Ask a SaaS team how they measure cloud efficiency, and you’ll hear familiar things. Total cloud spend. Average cost per customer. Maybe a breakdown of spend by service.

All useful, but rather wobbly.

Now ask, “What does it cost you to serve one more customer?”

That’s when the room goes quiet. And that’s often where cloud economics gets really wobbly.

Because that number, your marginal cost, is what actually determines your margins. Not your total cloud bill. Not your average cost per customer.

This single metric reveals whether your platform is scaling profitably… or just scaling.

And marginal costs don’t necessarily live inside a spreadsheet. You’ll find them inside your architecture, within autoscaling groups, along data transfer paths, in background jobs, across AI inference workloads, and in the micro-decisions your engineers make every day.

See more: Marginal Cost for Engineers: 10 Architecture Decisions That Secretly Inflate Your Costs

Finance teams depend on it. Engineering teams influence it. FinOps teams interpret it.

Yet most SaaS organizations don’t measure it at all.

Let’s fix that.

Related read: How To Calculate (And Improve) Your SaaS Gross Margin

What Is Marginal Cost?

In conventional finance, marginal cost is the additional cost of producing one more unit of output.

Manufacturing plants use units. Economists use curves. But, in SaaS and cloud-native organizations, marginal cost refers to the incremental cloud cost of delivering one additional unit of your product. That unit could be:

- onboarding one new customer next week

- serving an additional 1,000 (or 10M) API calls

- running one more ML inference

- ingesting another GB of data

- spinning up one more workspace or tenant

- deploying one more environment or microservice.

In the cloud, every additional customer or workload triggers a long chain of infrastructure activity. Think of compute, storage, data transfer, caching, retries, autoscaling, logging, queues, background workers, third-party APIs, and more.

Some workloads grow gracefully. Others explode. Some features cost pennies. Others cost dollars per transaction.

So, your SaaS marginal cost shows you the true cost of scaling. And that makes it a foundation of modern SaaS profitability.

Let’s ground this with real, concrete examples.

What Are Some Examples Of Marginal Cost In SaaS And Cloud-Based Businesses?

If adding a new customer increases your monthly S3, CloudWatch, and Lambda usage by $2.84, that’s a marginal cost.

If running a single AI inference consumes $0.0041 of GPU time, that’s marginal cost. And if the next million API calls cost an additional $120 in compute and $40 in data transfer, that’s marginal cost.

These seemingly tiny numbers do add up, especially when you’re onboarding thousands of customers or processing billions of events.

Now, SaaS isn’t the only industry that depends on marginal cost. Other sectors have used it for decades to guide pricing, forecasting, and product strategy. And there’s a lot we can borrow from them.

How Marginal Cost Works (And Why Most SaaS Teams Can’t Answer: ‘What Does Our Next Customer Cost?’)

Take manufacturing, streaming, and fintech, for example.

Marginal cost in manufacturing

Manufacturers obsess over marginal cost because it tells them the exact point where making one more unit becomes cheaper, or more expensive, than before.

If producing the next batch requires new machinery, overtime labor, or a different supply chain, marginal cost jumps. Their leaders use that insight to decide whether to increase production, raise prices, or redesign the product back to profitability.

Marginal cost in streaming platforms

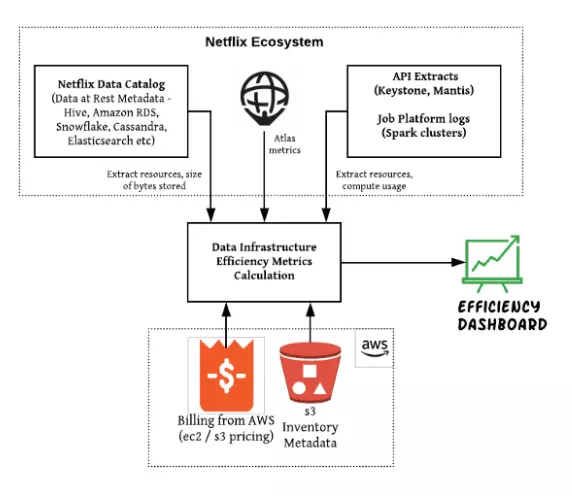

A streaming service seems infinitely scalable, but each additional viewer triggers transcoding, bandwidth, and CDN delivery costs. So, the platforms track the marginal cost per stream to set subscription tiers, control infrastructure decisions, and forecast gross margin as their user base grows.

See: How Netflix, Lyft, and Slack Stay Cost-Efficient on AWS — At Scale

Marginal costs in Fintech and payments

Payment processors calculate how much one more transaction costs them, including compute, fraud checks, logging, and settlement flows. Their marginal cost dictates transaction fees and helps determine which segments or transaction types are profitable.

For SaaS, that unit might be a customer, tenant, API call, data-intensive feature, or AI/ML inference. It becomes the signal that tells you:

- whether you’re adding profitable growth or overspending

- whether your architectural choices are pushing costs up or down

- where engineering and finance need to align,

- And whether a feature should be optimized, re-architected, or moved into a paid tier to keep it sustainable.

As cloud usage grows faster and less predictably than traditional production, SaaS teams have even more reason to borrow this discipline. And that starts with calculating your marginal cost.

Here’s how.

How To Calculate Your Marginal Cost

In finance, the formula for marginal cost is straightforward:

Marginal Cost = Change in Total Cost ÷ Change in Units Produced

Let’s translate that into SaaS and cloud terms.

