Imagine navigating a cross-country road trip using nothing but a paper map from the 1980s. Sure, you might eventually reach your destination, but you’d likely miss faster routes, real-time traffic updates, and helpful insights along the way.

That’s what it can feel like for modern finance teams to rely solely on spreadsheets for complex financial modeling.

Whether you’re shaping your company’s financial strategy or looking to optimize costs, the right financial modeling software can help you do better, faster, and a lot less caffeine.

But with dozens of SaaS financial modeling tools on the market, how do you choose the right one?

We’ll cover that and more in the next few minutes, without overcomplicating things, of course.

What Is Financial Modeling?

Financial modeling for SaaS companies involves creating detailed projections of a business’s financial performance based on historical data, future expectations, and key performance indicators (KPIs).

What makes SaaS financial modeling unique is the subscription-based revenue model. It adds complexity with factors like recurring revenue, customer churn, and multiple pricing tiers — all of which can change over time.

But that’s exactly why it’s so important.

Solid financial modeling helps SaaS companies understand their growth potential, manage risks, and optimize operational efficiency. And that’s not all.

Why financial modeling is crucial for SaaS companies

Financial modeling helps SaaS companies navigate the unique challenges tied to their subscription-based business model:

- Plan revenue: Predict Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) despite income fluctuations from subscription changes and churn.

- Managing risk: By analyzing SaaS KPIs like customer acquisition cost (CAC), lifetime value (LTV), and churn rate, your financial model can help you identify risks and guide strategic decisions.

- Support investor relations: Provide your potential and existing investors with insights into the company’s financial health and future trajectory.

- Boost operational efficiency: Spotlight inefficiencies in cost structures or customer acquisition strategies, enabling your team to refine processes and improve profitability.

And that brings us to the next question.

What does financial modeling software do?

Financial modeling software automates and streamlines the modeling process. A good pick can save you time, reduce human errors, and keep your models up to date.

The best financial modeling software platforms today use accurate data, reliable forecasts, and, increasingly, sophisticated models.

But before we dive deeper, let’s get this one thing out of the way.

What’s The Difference Between Financial Modeling And Forecasting?

Financial forecasting estimates a company’s future financial performance based on historical data and market conditions. Meanwhile, financial modeling builds detailed, data-driven models to analyze how specific decisions or scenarios could impact your company’s financial health.

This approach combines financial reporting tools and statements to simulate outcomes, such as projecting the profitability of a new product or evaluating the impact of a merger.

Here’s a quick comparison table to put this into perspective.

|

Financial modeling |

Financial forecasting | |

|

What it is |

Uses mathematical formulas, theoretical constructs, and scenario analysis to build detailed financial models for analyzing the impact of specific decisions or scenarios. |

Estimates future financial performance based on historical data and market conditions. |

|

Data sources |

Integrates financial statements to simulate outcomes. |

Focuses on key metrics like revenue, expenses, and cash flow. |

|

Use cases |

Used for strategic planning, investment analysis, and risk assessment. |

Supports budgeting and resource planning. |

|

When it’s used |

On-demand. Used as needed for specific business decisions. Also long-term. Typically, 3 years for SaaS companies |

Short-term Guide day-to-day operations Typically done quarterly or annually |

In the next sections, we’ll shift gears and cover the key features to look for in financial modeling software — along with the top tools available today.

From Spreadsheets To Automation: How Modern Financial Modeling Software Makes A Difference

Traditional financial modeling tools were once limited to local drives and email sharing. They were prone to duplication and version control issues. Today, many have moved online, offering real-time collaboration and improved version management.

But today’s SaaS-driven business environment demands even more. And modern financial modeling platforms have some advantages over traditional tools here, such as:

- Real-time data integration: Modern platforms automatically pull in live data from various sources (ERP, CRM, accounting systems), eliminating the need for manual uploads or complex macros.

- Enterprise-level scalability: Cloud-based solutions handle large, complex datasets and multi-dimensional models without performance issues — unlike conventional tools that struggle at scale.

- Improved auditability: Built-in audit trails, version histories, and permission-based access make it easier to track changes, maintain data integrity, and meet compliance requirements.

- Robust security: Modern tools include enterprise-grade security features such as encryption, role-based access controls, and compliance with standards like SOC 2 and GDPR.

- Automation and advanced analytics: Tasks like scenario analysis, sensitivity testing, and complex formula building are simplified through built-in automation, scenario planning, and AI/ML-driven forecasting. This saves time and reduces errors.

That said, not even modern financial modeling tools are created equal. Some offer superior features. Others may simply be a better fit for your specific workflows and SaaS finances.

