1. Why FinOps, Why Now?

Want to know how to get a job in FinOps? You’re not alone. FinOps careers are rapidly emerging as essential roles in tech, helping companies manage cloud costs without slowing down innovation.

These roles sit at the intersection of finance, engineering, and cloud operations. FinOps roles and responsibilities are expanding fast.

In this guide, you’ll learn what FinOps professionals do, how to frame your skills for the job, what certifications help, and how to grow your FinOps career over time.

2. What Is FinOps?

FinOps is all about helping companies get smarter with their cloud spend. It brings together finance, engineering, and product teams to make sure every cloud dollar is used with purpose — to move faster, deliver better, and grow efficiently.

FinOps blends financial thinking with technical insight, but you don’t need to be an expert in both to begin. You need curiosity, problem‑solving instincts, and an ability to turn data into better decisions. If you enjoy data, linking cost, performance, and business value, FinOps is the perfect place to build your career.

3. FinOps Roles And Responsibilities: What Do FinOps Professionals Actually Do?

FinOps professionals act as the connective tissue between cloud decisions and business outcomes. They’re part analyst, part strategist, part communicator.

The KPIs outlined in the FinOps maturity model will give you a good idea of where typical FinOps roles and responsibilities live. Roughly, the work involves:

- Breaking down cloud and technology costs into insights. Translate raw billing data into something engineers, finance, and leadership can actually use. Think dashboards that show who’s spending what, where, and why — not just line items buried in a CSV.

- Forecasting what’s coming. Build models that predict future spend and help teams plan for it with fewer surprises. You’re giving teams a heads-up before they blow the budget, not a postmortem after it’s gone.

- Finding and fixing waste. Spot unused resources, identify areas needing optimization, and unlock savings through RIs, Savings Plans, or better design. It’s like walking through a warehouse, tagging idle machines, and rerouting power where it’s actually needed.

- Driving accountability. Make cost data visible, actionable, and team-owned, so everyone understands the financial impact of their choices. Instead of chasing teams after the fact, you bake cost awareness into their daily tools and decisions.

- Bridging the gap. Translate between tech and finance, turning complexity into clarity and aligning everyone around shared goals. You’re the go-between who helps engineers speak budget and finance speak architecture without anyone needing a translator.

FinOps is part analysis, part strategy, part diplomacy. These are all focused on helping the business move faster with confidence in every dollar spent.

4. Who Can Start A Career In FinOps? Skills That Transfer Easily

Here’s where it gets interesting: FinOps welcomes people from a wide range of backgrounds. There’s no single “right” career path to becoming a FinOps professional.

If you’ve worked in any of the following areas, you already have a head start on a FinOps career:

Cloud Engineers, DevOps, and SREs

You know how cloud infrastructure works, and you’ve likely felt the pain of spiraling cloud bills. With some financial fluency, you can pivot into FinOps by helping teams build cost-conscious systems from the ground up.

Finance, FP&A, and Accounting Professionals

If you’ve crunched numbers working on forecasting, budgeting, or financial analysis, you already have the business mindset and familiarity that a FinOps function demands. Next up would be to learn cloud terminology and cloud cost drivers to round it all out.

Product Managers, BizOps, and Data Analysts

If you’ve managed product or business operations, you’re already experienced in cross-functional work, data digging, and outcome attainment. You can see FinOps as being an added layer of operational efficiency where your communications and analysis skills are valuable.

And it’s not just the jobs themselves. There are skills and capabilities too – read on for those.

5. Key Skills For FinOps Jobs: What You Need (And Probably Already Have)

You don’t need to be a cloud architect or finance expert from day one. The core FinOps skills — cost awareness, financial fluency, technical context, data analysis, communication, and curiosity — were introduced earlier. If you’ve worked in engineering, finance, product, data, or ops, chances are you already have many of them.

Now it’s about framing those skills in a FinOps context:

Cloud cost awareness

If you already know a little bit about cloud costs, you’re off to a head start. Sure, you don’t have to be a cloud billing expert on day one, but it does help to know what drives spend and how to tell when something’s off.

That means understanding the basics like compute, storage, data transfer, and pricing models, and being able to connect technical choices to financial outcomes. If you’ve ever looked at a cloud bill, asked why a service costs so much, or helped clean up tagging, you’re already thinking like someone in FinOps.

Financial acumen

You won’t need a CPA license, but you do need to understand and speak the language of budgets and forecasts. Knowing how to break down costs, track against plan, or align cloud spend to metrics like margin or unit economics is core to this role.

