FP&A tools can help your business assess, plan, and budget business activities effectively. The tools automate much of the work involved, help you tell where you could be losing money, and reveal additional revenue streams you can capitalize on.

At a time when SaaS competition is at an all-time high, you need all the advantages at your disposal to deliver the most value at the least cost. This can help you improve your margins, attract more investors, and generate enough profits to fund your growth.

In this FP&A software guide, we’ll share solutions to help you address different areas of your SaaS business, including cloud cost optimization, accounting, payroll, budgeting, and forecasting.

What Is Financial Planning And Analysis (FP&A)?

FP&A is a set of financial practices that include analysis, planning, budgeting, and forecasting. These practices explain financial performance and uncover growth opportunities.

Financial planning and analysis go beyond simply keeping records to examining why a company’s finances are the way they are and what the future might look like.

FP&A teams analyze economic and industry trends, assess past financial performance, and seek to anticipate challenges before they arise, aiming to forecast and influence the company’s future financial performance.

What is the difference between FP&A and finance?

FP&A differs from traditional finance because it takes a more strategic approach using current data. In contrast, traditional finance relies on historical data to determine an organization’s current financial health.

Finance has traditionally focused on recordkeeping, accounting, financial compliance, and payroll.

Meanwhile, FP&A teams review a company’s financial activities and create a roadmap. Often, the team works with other teams to attain company-wide financial goals, such as improving cost-efficiency with engineering and product.

Take FP&A analysts at a SaaS company, for example.

They will:

- Assess which customers, products, or software features generate the highest profit (not just revenue) and communicate this to decision-makers.

- Help marketing and customer acquisition teams target this profitable customer segment to grow future margins.

- Or, they can recommend retiring unprofitable or the least-profitable software features in favor of funding the most used and profitable features in their SaaS product.

- Or, they can recommend gradually migrating some or all operations to the cloud vs on-premises to improve margins, service delivery, and their CapEx/OpEx profile.

FP&A analysts typically report to the Chief Financial Officer (CFO), the person ultimately responsible for managing an organization’s financial health.

FP&A Process: How To Do Financial Planning And Analysis

The FP&A process is very similar to traditional financial activities. However, FP&A work involves more scenario planning, financial modeling, cost efficiency analyses, capital allocation (instead of just capital reporting), and uncovering new income streams.

Here’s a snapshot of the process.

- Collect data – The team collects all relevant financial data from internal departments and external sources. They consolidate it so it is easy to work with and verify it to eliminate errors.

- Plan and forecast – The FP&A team then works with other business units to create forecasts of each one’s business trajectory and marry those with the entire company’s financial trajectory. They can use various techniques, including scenario, driver-based, and predictive planning.

- Budget – Based on the revenue forecast from the strategic plan, FP&A calculates the cost of funding each department/team/unit’s plan.

- Monitor and analyze – Once funded, the FP&A continuously tracks how the budgets are being spent, looking for ways to reduce costs while increasing return on investment. Doing this manually can be extremely challenging, so proactive SaaS companies use robust FP&A software to optimize their financial planning.

- Performance reporting – Regularly report on financial performance to measure progress against forecasts and budgets. This includes generating reports on critical metrics and sharing insights with stakeholders. It ensures timely adjustments to stay on track.

How To Choose The Right FP&A Solution For Your Business

Here’s a checklist to guide you in choosing the best FP&A solution for your unique business.

- Identify your business needs. Start by determining the core areas you need to address, such as cloud cost management, payroll processing, accounting, or financial modeling. Some tools specialize in specific areas, while others offer a more comprehensive solution. Match the tool’s core functions with your primary pain points.

- Assess integration compatibility. Look for software that integrates with your current systems (ERP, CRM, accounting) to avoid data silos and streamline workflows. Smooth integration reduces the risk of errors and makes data consolidation easier.

- Consider scalability. Choose a platform that can scale as your business grows, with options for added users, features, and data storage. Scalable tools prevent the need for frequent software changes as your requirements evolve.

