Pricing is often one of the trickiest areas to get right for many SaaS businesses. Often, companies default to a “per user” pricing model. Yet recent surveys show that “per user” pricing is rarely the optimal pricing strategy for many SaaS companies — unless you are Slack.

We’ll dive into why this is further in this guide, but first let’s start by covering what value metrics are for SaaS companies — and how they relate to SaaS pricing, profitability, growth, and, well, “per user” pricing.

Table Of Contents

What Is A Value Metric In SaaS?

A value metric is an indication of how your customers perceive the value of your product or service. Value metrics are a group of metrics that affect the price you charge for your subscriptions or SaaS products.

Value is what buyers choose to pay (or not pay) for. Value metrics typically remain relatively stable, only changing when customers perceive the service or product’s value differently.

Thus, SaaS companies often need to bridge the gap between customers’ perceptions of value and the value the company delivers through its products or services to maintain the stability of their value metric.

Why Monitor Value Metrics?

The value metric is the answer to the question, “what does our ideal customer actually want in a SaaS product or service like ours?” and “how much are they able and willing to pay for that benefit(s)?”.

A customer will often buy or subscribe to your product or service based on the value it provides them. Value metrics represent what that value looks like and how much of it is sufficient to compel a customer to upgrade, renew, or sign up for free.

Whether it’s tiered pricing or volume pricing, value metrics are often at the center of a SaaS pricing strategy. Value metrics influence whether customers think your offering is worth their investment. You can increase or decrease your prices depending on how much value customers perceive they are receiving from your product or service.

They also help explain why users stay on a free plan rather than upgrade. Likewise, paying subscribers may downgrade to a lower-priced plan, cancel a subscription, or choose not to renew their subscription. In either case, they likely don’t believe the paid plan has enough value to justify upgrading or renewing.

Most SaaS companies focus on other metrics, like Customer Acquisition Cost, Customer Lifetime Value, and Payback Period. But value metrics offer valuable insights that companies can use to increase sign-ups and reduce downgrades and cancellations.

What Are The Two Types Of Value Metrics For SaaS?

There are two types of value metrics: outcome-based and functional. Let’s review them.

- Functional value metrics affect pricing by adjusting around a function of usage. Essentially, functional value metrics charge based on how frequently a customer uses a service or product (Jobs To Be Done). Examples of frequency metrics include “per user”, “per feature”, “per event”, “per 1000 contacts”, “requests per minute”, and “per video upload”.

- Outcome-based value metrics inform how much you charge your customers based on the gains they make from your product or service. Non-functional, these focus on the goal a customer seeks to achieve (Goal to Achieve or GTBA). Revenue generated, views garnered, clicks achieved, and customers reached are all examples here. These metrics are often the key to delivering value to the customer.

Now, here are some crucial metrics any SaaS provider should look for when setting SaaS pricing.

8 Value Metrics You Should Be Following

This list contains a variety of outcome-based and functional SaaS value metrics you should monitor.