If you’ve ever owned a budget, explained a cost spike, or helped a team forecast better, that’s valuable experience for a FinOps career.

Technical fluency

While we’re not all engineers, having a base understanding of how engineering decisions affect costs is key to FinOps. If you’ve had firsthand knowledge or even a grasp of things like how services are architected, what scales automatically, or where waste tends to hide, that’s huge.

Plus, if you’ve worked with cloud-native apps, helped monitor infrastructure, or partnered closely with engineering teams, you’ve already got the technical fluency that matters.

Data analysis and visualization

FinOps lives and dies by the data. To excel in FinOps, you need to spot trends, build trust with numbers, and help teams act on what they see.

That doesn’t mean you need to be a data scientist, but if you’ve built dashboards, tracked anomalies, modeled scenarios, or worked with tools like Excel, SQL, Tableau, Power BI, or anything like that, that’s a huge part of your value proposition as a candidate applying for a FinOps position.

Cross-functional communication

We’ve alluded to this above – FinOps is not a solo role. It’s a collaborative function, sitting between engineering, finance, and product — and it thrives on communication.

In short: you need to explain costs to engineers, technical tradeoffs to finance, and rally teams around shared goals. If you’ve led cross-team projects, translated between departments, or helped make complex data understandable, you already know what this part of the job is like.

Curiosity and continuous learning

FinOps is always evolving — tools change, cloud pricing shifts, new patterns emerge. The best people in this space stay curious and keep learning.

If you’ve explored FinOps Foundation resources, picked up a cloud cert, or chased down a weird cost spike just because you wanted to understand it, you’re well on track.

Honestly, most FinOps skills and capabilities aren’t rare. They just need reframing. If you’re already comfortable crunching numbers and working with people in cloud-specific operations, you may be more ready than you think. The domain-specific stuff can be built through projects, training, community, and so on.

It’s important to remember that managers aren’t necessarily looking for perfection. Sure, we all want the unicorn, but in the end, when teams are hiring for a FinOps role, they’re interested in the function and how it can help them grow. Show them that you’ve got the mindset, the drive, and the capabilities to connect the dots, and you’ll stand out among the best of them.

6. FinOps Certifications That Make You Stand Out

While skills and backgrounds appeal to hiring managers, certifications are attractive as well. Certifications signal commitment and help open doors:

- FinOps Certified Practitioner (FinOps Foundation): the foundational certification recognized across the industry. Ideal for beginners or those transitioning in.

- FinOps Certified Professional (FinOps Foundation): a significantly more advanced certification focused on hands-on FinOps leadership and technical depth.

- AWS Cloud Practitioner or Solutions Architect Associate: demonstrates cloud fundamentals, important for those coming from finance or non-technical backgrounds.

- Azure Fundamentals (AZ-900) or GCP Cloud Digital Leader: Other cloud platform basics if you’re in multi-cloud environments.

- Certified Cost Professional (CCP) or other finance certifications: Valuable for those coming from engineering and looking to boost financial knowledge.

Is FinOps certification worth it? You bet it is. Remember: Certifications are a signal, but what matters most is how you apply them to real-world outcomes.

7. FinOps Careers And Job Titles: From Analyst To Head Of FinOps

Your FinOps path can begin as an analyst, then grow into program management or executive leadership:

FinOps Specialist (individual contributor)

Also known as: FinOps Analyst, Cloud Cost Analyst, Cloud Financial Analyst, FinOps Engineer, Cloud Optimization Engineer

What you do: You’re hands-on in cloud cost management — analyzing spend, running reports, identifying savings opportunities, and helping teams make better decisions. This is where most people start.

Who this is for: Cloud engineers who want to shift into business impact roles, FP&A or finance pros curious about tech, and data analysts or BizOps folks who love solving messy problems.

Next steps: Build technical fluency (cloud billing, tagging, usage patterns) and business context (forecasting, unit economics). From here, you can move into strategy or management.

FinOps Manager (team or program leader)

Also known as: FinOps Manager, Cloud Economist, Cloud Cost Optimization Manager, FinOps Program Lead

What you do: You own the FinOps program. You define processes, create cost accountability, and align finance, engineering, and leadership around cloud spending strategy. You may lead a small team of specialists or manage FinOps as an “entity”.

Who this is for: Experienced individual contributors in FinOps, finance managers with a strong tech slant, and tech leaders with a talent for business communication.