- Review security standards. Ensure the tool meets security and compliance requirements, especially if handling sensitive financial data. Key features include encryption, access controls, and compliance with relevant regulations (SOC 2, GDPR, etc).

- Prioritize real-time data access. FP&A involves working closely with different teams. Choose a tool that enables real-time collaboration and offers shared data access. It should also support team transparency to streamline the planning and analysis process.

- Test usability. A user-friendly interface reduces the learning curve and increases team adoption. Look for a tool with an intuitive design and a robust reputation for usability.

- Look for collaboration features. FP&A often requires input from multiple departments. Tools with shared dashboards, multi-user access, and collaboration features improve alignment and communication.

- Compare pricing models. Review the pricing structures and ensure they align with your budget and usage needs. Some tools offer tiered plans or custom pricing.

- Assess customer support and training. Choose a provider with responsive support and various training options, such as tutorials or webinars.

Below are some of the most widely-used FP&A tools for SaaS companies (we’ve organized them into categories).

Cloud Cost Management Software

With more software and tech companies building in the cloud, cloud cost optimization has become an increasingly crucial issue. Although cloud providers like AWS provide flexibility and easy scaling, cloud cost visibility remains hazy.

In addition, Kubernetes, shared costs in multi-tenant applications, and non-taggable AWS spend can all complicate cost allocation. The following cloud cost optimization tools will help you collect, understand, and act on your cloud costs.