Speaking of features, what capabilities should you prioritize to get the best return on your investment?

We’ve already covered the must-have features when comparing traditional tools to modern financial modeling solutions. Beyond the essentials, the best financial modeling tools for SaaS companies offer advanced capabilities.

Here’s your quick checklist:

- FinOps and cloud cost integration: Integrate with platforms like CloudZero or AWS Cost Explorer. Then connect financial models with real-time cloud spend data, including cost of goods sold (COGS) and cost per environment.

- Detailed reporting and dashboards: Include customizable, presentation-ready reports and dashboards for board meetings and investor updates.

- Revenue cohort analysis: Deliver advanced analysis of revenue performance by acquisition period, customer segment, or geography.

- AI-driven forecasting: Support machine learning-powered forecasts based on historical trends and market variables.

- Customizable assumptions and driver-based modeling: They offer flexibility to adjust key assumptions (such as churn, CAC, hiring plans) and build models based on operational drivers.

- Multi-entity and multi-currency support: This covers the ability to model subsidiaries and global operations with multiple currencies.

- Security and compliance: Support enterprise-grade security standards (SOC 2, GDPR, etc.) and safeguard sensitive financial data.

- Trial periods and expert support: Offer transparent trial access and dedicated onboarding or expert support to help teams get started.

In the next section, we’ll see how these capabilities come to life in some of the top financial modeling software options for SaaS businesses.

7 Robust Financial Modeling Software Examples To Consider

Each of the following financial modeling tools offers a unique set of capabilities for SaaS-specific financial modeling:

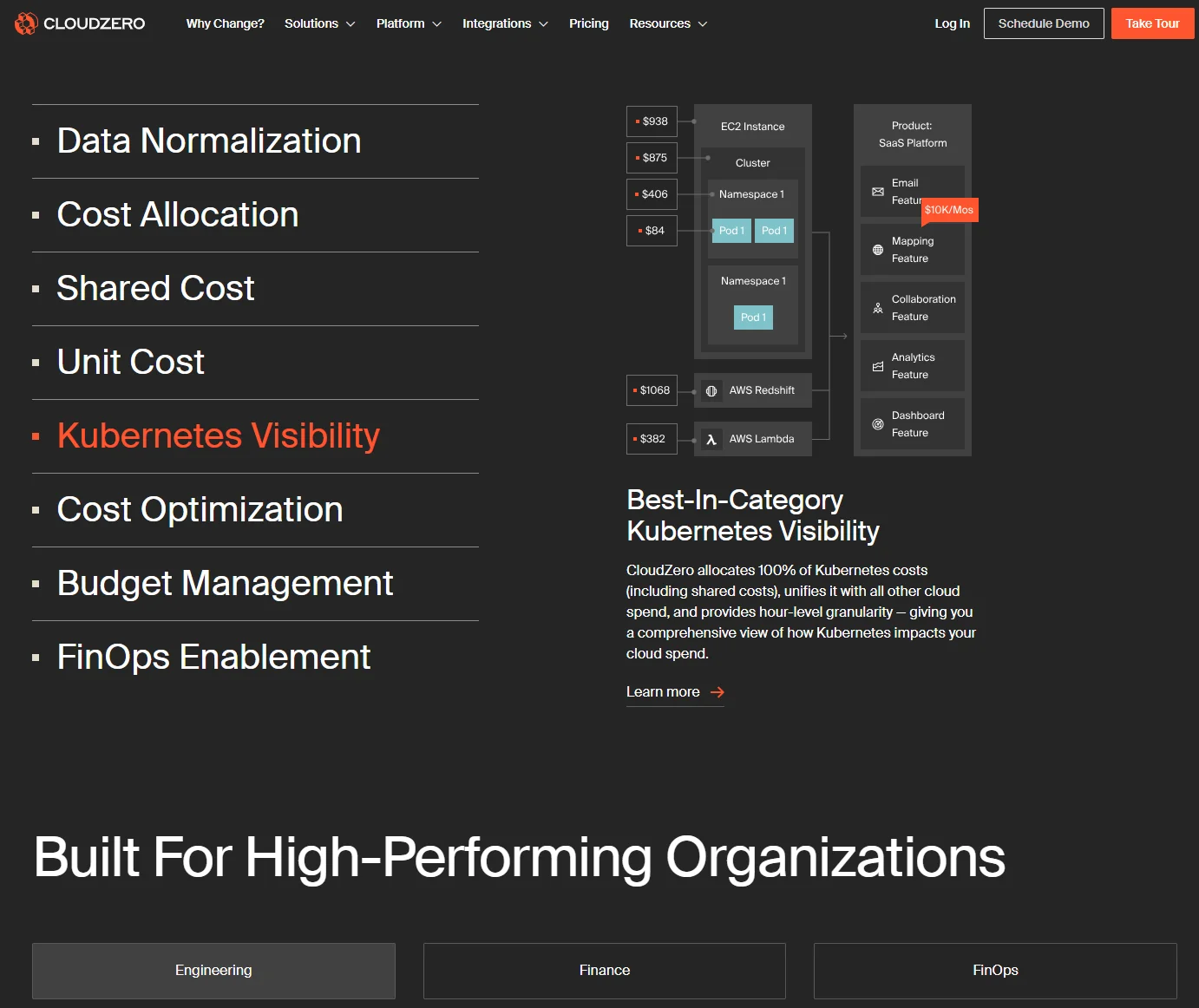

1. CloudZero

Best for: Cloud cost intelligence and SaaS financial planning

CloudZero is purpose-built for SaaS companies looking to connect financial modeling with real-time cloud cost data. Unlike traditional financial tools that overlook infrastructure spend, CloudZero helps businesses tie every dollar spent in the cloud back to specific customers, products, and teams.

This gives finance and engineering teams a unified view of how cloud costs impact profitability and product decisions.

CloudZero Saas financial modeling features:

- Tracks unit cost metrics like cost per customer, per feature, and per deployment.

Take cost per customer, for example. Once you know exactly how much you spend to serve each customer, you can start spotting patterns and identifying your most profitable customers or segments.

- With that insight, you can refocus your marketing efforts to attract more of these high-margin customers.

- On the flip side, you might renegotiate terms with your most expensive customers to encourage subscription renewal while protecting your margins.

- CloudZero breaks down cloud cost drivers by role (engineering, finance, FinOps, executives, or the board), ensuring the right people get the most relevant insights at the right time to make informed cloud spending decisions.

- Engineering-Led Optimization (ELO) supports tying cost data directly to engineering activity. For example, tracking cost per deployment gives your engineers the visibility they need to build cost-efficient solutions at the code level, driving long-term efficiency.

- Single source of truth: Integrate with cloud providers like AWS, Azure, and GCP and cloud platforms like Kubernetes, Snowflake, New Relic, and MongoDB.

- Offers real-time dashboards, cost anomaly alerts, and top-tier accurate reporting for cloud spend accountability.

CloudZero makes cloud costs a first-class business metric, not an afterthought. Don’t wanna take our word for it? Get your free product tour here.

Or, check out CloudZero in action  .

.