1. Monthly recurring revenue (MRR)

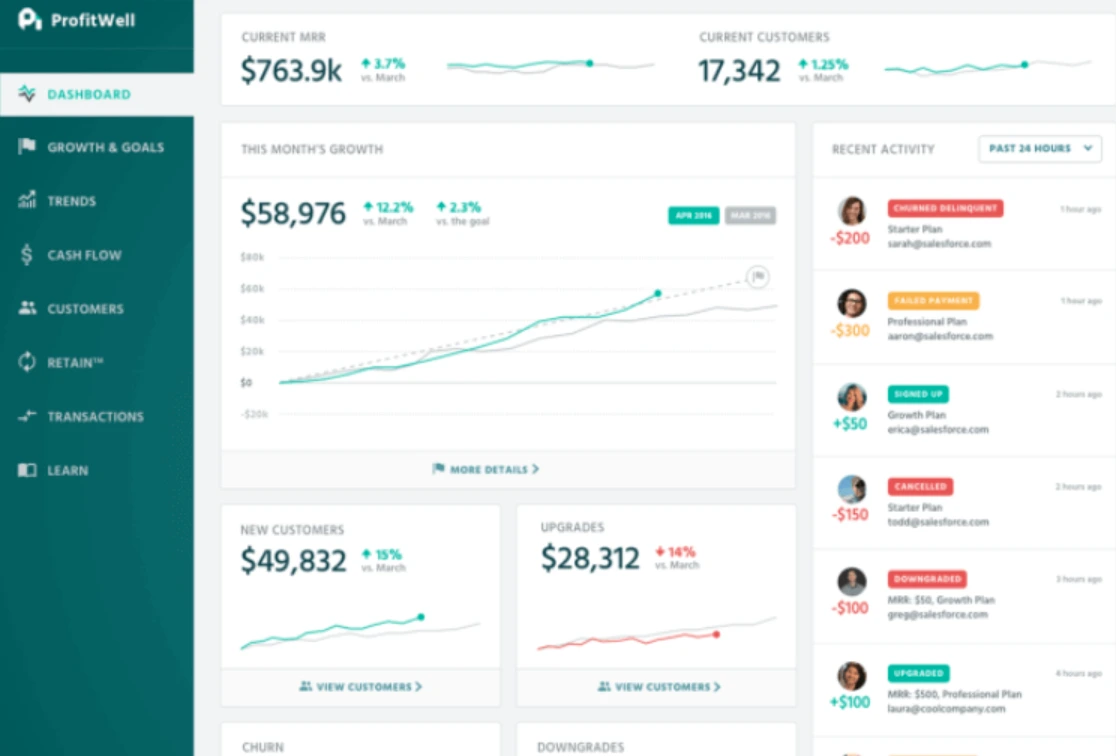

You can use MRR to determine if your pricing strategy is working. Increases may reflect a balance between value delivered and value perceived. It may also indicate that you are undervaluing a paid tier and can increase the price in the future.

MRR may decrease or stagnate if your target customers do not think your paid plan offers enough value for its price. This may also indicate that potential customers are unaware of how your offer can help them reach their goals.

You can calculate MRR manually or you can use a tool like ProfitWell to calculate it in real-time.

2. Customer churn

Customer churn refers to the percentage of customers who leave every subscription cycle, such as monthly. High customer churn often stems from customers feeling they are getting less value than they are paying for — that the product or service is overpriced.

Naturally, there are exceptions.

You might see some subscribers leave if you offered the product/service for free in previous months. If customers are signing up and unsubscribing before the subscription cycle ends, it could mean you need to add more benefits to your paid tier(s).

3. Renewal rate

Renewal rate is a measure of customer retention expressed as a percentage. Generally, the higher your renewal rate is across multiple customer segments and pricing levels, the more likely it is that your customers believe you deliver enough value for their investment.

You’ll get the best results if you measure this value metric by customer segment or price tier. You may have a rapid drop in renewal rates because the segment of customers you are targeting in that tier may not be satisfied with the plan’s results or features.

Don’t forget to check whether the non-renewers are canceling their subscription or switching to another tier, which can indicate that the tier they are leaving may be insufficient for their needs. However, they still value your service offering enough to want to try out another plan — more on this in the section on contraction MRR and expansion MRR.

When renewal rates are stable, it may indicate that customers are happy with what they receive.

4. Revenue churn

Revenue churn refers to the percentage of revenue lost per subscription cycle. It measures how much revenue a company generates from the subscribers it already had when the subscription cycle began, not from new subscribers added during the period.

Revenue churn is a good value metric for measuring how much revenue is lost from customers who downgrade plans instead of canceling them. This implies they perceive the more expensive plans as being less valuable to their needs or investment.

5. Revenue retention

A SaaS company’s revenue retention determines how healthy it is by deciding how much revenue it retains from existing customers over a specific period. The net revenue retention (NRR) further measures how recurring revenue for a particular customer segment has changed over time.