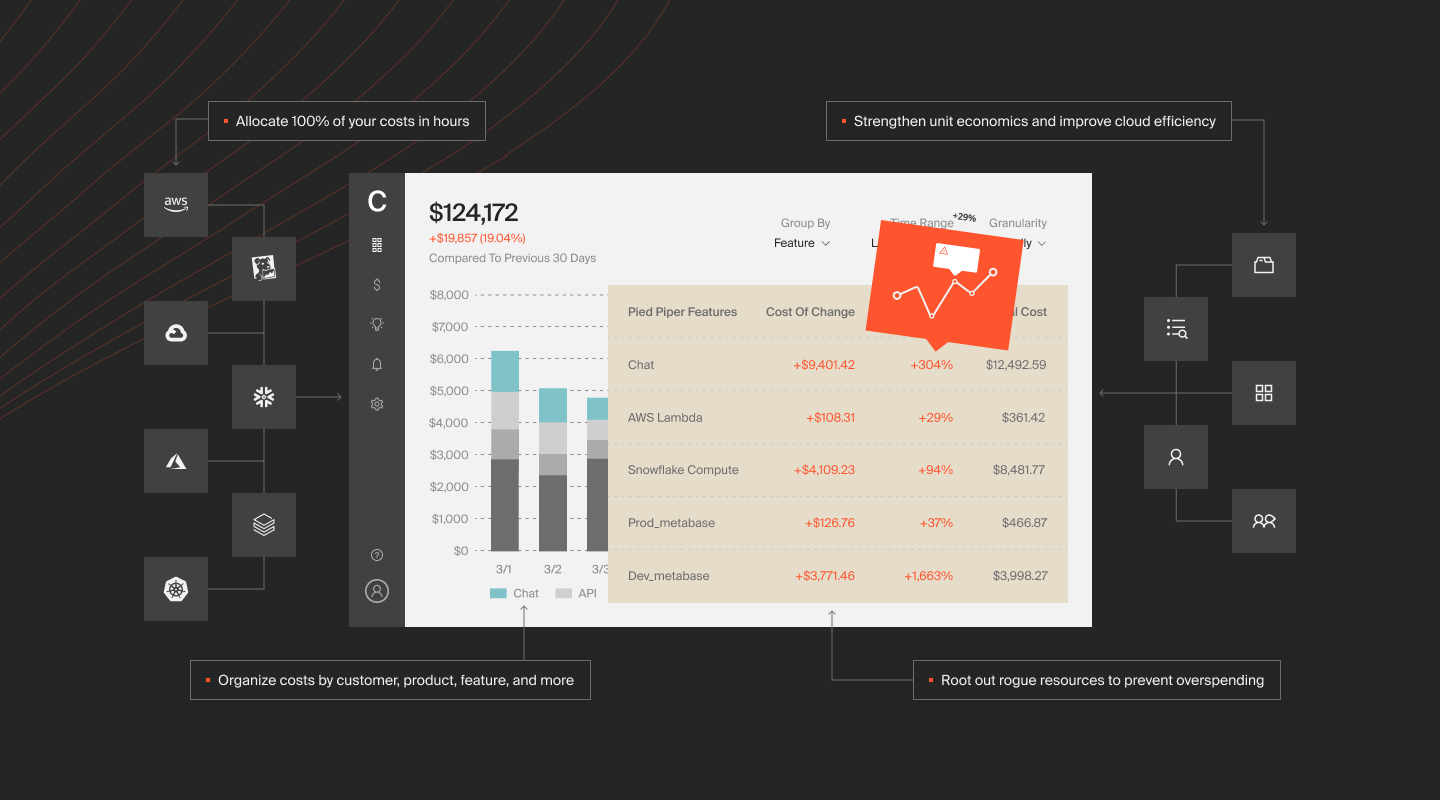

1. CloudZero AnyCost – Hybrid cloud cost optimization solution

CloudZero is a full-fledged cloud cost intelligence platform for SaaS and tech brands. With CloudZero, FP&A and finance teams can easily understand unit costs to inform business decisions, such as how to price different tiers or which features to include in each tier. They can also tell what and who drives their cloud spend and why.

Unlike most cloud cost management tools, CloudZero translates cloud metrics into actionable cost insights that connect to your daily business activities. Check this out:

- Cost per customer – Find out how much you spend to support a specific customer so you can review their contract and develop profitability pricing.

- Unit cost insights – Know how much each product feature, development project, team, etc., costs so you can improve efficiency and achieve economies of scale.

- SaaS COGS analysis and reporting – Understand the cost of goods sold and how to improve your gross margins.

- Kubernetes cost monitoring and reporting – Prevent cost blindspots while you embrace Kubernetes, containerized apps, and multi-tenant infrastructure. No tagging is required.

- Cost anomaly detection and alerting – Leverage real-time anomaly detection and receive timely alerts when CloudZero detects unusual costs to prevent overspending.

Using CloudZero AnyCost, you see your cloud costs across AWS, Azure, GCP, Snowflake, Kubernetes, and more. You can tell who, what, and why your costs change, empowering you to tell where to optimize costs or increase investment to improve ROI.  .

.