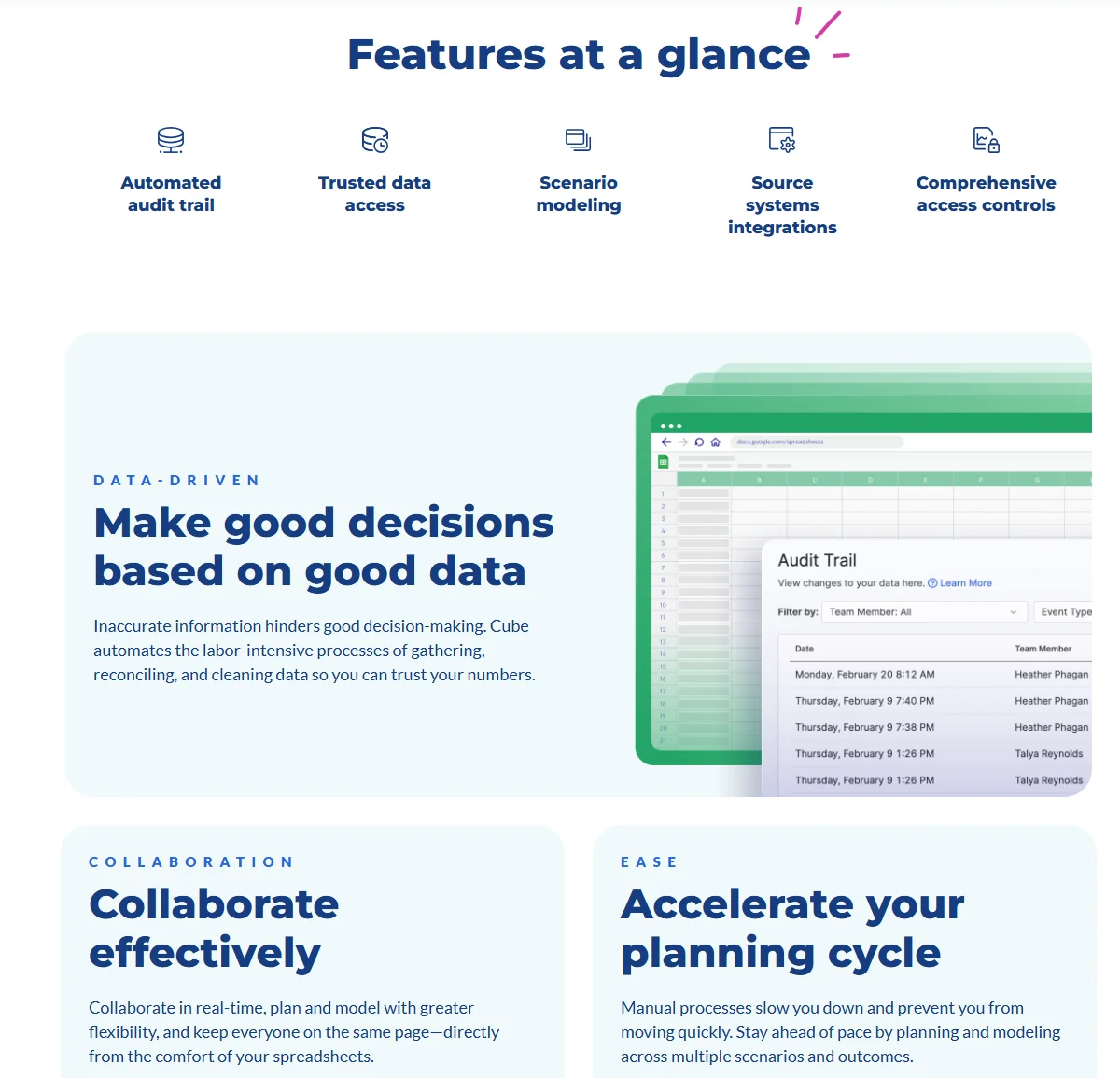

2. Cube

Best for: Spreadsheet-native FP&A modeling for mid-market SaaS teams

Cube sits on top of your existing spreadsheet models. It then improves them with automation, data syncing, and version control. For SaaS teams that are outgrowing manual spreadsheets but not yet ready for a full EPM system, Cube strikes a good balance of flexibility and structure.

Cube financial modeling features:

- Connect Excel/Sheets to live data from ERPs, CRMs, and HR tools

- Multi-scenario modeling, driver-based forecasting, and rolling budgets

- Role-based access, approval workflows, and audit trails

- Real-time collaboration and centralized data across models

- Easy setup with minimal disruption to existing workflows

Some notable alternatives to Cube include Microsoft Excel and Vena.