You can calculate NRR by dividing the current MRR for a particular customer segment by the MRR of that segment a year earlier. An answer exceeding 100% indicates a good market fit. So you deliver value that is in line with buyers’ expectations.

If the NRR is closer to 0%, you may want to revise your pricing strategy for that customer segment.

6. Expansion MRR (Growth MRR)

Expansion or growth MRR is the revenue generated from customers who have been with you for more than one subscription cycle. Additional earnings from cross-selling, upselling, upgrades, and add-ons contribute to expansion MRR.

Add all revenue generated from new subscribers to monthly recurring revenue (MRR) to calculate expansion MRR. A company with a higher expansion MRR than its contraction MRR (see below) is indicative of a healthy, growing SaaS business. The reverse is also true.

7. Contraction MRR

MRR contraction is the reduction in monthly recurring revenue due to cancellations (churn) and downgrades compared to the previous subscription period. Contraction MRR is calculated by adding up all revenue lost to cancellations and downgrades.

Pay attention to revenue lost due to downgrades because it can indicate customers view perceive higher-paid tiers negatively.

8. Unit costs

In SaaS, Average Revenue Per User is a high-level metric that does not provide specific information about which customers are the least expensive, what features cost the most to support, and which teams are the most efficient.

Unit cost economics help you determine how to set SaaS pricing tiers to sustain profitability and healthy gross margins per customer, feature, and team.

Here is how:

Cost per feature

You can determine which features your customers frequently use by monitoring how much you spend to support them (value driver for your customers). This helps you figure out what features they may be willing to pay more for.

Keep in mind that the higher the cost per feature you incur, the more you have to charge to remain profitable. Alternatively, you can move the most expensive features to your highest-paid plan. If your competitors charge less, you can brainstorm ways to reduce per-feature costs to remain competitive.

You can also determine which features are least popular. Then, you can decide whether it makes sense to decommission them to reduce operational costs. Alternatively, combining or adding the least-popular features to another tier may improve its perceived value and, in turn, improve its retention rate.

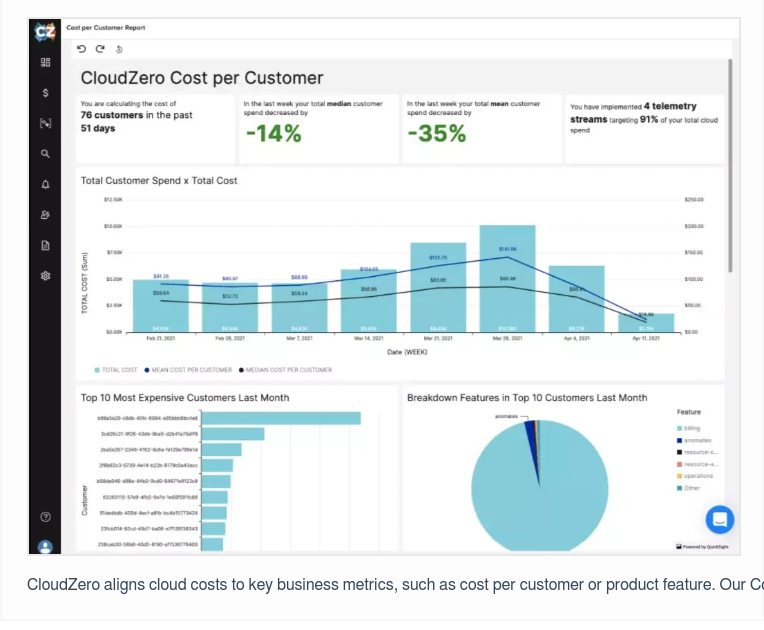

Cost per customer/user/tenant

The average cost per customer (ACC) does not tell you how much you spend supporting specific customers and their activities. In contrast, cost per customer allows you to tell who your most expensive customers are.