Next steps: Develop leadership skills, deepen financial strategy expertise, and demonstrate impact at the organizational level. This sets the stage for executive roles.

Head of FinOps (executive leadership)

Also known as: Director of FinOps, VP of Cloud Optimization, Head of Cloud Cost Management

What you do: You set the vision for cloud financial management and you are responsible for its full execution. You drive enterprise-wide cost governance, influence architectural decisions, and ensure that cloud investments align with business outcomes.

Who this is for: Senior finance or tech leaders, experienced FinOps program managers, and business-savvy cloud experts

Next steps: Many Heads of FinOps grow into broader cloud strategy, procurement, or even CFO/CTO tracks as cloud becomes central to business performance.

Growth in FinOps comes from delivering business impact, not just technical depth.

8. How Much Do FinOps People Make?

FinOps salaries in the United States range widely. Those in the 25th percentile make $72,500 (meaning, only 25% of FinOps salaries are lower than theirs), whereas top earners make as much as $189,000 per annum. On average, FInOps professionals pull in just north of $100K annually, according to ZipRecruiter:

| Annual Salary | Monthly Pay | Weekly Pay | Hourly Wage | |

| Top Earners | $189,000 | $15,750 | $3,634 | $90 |

| 75th Percentile | $106,000 | $8,833 | $2,038 | $51 |

| Average | $100,669 | $8,389 | $1,935 | $48 |

| 25th Percentile | $72,500 | $6,041 | $1,394 | $35 |

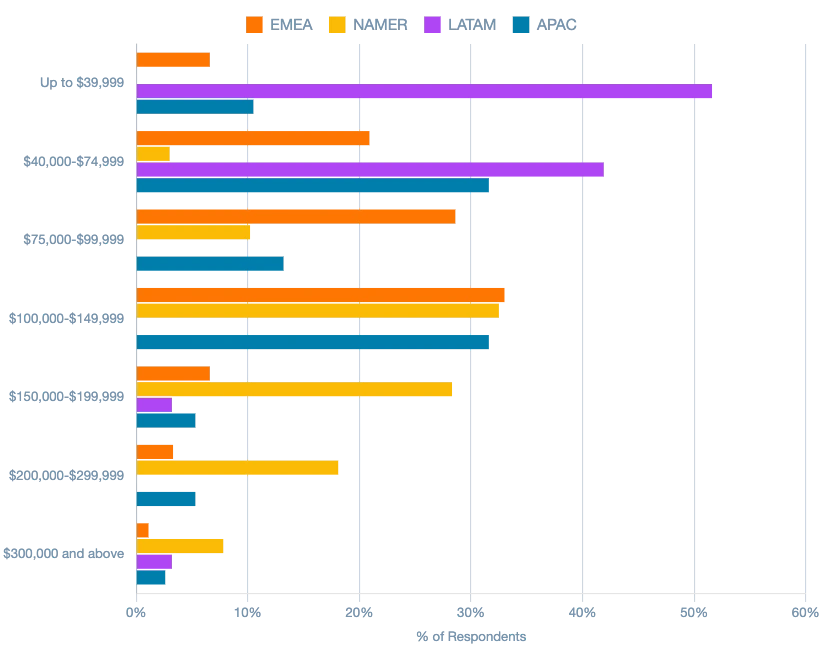

Like any profession, salaries are much more varied elsewhere. FinOps pros working in North America make the highest salary out of any region — and a rule of thumb to follow is that FinOps salaries generally trend with other tech-based professions, according to a 2023 report from the FinOps Foundation:

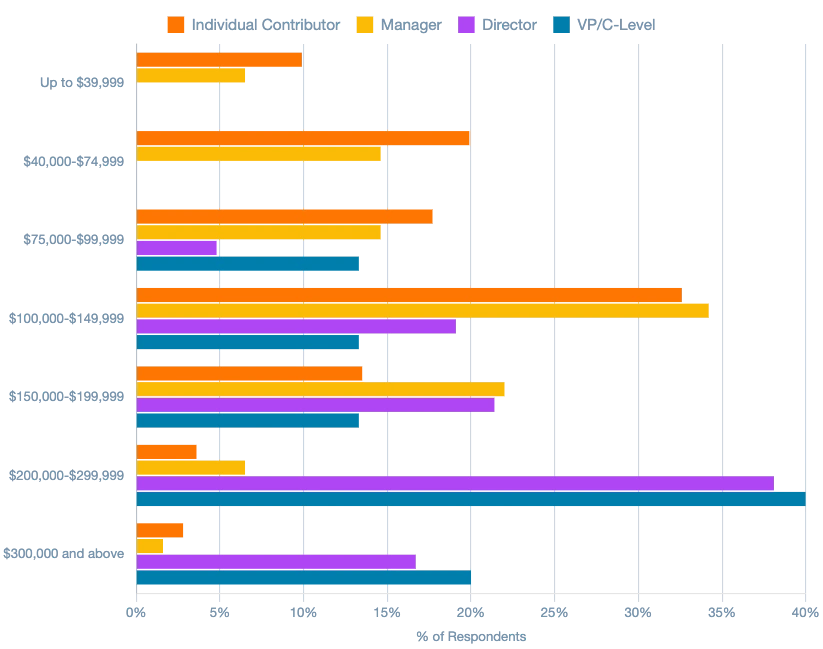

Again, salaries change based on roles and responsibilities. Those in individual contributor or managerial positions cluster in annual salary brackets up to $149,000, whereas those in directorial and VP/C-level roles tend to pull in north of $200,000-$300,000 or more (all US currency).

9. How To Get a Job in FinOps: Interview Questions And Strong Answers

Hiring teams like to ask how you might perform in a given scenario so they can learn about your problem-solving, communication, and behavioral skills — all of which are crucial to job performance.

Here’s how to talk about FinOps-specific performance:

- Lower storage cost for an engineering team? Analyze usage, present specific actions with expected savings. “In my last role, deleting idle volumes cut costs by $12,000 per quarter.”

- Explain a $10K bill spike to both engineers and finance? Identify the driver, translate its technical and business impact, and recommend controls.

With that in mind, here are some sample questions with “good” and “meh” answers for each:

Q: “How would you help an engineering team reduce AWS storage (EBS) costs?”

Why they’re asking this: With this question, hiring managers want to see if you’re adept at digging into cost data and working closely with technical teams, and most of all, recommending and implementing practical solutions. This is your opportunity to show off your practical and creative problem-solving capabilities that lead to real cost reduction. Be specific. Show exactly what you did, how, and what it saved.

Strong answer: “I’d pull a cost and usage report from AWS to identify volumes with zero I/O activity over the past 30 days or oversized volumes running at low utilization. I’d meet with the engineers to review these findings, suggest moving infrequent workloads to cheaper storage classes or deleting unused volumes, and set up regular cost monitoring. In my last role, this approach saved us around $12,000 per quarter on unnecessary storage.”

“Meh” answer: “I’d review the monthly cloud bill and check if there are any big cost spikes related to storage. I’d suggest the engineers take a look since they’re closest to the workloads and might know where savings could be found. If needed, I’d raise it in a team meeting.” (This shows you’re trying to look at spend and flag the spikes, which is fair, but if you defer too much and don’t show signs of real ownership and initiative, that might be a detractor.”

Q: “How would you explain an unexpected $10,000 cloud bill spike to both engineering and finance?”

Why they’re asking this: What managers are looking for in addition to the above is how well you can explain complex technical issues into clear business impact. More so, they want to know your ability to translate the same concept into different “languages” to engineers and finance, demonstrating your capabilities in bridging worlds as well as diagnosing costs. Your communication and collaboration skills are on display here. Demonstrate that spirit and you’ll crush this one.

Strong answer: “I’d start by analyzing usage data to pinpoint the driver whether it was a scale-out event, forgotten resource, or new workload. For engineering, I’d explain what happened technically (e.g., an autoscaling configuration that triggered excess compute). For finance, I’d quantify the dollar impact, flag whether it’s likely to recur, and suggest controls like spend thresholds. In my previous role, I helped reduce variance in monthly cloud spend by 15% through this kind of proactive review.”

“Meh” answer: “I’d let both teams know we’ve seen a spike and share the basic billing report with them. I’d ask engineering if anything unusual happened and tell finance we’re investigating. Once I get answers, I’d pass them back to finance.” (Well done, but you’ve just shown that you’re a reactive communicator without real analysis, translation, or most of all, prevention.)

Q: “Tell me about a time you influenced stakeholders without formal authority.”

Why they’re asking this: Here, interviewers want to understand how well you can influence others and indirectly manage others regardless of job title. Managers don’t want to know your coercive or argumentative skills (hint: being a “go-getter” doesn’t matter as much as you’d like to think). Rather, they want to know how you’ve gotten others willingly on board with action items to achieve outcomes.