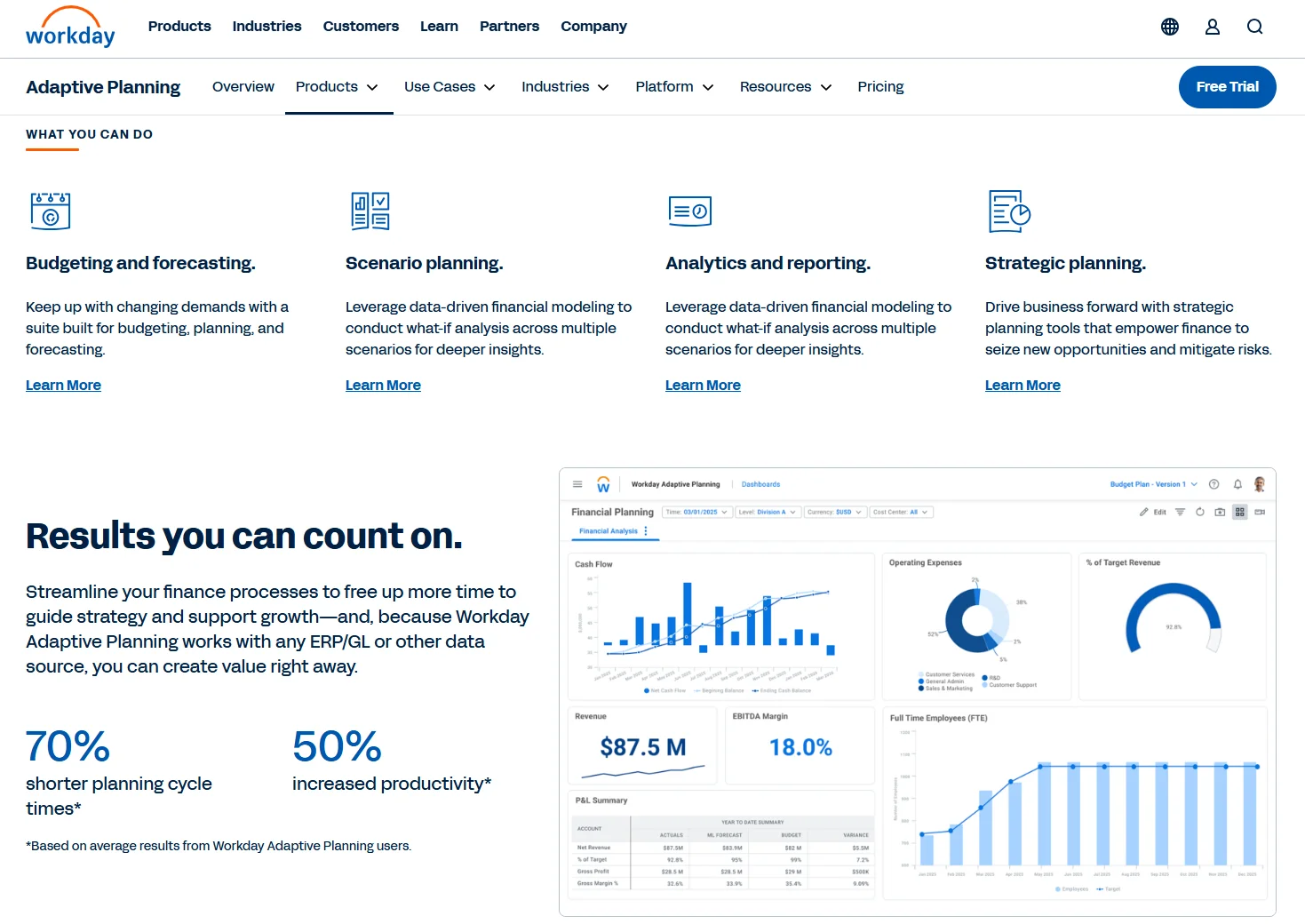

3. Workday Adaptive Planning

Best for: Enterprise-grade financial planning for global SaaS organizations

Workday’s Adaptive Planning helps large SaaS companies manage complex, multi-entity, and multi-currency financial models. It’s designed to support advanced financial forecasting, workforce planning, and operational modeling at scale.

Top Workday Adaptive Planning financial modeling capabilities include:

- Built-in AI and machine learning for more accurate forecasts

- Real-time collaboration across departments and geographies

- Prebuilt integrations with Workday Financials, HCM, and other systems

- Detailed audit trails and enterprise-grade compliance features

- Customizable dashboards and real-time collaboration features

The platform is also a natural choice if you already use Workday tools.