With a cost intelligence platform such as CloudZero, you can measure and monitor valuable cost insight like cost per customer and cost per feature. As a result, you can determine other important value metrics such as the cost of goods sold (COGS). You can also identify the cost per feature for specific customers.

With this insight, you can adjust pricing across various customer segments to increase margins come renewal time.

You can also use it to identify how actions such as onboarding more customers (increased MRR) and allocating more resources to growing customers (expansion MRR) affect COGS. By comparing your costs to your gross margins, you know if you need to re-evaluate your workflows to achieve improved economies of scale.

So, how do you find the right SaaS value metrics?

How To Identify Your Value Metrics

What are some examples of value metrics in SaaS?

Value metrics vary by use case.

Video platforms like Wistia will have value metrics such as their capacity, the number of videos customers can upload, or the ability to custom-brand content. A marketing brand like HubSpot might use revenue or verified contacts as its value metrics. Slack could use the number of messages customers can send and the number of users per channel as value metrics for its communication platform.

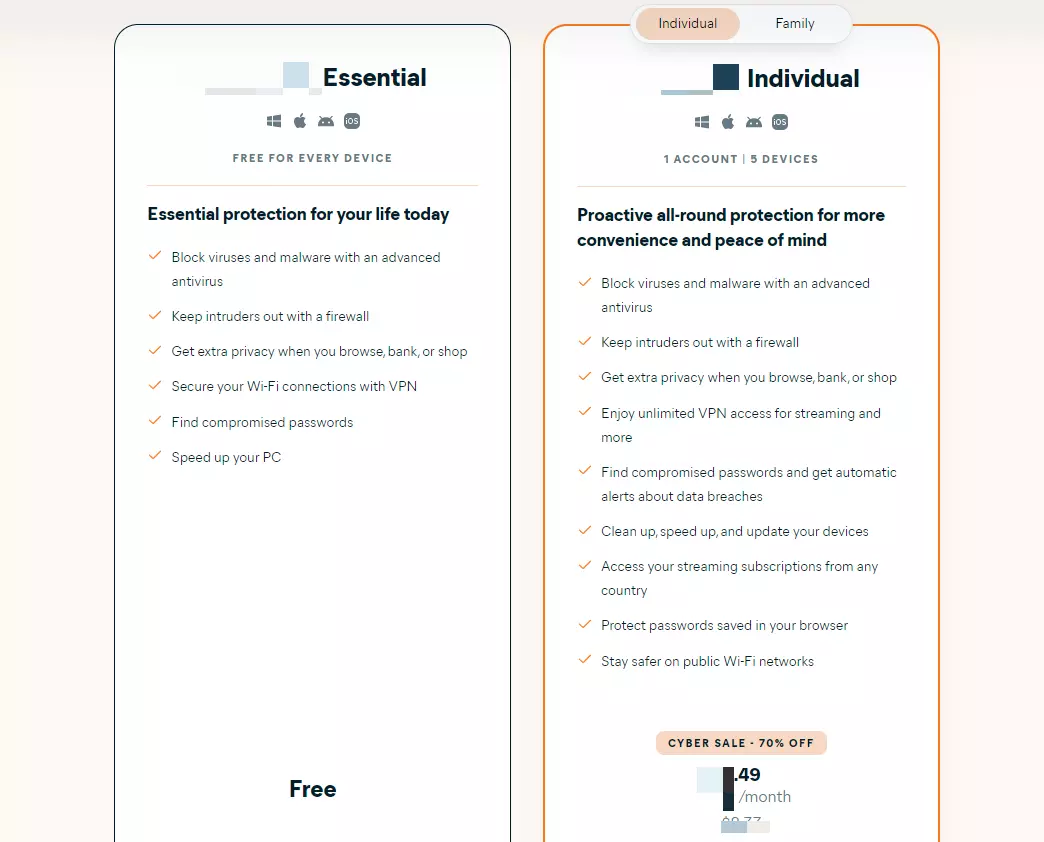

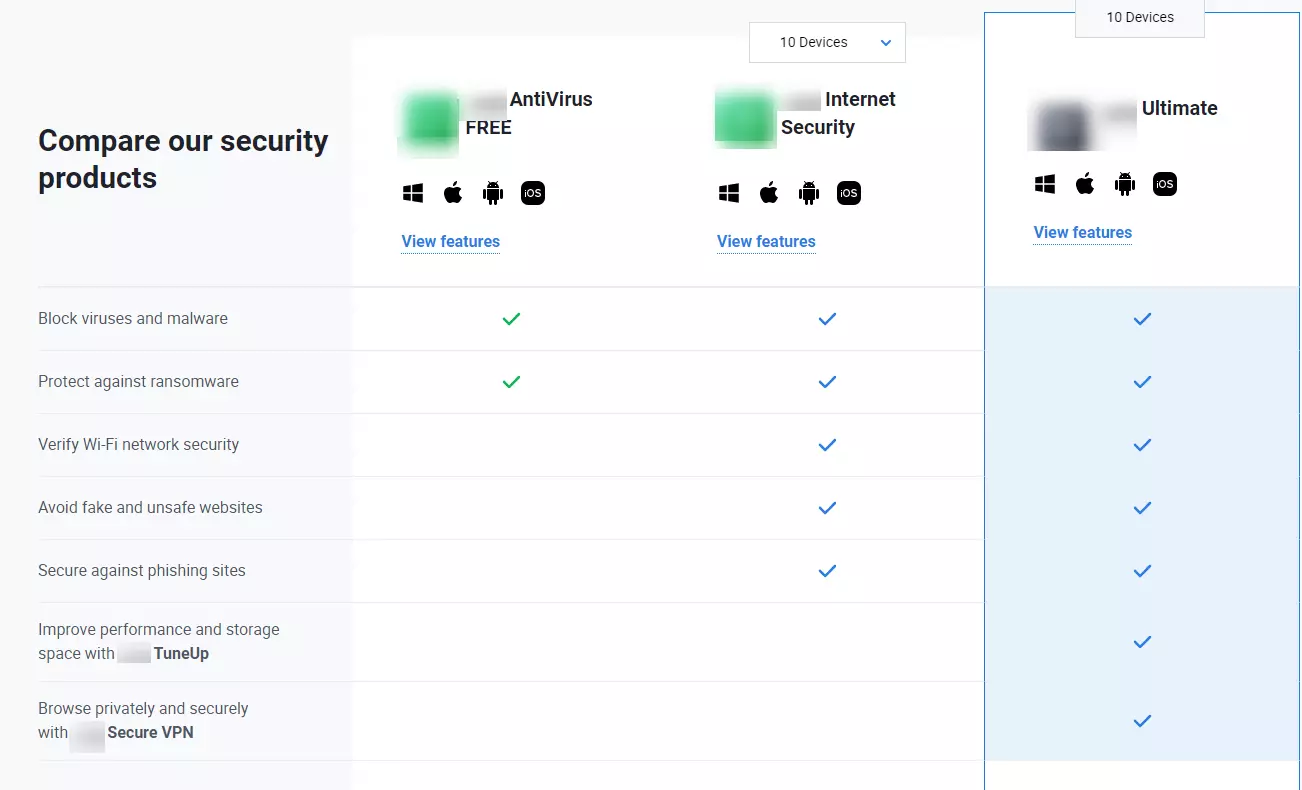

Another example. Consider these two antivirus programs:

Company A

Company B

They are both reputable brands. Their premium plans are pretty close at $39.99 and $36.99, respectively. Both offer a free version with features standard in their industries.

Either program offers enough value at this point to convince a potential buyer to sign up.

However, Company A provides additional features such as a junk removal tool for PC/Mac machines, a virtual private network (VPN) for securing online shopping sessions, and password protection. Company B offers to secure five more devices and a junk removal cleaning tool.

Which company would you choose if all other factors were held constant?

