborate with engineering rather than dictate solutions.

- Good answer: “I’d first review usage data to identify idle or oversized volumes. Next, I’d collaborate with engineers to implement practical optimizations — rightsizing, deleting unused snapshots, or using more cost-efficient volume types.”

- Bad answer: “I haven’t worked directly with EBS costs, so I’d defer to engineers.” (Shows lack of initiative or technical understanding.)

Q: “Describe how you’d explain an unplanned cost spike to both engineering and finance.”

- What this reveals: This tests the candidate’s ability to tailor communication to different audiences — both technical and financial.

- Good answer: “I’d quickly pinpoint the cause through billing data. For engineering, I’d clearly explain the technical root cause and recommend fixes. For finance, I’d highlight financial impacts and present proactive solutions to prevent recurrence.”

- Bad answer: “Finance typically only wants bottom-line numbers, so I wouldn’t bother them with technical details. I’d just have engineers fix it.” (Overly simplistic and fails to bridge communication gaps.)

Behavioral questions

Q: “Tell me about a time you influenced stakeholders without direct authority.”

- What this reveals: You’re looking for their ability to drive change through influence and relationship-building, not positional power.

- Good answer: “Engineering initially resisted cost tagging. By clearly showing how tagging improved their own visibility and simplified troubleshooting, I earned their buy-in. Eventually, they adopted tagging willingly, achieving measurable savings.”

- Bad answer: “Usually stakeholders follow standard processes, so influencing hasn’t been an issue for me.” (Avoids demonstrating influencing skills or acknowledging realistic challenges.)

Q: “How do you handle pushback from engineers claiming their workloads can’t be optimized, or from finance frustrated by inaccurate forecasts?”

- What this reveals: This question gauges resilience, diplomacy, and problem-solving when facing resistance — a daily reality in FinOps work.

- Good answer: “I acknowledge their perspective first, then present clear data to gently challenge assumptions. With engineers, I propose low-risk optimization tests. With finance, I collaboratively review forecasting assumptions and refine models.”

- Bad answer: “I generally accept that engineering workloads are fixed and tell finance forecasts naturally fluctuate, so accuracy is always limited.” (Shows passive acceptance rather than proactive problem-solving.)

Quick evaluation tips

Strong candidates blend technical know-how with empathy, clear communication, and proactive collaboration. You want to see strategic thinking, a collaborative approach, and effective use of data.

Be cautious of responses that are overly simplistic, avoid difficult scenarios, or lack concrete examples of influencing or problem-solving skills.

Flags to watch for

Hiring the right FinOps professional means spotting subtle warning signs early. Watch for these three common red flags:

1. Plenty of technical or financial expertise — but not enough of both

FinOps lives at the intersection of cloud infrastructure and financial strategy. Be cautious if candidates lean heavily toward one side without showing the ability — or willingness — to bridge the gap between tech teams and business goals.

2. Short-term fixation without long-term value thinking

If a candidate talks only about cutting costs, eliminating waste, or short-term savings without mentioning business impact, forecasting, or strategic value creation, it’s a red flag. The real value in FinOps is found in enabling smarter, sustainable growth — i.e. the bigger picture — not just trimming expenses.

3. Lack of poise in ambiguous environments and cross-team communication

FinOps roles thrive in ambiguity. Candidates who need perfect data to excel may struggle to make decisions in gray areas — and those who can’t clearly explain insights in different “languages” to engineering, finance, and other teams are unlikely to succeed. Look for adaptable communicators and quick thinkers.

Pro tip: Most candidates who really want the job will come well-prepared with thoughtful and sometimes rehearsed answers to your questions (not a bad thing, really). What you want to do — in a well-intentioned way — is to catch them in the act.

Throw scenario-based questions at candidates to give them an opportunity to show how they can think on their feet in pressure situations. This will often reveal more about a candidate than the usual laundry list of qualifications and knowledge.

7. Where To Find FinOps Talent

FinOps professionals typically pivot from engineering, finance, or cloud consulting. Because it’s an emerging field, standard job boards may not always reach the best talent. Here are targeted, specialized channels to post FinOps roles:

FinOps Foundation job board: The official FinOps Foundation maintains a curated, specialized board that reaches certified professionals actively engaged in the FinOps community.

Slack communities: Active Slack groups that cater to the FinOps community, including the FinOps Foundation channel, are excellent for direct outreach to engaged, experienced practitioners. Some Slack communities may not want cross-promotion of jobs or other resources — be sure to check first.

Specialized LinkedIn groups: LinkedIn is a goldmine both for those hiring and applying. Join dedicated FinOps groups — just search for them under “Groups” in LinkedIn — and post jobs there. Like in Slack or Reddit, ensure that group guidelines are respected.

Conferences and events: Sponsor or attend events like FinOps X, AWS re:Invent, KubeCon & CloudNativeCon, and others to network directly with the FinOps community and grow your employer brand as one that’s actively hiring in FinOps.

Cloud consulting networks: Reach out to FinOps-specialized firms like CloudZero, Duckbill Group, Presidio, Ahead, or Trace3 for direct referrals or to identify consultants seeking in-house roles.

Leveraging these specialized channels will boost your visibility among qualified FinOps talent beyond standard job boards.

8. Alternatives And Interim Solutions If You Can’t Hire (Yet)

Sometimes hiring your first FinOps pro isn’t immediately feasible. Maybe leadership isn’t ready, good talent is scarce, or the budget is tight.

But cloud costs won’t manage themselves. In these situations, you still have options:

1. Leverage specialized software:

Start by adopting user-friendly platforms like CloudZero, which provide immediate visibility, simplify cost tracking, and alert you to unusual spend patterns — all manageable to a certain degree even without dedicated FinOps staff.

2. Expand internal responsibilities (carefully):

You might temporarily embed basic FinOps tasks into your engineering or finance teams. Engineering can improve resource tagging or automate basic cost monitoring, while finance takes ownership of forecasting and variance analysis. Clearly defining roles and responsibilities ensures nobody feels overloaded.

3. Bring in short-term expertise:

If hiring full-time isn’t possible yet, consultants or contractors specializing in cloud cost optimization can bridge the gap, delivering quick wins and buying time until you can secure that first permanent FinOps hire. CloudZero’s FinOps- and AWS-certified customer success team is also at the ready for any immediate or ongoing needs.

9. Start Your FinOps Hiring Journey

Cloud costs are no longer something you can afford to leave unmanaged. As cloud spending climbs and complexity grows, having the right FinOps professional — or team — in place is quickly becoming a business necessity, not a nice-to-have.

Whether you’re making your first FinOps hire or looking to scale your capabilities, the steps are the same: get clear on the role, evaluate candidates thoughtfully, and build a case around real business impact.

And remember, you don’t have to do it alone. CloudZero is always here to help — whether that means providing the tools, the expertise, or both to support you on your FinOps journey.