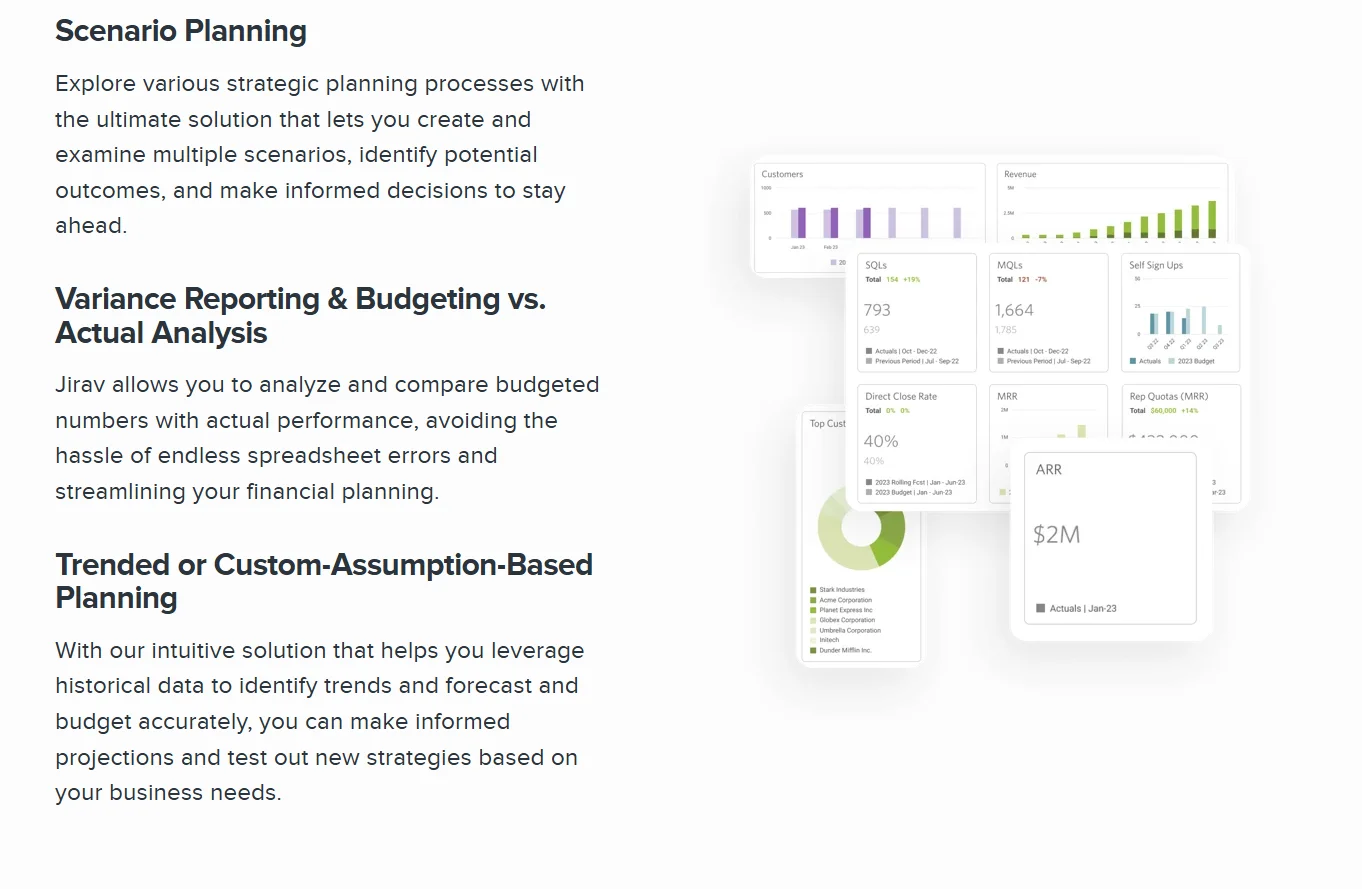

4. Jirav

Best for: All-in-one financial planning for startups and SMB SaaS companies

Jirav stands out for its balance between power and simplicity. It’s powerful enough to handle sophisticated forecasting and scenario planning, yet user-friendly enough for lean finance teams without dedicated FP&A resources.

Key Jirav modeling capabilities:

- SaaS-specific templates for MRR, ARR, churn, LTV, headcount, CAC, and more

- Driver-based modeling and scenario analysis

- Real-time dashboards for cash flow, runway, and SaaS metrics

- Quick integration with HR and CRM systems

- Also integrates with accounting tools such as QuickBooks, NetSuite, Xero, Gusto, and more