Pricing: Custom to your cloud environment

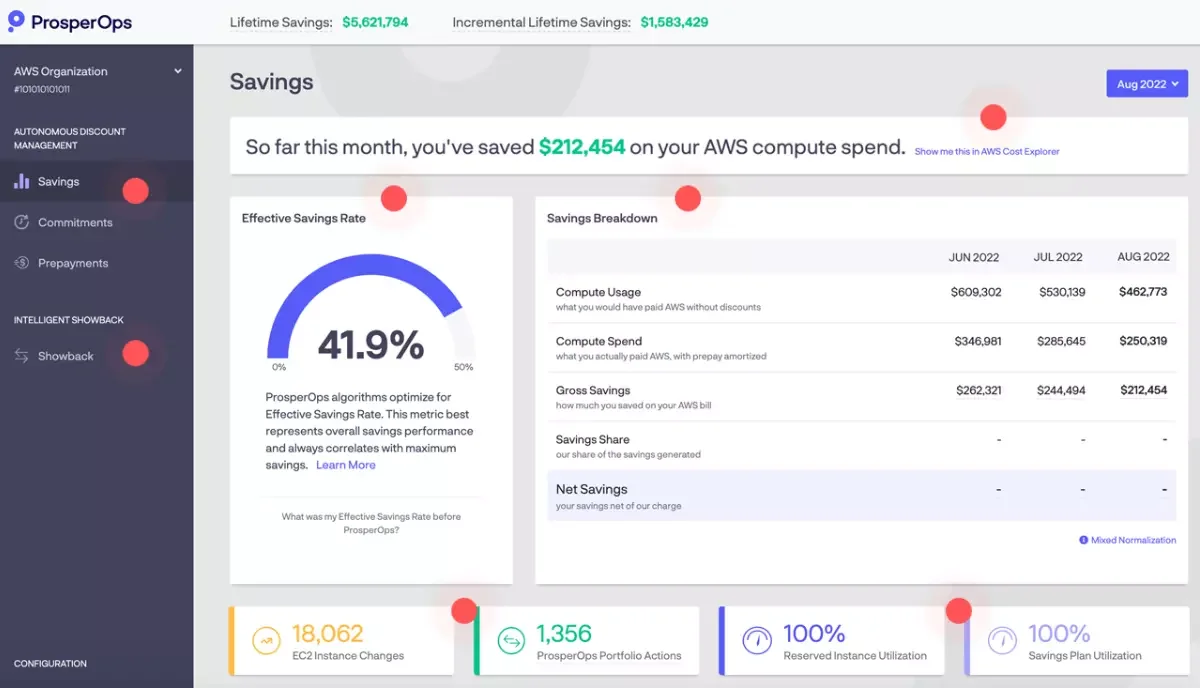

2. ProsperOps – Autonomous AWS RIs and SP orchestration

ProsperOps is a cloud financial management tool for companies using Amazon Web Services (AWS). FP&A teams use ProsperOps to help them leverage discount programs on AWS, like Savings Plans and Reserved Instances (RIs), by committing to use specific resources over one or three years.

The tool automatically creates, manages, and optimizes a range of Savings Plans and RIs on your behalf, dynamically adapting them to changes in your cloud environment every hour. This allows you to derisk commitments to use specific AWS services and resources during the contract, even if your consumption patterns change.

And, if you’d prefer to use AWS Spot instances, which are the most affordable and without the risk of disruptions, check out Xosphere.