If you answered Company A, it’s because you thought you’d get more value for just $3 more. As a result, you choose the option that seems more expensive on the surface, but one you believe delivers more value than a $3 discount.

If you answered Company B, you probably value securing and maintaining your devices more than password protection or browsing anonymously with a VPN.

While this is a simplified example, you can see the features on which these companies’ customers place a high value.

All the features available are still great value metrics because different customer segments are willing to pay for each. If either company wanted to appeal to both buyer personas, it would have to offer different price tiers tailored to each persona.

What Is A Good Value Metric?

Ideally, a good value metric should:

- Help customers can immediately see what value they are paying for.

- Align with what your best customers do the most with your product or service.

- Provide details on what pricing plan they fit into without needing clarification from you.

- Be easy for customers to see your service or product’s impact on their revenue, such as increased savings.

- Multiple customers attribute success to this metric.

- The more your customers experience the value of your product or service, the more you can charge. This is what would fuel your growth — and the reason per-user pricing is often a hindrance to growth for many SaaS companies.

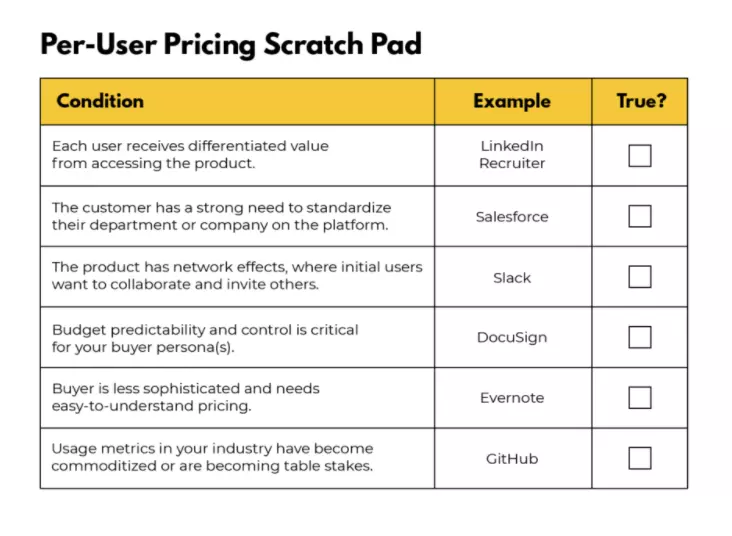

The only time you should use per-user pricing is when you can check “true” for each item on this checklist:

Credit: Openview

As a final step, survey your prospects, repeat customers, churned customers, etc., to determine what they value most in your product or service. You may ask them to rate each feature from one to five, where one is the most valuable to them, and five is the least important.

Compare the response with your answers to the questions above. Do the two responses match? If they do, then you have your value metrics in the order you should aim to boost their perceived value among customers.

This can help enhance customer experience, reduce cancellations, and increase a tier’s price to ensure healthy margins without losing customers.

Does all that sound overwhelming? You can use a cost intelligence solution to simplify your work.

Use Cloud Cost Intelligence To Set Profitable SaaS Pricing With Confidence

With CloudZero, everyone from engineering and finance to the C-suite and investors can organize cloud spending around value metrics. All stakeholders can see cost insight in the language they prefer:

- Engineering – Cost per feature, deployment, or dev team so they can build innovative solutions without overspending.

- Finance and FinOps – Cost per customer and unit cost to help them set profitable pricing tiers and allocate cloud costs accurately.

- FinOps – Cost anomaly alerts inform you of abnormal cost trends via Slack so that you can prevent overspending as soon as possible.

- Executives – Understand COGS and unit cost economics to inform strategic decisions.

- Investors – Share rich gross margins and profit reports to attract investors into funding your growth.

to learn how CloudZero converts value metrics into actionable Saas pricing intelligence for startups, enterprises, and scaleups.

to learn how CloudZero converts value metrics into actionable Saas pricing intelligence for startups, enterprises, and scaleups.