- Collaborative budgeting and forecasting features

- Prebuilt SaaS-specific templates and reporting dashboards

- Multi-scenario planning and variance analysis

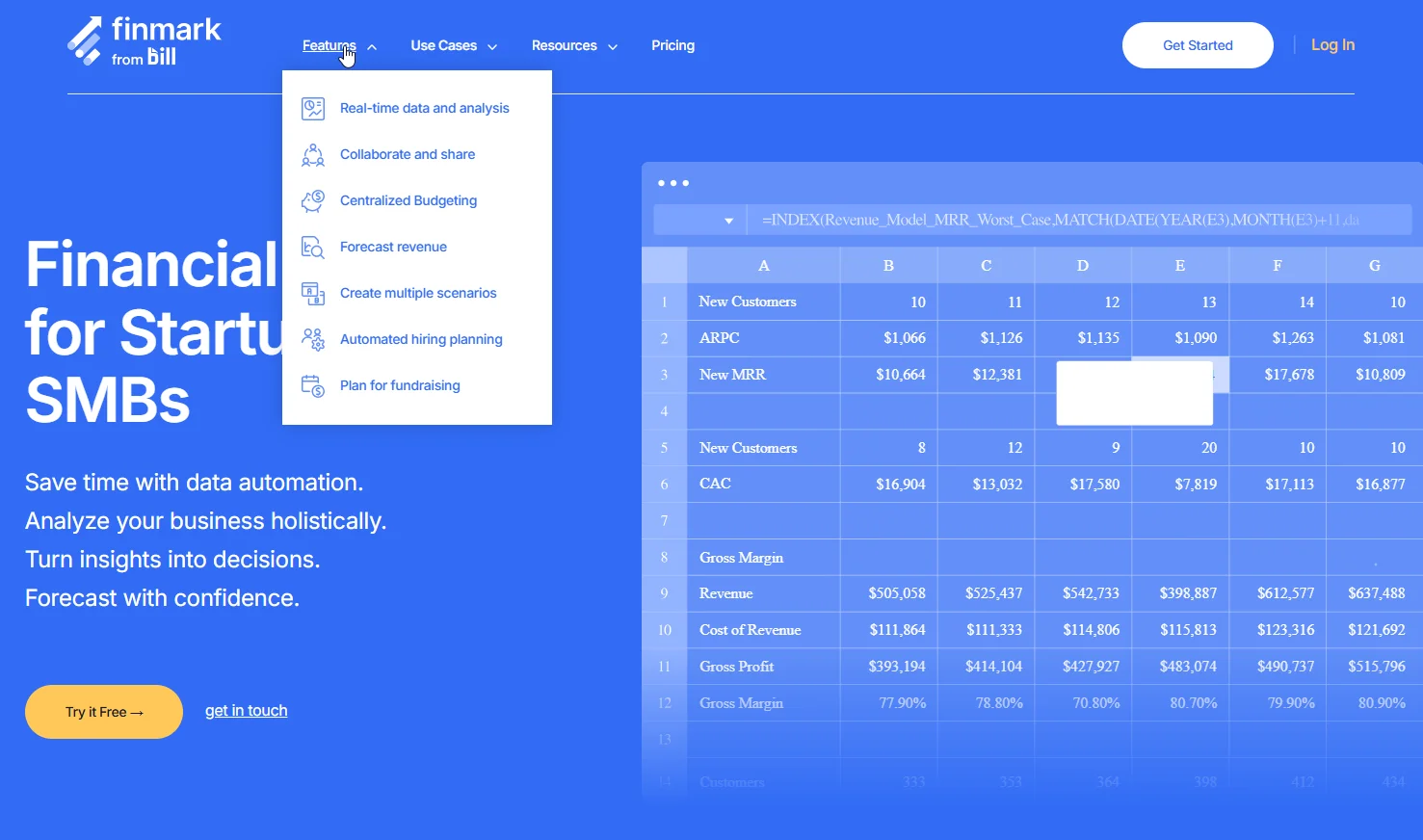

5. Finmark (by BILL)

Best for: Early-stage SaaS startups

Finmark provides an easy-to-use platform for financial modeling and runway planning without the need for complex spreadsheets. Its clean, intuitive interface enables startups to build and adjust financial models quickly. You can track burn rate, forecast revenue, and plan for fundraising rounds.

Finmark financial modeling capabilities include:

- Quick-start templates for SaaS revenue, hiring, and burn modeling

- Scenario planning for “best case,” “worst case,” and fundraising timelines

- Real-time syncing with accounting tools like QuickBooks and Xero

- Easy-to-share reports for board meetings and investor updates

- Designed to grow with startups through early-stage funding and beyond

Ultimately, Finmark is ideal for fast-moving teams that need clear, data-driven financial visibility without the overhead of sophisticated FP&A tools.

6. Anaplan

Best for: Large, global SaaS enterprises

Anaplan supports complex, cross-functional financial modeling across large, global organizations. It’ll help you connect financial, sales, workforce, and operational planning in one unified platform.

Key Anaplan financial modeling features:

- Enterprise-grade real-time financial and operational planning

- Multi-entity, multi-currency, and multi-geo support

- Advanced scenario modeling and what-if analysis

- Integration with ERP, CRM, and HR systems

- Strong audit, compliance, and governance controls

- Custom business logic and driver-based modeling

- Real-time updates with version control and audit history

- AI/ML-driven forecasting and predictive scenario analysis

In addition, its in-memory Hyperblock tech enables real-time, large-scale data processing, essential for enterprises managing thousands of customers and revenue streams.