Pricing: ProsperOps charges a percentage of the savings it generates for you

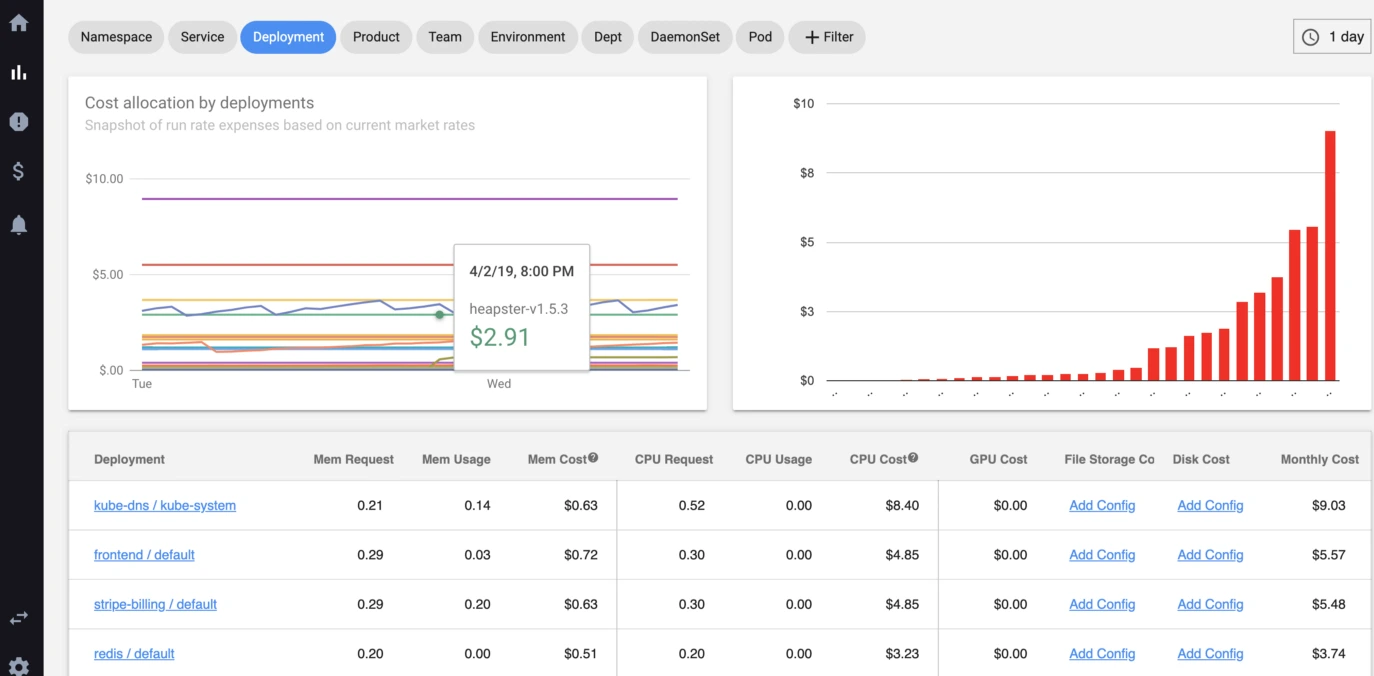

3. Kubecost – Kubernetes cost management and allocation

Kubecost targets teams that run Kubernetes with a set of K8s cost allocation, monitoring, governance, and optimization tools. With KubeCost, you can break down costs by various Kubernetes concepts, like namespace, service, and deployment, in a cloud or on-premises Kubernetes infrastructure.

You can also chargeback or showback costs based on organizational concepts like team, application, project, environment, or department. In addition, you can get recurring cost reports, with costs broken down by namespace, to track trends and efficiency.

Pricing: Team (Free), Business ($449/month – 100 nodes), Enterprise (Upon Request)

4. Harness Cloud Cost Management (HCCM)

Using tools like the Intelligent Cloud Auto Stopping feature, Harness Cloud Cost Management (HCCM) helps you control costs by dynamically shutting down idle resources. It also provides a Cloud Cost BI solution for monitoring data, resources, databases, and other usage data.

HCCM helps FP&A analysts schedule cloud financial reports, create custom notifications and alerts, and practice cost allocation in the cloud. The platform supports several major cloud services, including AWS, Kubernetes, and Jenkins.

Pricing: Upon Request

Accounting Software

As noted earlier, FP&A covers a lot of traditional financial activities. They do this to gather accurate financial performance data to inform future plans. Here are several accounting software solutions you can look into for your FP&A work.

5. Intuit QuickBooks Online – Accounting software for small and medium-sized businesses

QuickBooks helps small and medium businesses collect, consolidate, and analyze financial performance in one place.

It is a full-featured package with tools for accounting, invoicing, payroll, inventory, and tax filing. It also handles budgeting, payment processing, expense management, bank account management, and reconciliation. Better yet, you can manage your accounts receivable and accounts payable via Quickbooks online.

Pricing: Simple Start ($8/month), Essential ($12.50/month), Plus ($17/month)