Strong answer: “Our tagging compliance was under 40%, making cost reports nearly useless. I organized a working group with engineering leads, showed them how missing tags directly blocked forecasting accuracy and chargebacks, and helped them create automated tagging rules in Terraform. We improved compliance to 92% within two quarters without top-down mandates.”

“”Meh” answer: “We were having trouble with inconsistent tagging, so I brought it up during sprint planning and suggested we aim for better standards. Some of the team agreed, but we didn’t really get to full adoption since priorities shifted. I didn’t push further at the time.” (This shows that while the intent is there, you didn’t pull out the right stops or follow through in your attempt to get teams to act on your suggestions.)

Q: “How do you handle pushback when teams say optimization isn’t possible or forecasts can’t be improved?”

Why they’re asking this: Pushback is common in the tech workplace, especially from reticent higher-ups who need to be conservative about how things are run, and from leaders who have long-established protocols in place. Your interviewer wants to hear how you’ve managed to press forward in the face of resistance, whether it’s in identifying and executing action items that don’t require others to adapt or, better yet, that fall squarely in line with existing protocols.

Strong answer: “I usually start by acknowledging their concerns. Sometimes optimization genuinely isn’t feasible right away. But I look for low-effort wins: in one case, I identified underused dev environments that could be scheduled off hours, saving $4,500/month without affecting workloads. For finance, I’ve improved forecast accuracy by partnering with teams to break down usage by service or project rather than using flat growth assumptions.”

“Meh” answer: “I usually ask for more details to understand why they feel optimization won’t work or why forecasts are off. Sometimes I suggest looking at past trends or making small tweaks, but if they say it’s not feasible, I respect that and move on to other areas we can improve.” (That shows you’re respectful and collaborative, which is good, but it also shows that you give up too easily instead of creatively reframing the problem.)

Also dive deeper into these interview guides for both candidate and interviewer:

Key Takeaways to Ace the Interview:

Ultimately, there are three key things to keep in mind when preparing your answers in interviews:

- Be specific: Use real numbers, outcomes, or technical details to show depth.

- Demonstrate cross-functional thinking: Show how you align finance, engineering, and leadership – a core tenet of FinOps.

- Stay proactive: Even small optimizations or process wins make for strong examples.

10. Advancing Your FinOps Career: How To Grow From IC To Executive

Once you’ve landed a FinOps role, the next step is scaling your impact. Advancing a FinOps career often means growing beyond cost analysis into strategy, tooling, and leadership.

You might start in a hands-on role (like a Cloud FinOps Analyst or Optimization Engineer), then evolve into managing cross-functional programs or leading cost governance at scale. From there, senior FinOps roles like Director of Cloud Optimization or VP of FinOps are increasingly in demand — especially in cloud-first or high-growth companies.

To move up:

- Show measurable cost savings and impact

- Lead FinOps education across teams

- Influence architectural decisions, not just costs

- Connect cloud spend to business outcomes at the unit level

Cloud cost maturity is evolving, and organizations need leaders who can make FinOps a strategic function. That’s your opportunity.

11. Ready To Get Started? Your FinOps Job Action Plan

You’ve seen what FinOps is, what it takes, and how to grow in the role. Now here’s a step-by-step way to start gaining real-world FinOps experience even if you’re brand new.

- Learn the basics: Start with FinOps Foundation content and case studies.

- Get hands-on: Improve tagging, build dashboards, or analyze costs where you work.

- Show results: Highlight measurable impact, not just tasks, on your resume.

- Build your network: Join FinOps Slack groups, follow experts, and attend events.

- Apply boldly: Focus on what you bring, even if you don’t meet every requirement.

The cloud isn’t slowing down. Neither is the demand for people who can help companies spend smarter while moving faster. That’s the real value of FinOps.

The best part? It’s still early days. FinOps is a young, fast-growing discipline with plenty of room for new voices, diverse backgrounds, and future leaders. Whether you come from engineering, finance, product, or operations, chances are you already have skills that map directly to FinOps jobs.

The key is to start where you are. Learn as you go. Stay curious. Every small win — tagging cleanup, a cost-saving tweak, a better dashboard — builds momentum. Over time, you’ll not only grow your skills but also help shape how cloud-powered businesses make smarter decisions.

So dig into the resources above. Connect with the community. And when you’re ready to make your move, CloudZero’s FinOps-certified team is here to support you.

Also read: Hiring a FinOps Specialist? and How To Hire In FinOps to get more examples of how hiring managers think.