Step 1: Define your “unit”

Your unit should match the thing that actually scales your cloud usage. For most SaaS companies, this looks like:

- One additional customer

- One million API calls

- One GB or TB of data stored/processed

- One AI inference or model request

- One workspace, tenant, or environment

- One product feature used at scale

Pick the unit that best reflects how your product grows. Next…

If AI usage is your biggest source of variable cost, see our deep dive into inference cost and how it impacts margin.

Related read: The AI Cost Optimization Playbook

Step 2: Measure the incremental cloud cost

Look at how your cloud spend changes when that unit increases. Here are examples:

- If API calls double from 50M to 100M and cloud costs rise from $8,000 to $11,000, the marginal cost is $3,000 ÷ 50M = $0.00006 per API call.

- If adding a new enterprise customer increases S3, compute, and data transfer by $5.80, your marginal cost per customer is $5.80.

- And if running one more AI inference consumes $0.004 in GPU time, that’s your marginal cost per inference.

These calculations seem simple, but as we’ve often shared on this blog, most teams struggle because cloud bills are often shared, depend on less-than-perfect tags, and are spread across services.

- One API call can trigger multiple services

- Data transfer charges spike without visibility

- Logs, retries, and background jobs accumulate quietly

- Teams deploy features with different cost profiles

- Multi-tenant architectures blur per-customer usage

All of this makes it nearly impossible to isolate marginal cost manually or in spreadsheets.

But with proper cost allocation, your marginal costs become measurable in real time. Take using CloudZero, for example.

With CloudZero, you can map each dollar of cloud spend to the units that actually generate it. Think of granular, immediately actionable insights such as cost per customer, per API call, per feature, and per environment. And that means you can:

- See how your marginal cost changes as you scale, monthly, weekly, even hourly

- Forecast your gross margin more accurately

- Identify high-cost features before they erode your bottomline

- Give engineering clear cost signals, such as cost per deployment, so they can innovate without setting your bottomline on fire. Don’t just take our word for it. Take this quick, free tour of CloudZero to see for yourself. Better yet, watch here how Wise used CloudZero to turn 200+ engineers into cloud efficiency experts, so you can, too.

Now that we’ve covered how to calculate marginal cost, and why unit-level visibility matters, it’s worth placing it in context.

Marginal Cost Vs. Other Cost Types

Marginal cost often gets confused with other cloud or SaaS cost metrics, but each one serves a different purpose. Here’s how.

Average cost

This is the total cost divided by total units produced. Average cost shows your blended efficiency over time. However, it hides scaling problems. Your average cost can look stable while your marginal cost is quietly increasing. And that means each new customer is less profitable than the last.

Also see: What’s The Difference Between Average Cost per Customer vs Cost per Customer?

Fixed cost

Fixed costs do not change as usage grows. These include engineering salaries, core platform overhead, and base infrastructure. They determine your break-even point and long-term operating leverage.

But fixed cost tells you nothing about how efficiently you scale. A healthy fixed-cost structure can still produce terrible SaaS unit economics if your marginal cost is high.

Helpful resource: 5 Questions A CFO Should Ask When Evaluating Cloud Spend

Variable cost

These are costs that rise with usage, compute, storage, data transfer, API gateways, inference workloads, and beyond. Variable cost is where cloud spend truly lives.

Helpful resource: Here Is What Variable Costs Are In The Cloud

Variable costs are broad. Marginal costs narrow the focus to the next unit, which is the actual cost driver behind short-term spikes and long-term margin trends.

Fact: If your marginal cost per customer goes up, your gross margin will eventually go down, even if your average cost and fixed cost look stable on paper. That’s why it’s such a crucial SaaS KPI today.

How to Translate Your Marginal Cost Analysis Into Efficient, Profitable Cloud Growth

It’s one thing to understand what marginal cost is. It’s another to use it to guide engineering and financial decisions, which is where the real impact happens.

When you can see your marginal cost clearly, three things happen:

You can scale with cost confidence

Your team stops guessing how growth will affect spend. They start pinpointing exactly which parts of your architecture scale efficiently and which ones need rework before they start eating into your margins.

You can align engineering and finance around the same truth

Instead of debating totals or averages, your dev, ops, and finance teams can zoom in on the units that actually move your costs, like specific features, workloads, customers, and services. This reduces friction and makes decisions faster and far more accountable.

You can protect margins without dimming innovation

The goal isn’t to cut cloud costs indiscriminately. It’s to ensure each incremental user or workload contributes positively to your economics. With unit-level visibility, you can see who, what, and why your costs are changing, and more importantly, identify exactly which levers to pull to sustain long-term profitability.

And you don’t have to reinvent the wheel to get there

CloudZero surfaces your marginal costs down to the people, products, and processes influencing your cloud bill. And instead of waiting 24 hours for a batch update, CloudZero delivers hourly, immediately actionable insights, like your daily cost per feature per user, and alerts you to anomalies before they hit your invoice.

These are just a few of the ways leading teams at Upstart, PicPay, and Drift used CloudZero to save over $20 million, $18.6 million, and $2.4 million these last few months. You can, too.  to see the smarter, quicker way to turn marginal cost data into fuel for your profitable, scalable growth.

to see the smarter, quicker way to turn marginal cost data into fuel for your profitable, scalable growth.