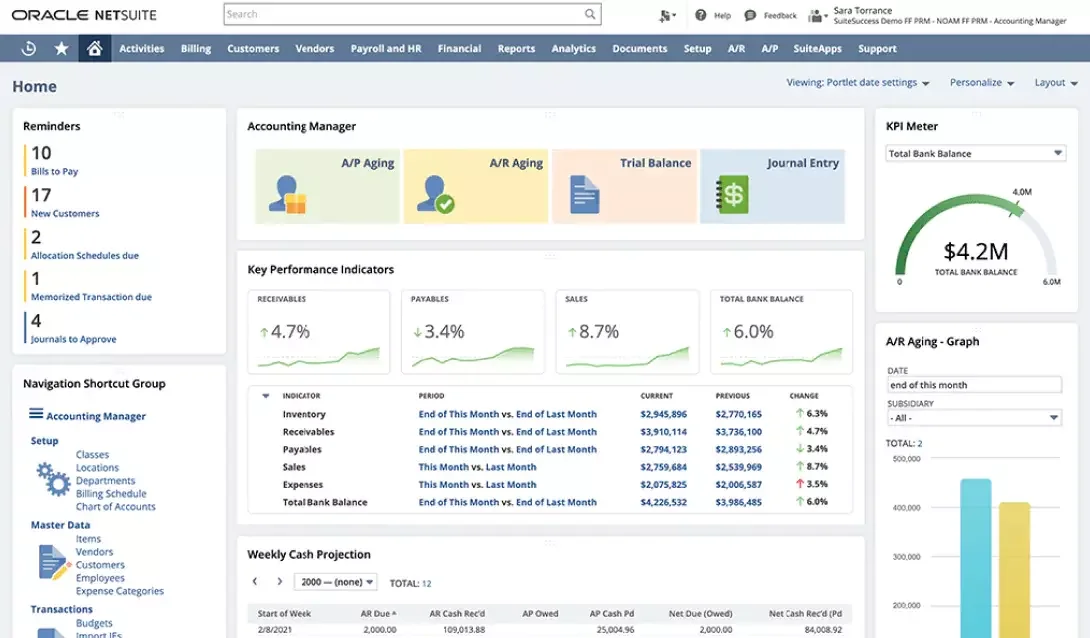

6. NetSuite Cloud Accounting – Oracle’s all-in-one accounting tool

NetSuite Cloud Accounting offers businesses of all sizes a comprehensive accounting solution. With NetSuite, finance leaders can generate rich and interactive reports of their overall accounting and financial performance.

Using rules-based accounting simplifies the data entry process, making it more efficient, but NetSuite can also automate and streamline the A/P and A/R processes and manage local and international taxes.

Pricing: Upon Request

Budgeting And Forecasting Software

Better financial planning and forecasting begin with budgeting. A budget serves as a yardstick for comparing future performance.

A budget is itself a forecasting tool, but you can also generate individual forecasting reports, such as cash flow forecasts, forecasted income statements, CAPEX budgets, etc. The data from the budget is carried forward to these individual reports.

The following budgeting and forecasting solutions can help your FP&A team.

7. Drivepoint – Strategic financial planning platform

Drivepoint is a dynamic financial planning and analysis platform designed to empower FP&A teams at modern consumer brands. The platform centralizes data to streamline forecasting, budgeting, and scenario modeling. Its SmartModel™ integrates with Shopify, Amazon, and QuickBooks, ensuring accurate, real-time inputs.

Cohort-based forecasting delivers detailed revenue projections by analyzing retention and reorder rates, while cash flow forecasting enhances liquidity planning.

Scenario planning tools empower teams to evaluate the financial impact of changes in pricing, customer acquisition, or expenses, enabling data-driven decision-making. Drivepoint simplifies complex financial processes, helping FP&A teams align strategy with business goals effectively.

8. Cube – User-friendly FP&A solution

While many advanced FP&A platforms require weeks of initial setup, additional consulting, and constant management, Cube delivers a powerful solution in an intuitive package.

Cube includes enterprise-grade financial modeling, security, consolidation, and validation on the fly. It also collects data from multiple sources, including ERP, CRM, and HRIS.

It promises your team will be up and running within 10 days and is fully compatible with your favorite financial management tools (including Excel, Salesforce, Tableau, Xero, Snowflake, and Quickbooks).

Pricing: Starts at $1,250/month for two contributors and two admins, unlimited scenarios, integrations with ERPs, etc.