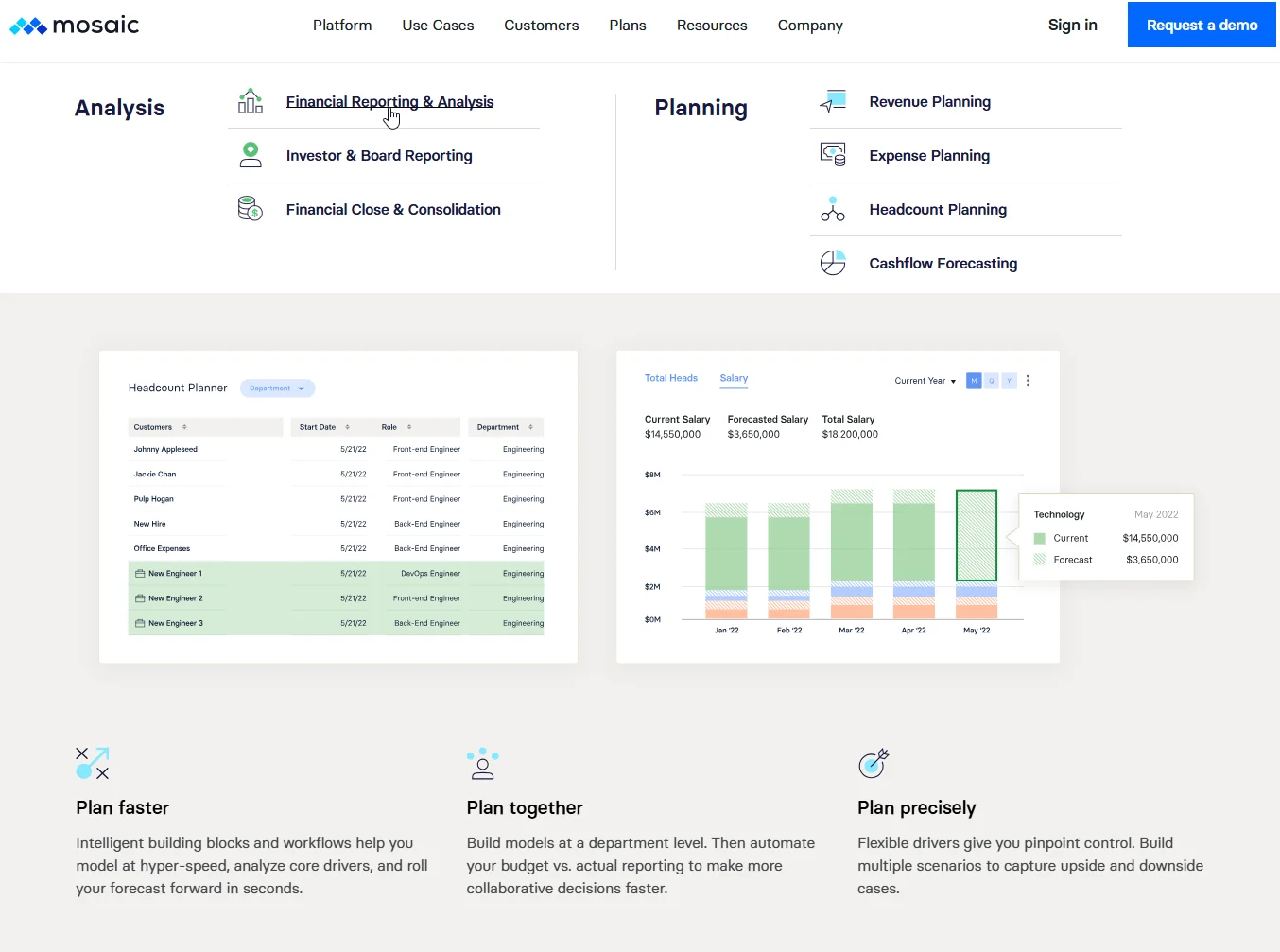

7. Mosaic

Best for: Real-time modeling for high-growth SaaS companies

Mosaic connects directly to your existing tech stack, such as CRM, ERP, and billing systems. It then continuously updates your models with the latest data. Its user-friendly interface and powerful analytics make it particularly suitable for companies that need agile and responsive financial planning tools.

Anaplan financial modeling capabilities include:

- Continuous, real-time updates to financial models as new data becomes available

- Create and compare multiple financial scenarios to assess potential outcomes and risks.

- Detailed, auto-generated financial reports and dashboards to reduce manual effort and increase accuracy

What’s Next: Level-Up Your Financial Modeling With Complete Cost Intelligence

Most financial modeling software solutions stop at revenue projections and expense forecasts. CloudZero goes deeper. It breaks down your cloud costs at the unit level, showing you exactly who, what, and why your cloud bill is changing.

CloudZero is the missing piece your SaaS business needs to finally answer questions like:

- Are we charging enough for this feature to cover its cost?

- How much are we spending to serve each customer? And how does that cost vary by segment, geography, or package?

- What’s our margin on each client?

- Should we refactor this feature, move it to a paid tier, or decommission it altogether?

- How will our costs change if we onboard 15 more clients next quarter?

- Should we renegotiate contract terms with this client to protect our margins?

- How do costs compare between our production and R&D environments?

- Why does email automation cost three times more than our live chatbot?

- How much of a discount can we afford this client to encourage renewal without hurting profitability?

- Which customer segment delivers the highest margins so that we can prioritize our marketing efforts?

- Are we on track to meet our budgeting and financial goals?

Whether you want to improve margins, drive smarter product decisions, or scale profitably, CloudZero delivers clear, real-time answers that help you turn cloud spend data into a competitive advantage.

Ambitious teams at Coinbase and Drift already trust CloudZero to help them model, manage, and grow confidently. You can, too.  to supercharge your financial modeling with complete cost visibility.

to supercharge your financial modeling with complete cost visibility.