9. Centage – For small to mid-businesses

Centage features a formula-free, drag-and-drop interface that enables the development of comprehensive and accurate budgets accessible anytime, anywhere. It automatically generates forecasted balance sheets and cash flow statements based on different models and assumptions. The platform’s customized financial dashboards also offer insights into the business’s health.

Users can also perform dynamic and infinite “what-if” scenarios without coding or programming.

Pricing: Upon Request

10. Vena – Excel-based budgeting and forecasting platform

Vena Budgeting & Forecasting software speeds up your budget creation process by automating tasks, enabling data consolidation, providing templates, and streamlining FP&A workflows. With Vena, you can identify key cost drivers for your various business units and create budgets using that information.

Perhaps the best thing about Vena is its Excel-based interface. Since almost all financial experts use Excel, Vena can be a breeze. Using a single source of truth, Vena can create a real-time, long-term forecast, which finance teams can then analyze in depth and take timely actions.

Pricing: Upon Request

11. Anaplan – Enterprise FP&A platform

Anaplan designed its financial planning and analysis solution to help medium and large businesses leverage complex FP&A workflows.

Its Corporate Financial Planning and Analysis (FP&A) tool facilitates multiple scenarios forecasting on a rolling basis. Alongside Anaplan’s other enterprise-wide financial solutions, you can consolidate, sync, validate, and analyze large amounts of data connected to a single source of truth.

Anaplan enables your team to use enterprise formulas to create scalable financial models and collaborate across your business units in real time.

Pricing: Custom pricing

12. Mosaic Tech – Agile financial forecasting

Mosaic Tech aggregates data across ERP, CRM, and other systems to create a unified financial view. Its features, such as driver-based forecasting, rolling forecasts, and what-if scenario analysis, support financial modeling and analysis.

Mosaic’s collaborative planning and real-time data updates also make it suitable for budgeting and forecasting. It enables teams to make proactive financial adjustments.

Pricing: Upon Request

13. Workday Adaptive Planning – Enterprise planning platform

Workday is a popular enterprise-level financial planning platform. Its enterprise management cloud approach covers financial, operational, workforce, and sales planning.

To power these areas, Workday provides a set of tools to create simple to complex models, workflows, and reporting/analytics.

Pricing: Contact sales

Financial Modeling And Analysis Solutions

The following tools combine financial management processes with modern, collaborative, and cloud-based planning workflows for finance professionals.

14. Datarails – Financial analytics software with excel dode

Datarails aims to help FP&A analysts maintain their Excel financial models while automating and improving them. Datarails integrates with many of the major accounting, ERP, CRM, and data warehouse solutions available today.

After consolidating and validating your data, you decide whether to keep rows and columns or use a dashboard to view and share your FP&A insights with stakeholders. Either way, you can quickly zoom into your data to answer specific questions in real time.

Pricing: Custom pricing

15. OneStream – Enterprise FP & A

OneStream is ideal for enterprises aiming to eliminate data silos. It unifies financial and operational data into a single, integrated platform, thus replacing fragmented systems and spreadsheets.

OneStream integrates with Microsoft Excel through its Excel Add-In, enabling users to perform ad hoc analysis, create reports, and enter or update data directly within the familiar Excel interface.

Pricing: Custom pricing

16. Planful – Continuous financial planning solution

With this feature-rich platform, you can seamlessly integrate business and financial planning. Besides scenario analysis, Planful emphasizes continuous planning, forecasting, and reporting for marketing, HR, accounting, and FP&A teams.

Planful automates financial planning workflows, enables collaboration across departments, and is highly scalable for large organizations.

Pricing: Upon request by use case

17. Pigment – Cloud-based agile planning platform

Pigment supports agility and coordination across finance, sales, HR, and supply chain. Centralizing planning in one system eliminates siloed workflows, ensuring all teams work cohesively toward shared goals and clear strategies.

The platform integrates real-time data, giving companies a complete, up-to-date view of their performance. With Pigment’s data insights, leaders can make swift, informed decisions backed by accurate and current data.

Pigment’s interface is also intuitive, supporting team collaboration and transparency. Teams work on shared data, fostering accountability and clarity.

Pricing: Custom

18. Board – Business intelligence solution for FP&A work

Board offers a package of software modules and capabilities. Your team can leverage the tools for analytics, business intelligence, and performance management. Its core modules include predictive analytics, dashboards, reports, data discovery, and scorecards.

You can integrate Board seamlessly with systems like SAP ERP, Microsoft Azure, SQL databases, and data presentation tools.

Pricing: Upon request

Other powerful FP&A tools suitable for planning and analysis include Jedox, Prophix, and Jirav.

Payroll Processing Software

Payroll processing software helps finance teams process employee payrolls and ensure compliant and timely tax filings. It also facilitates tax planning by keeping track of credits and deferred tax payments.

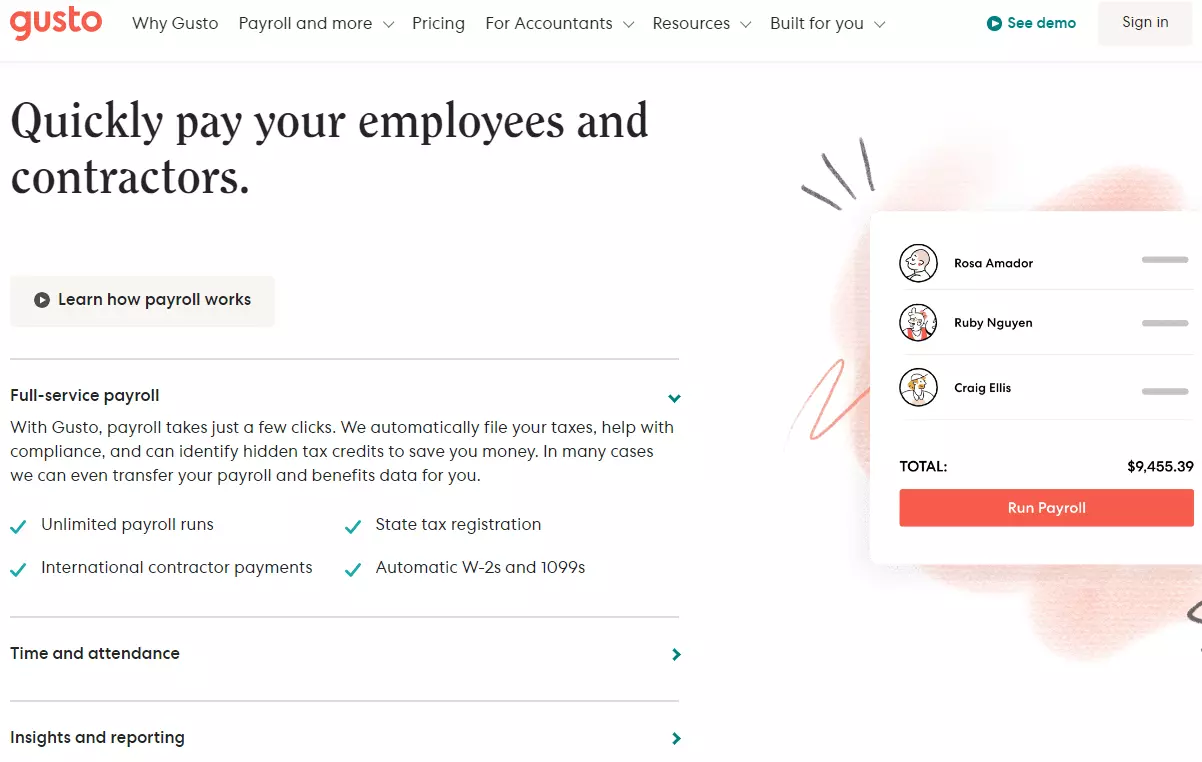

19. Gusto – Payroll and benefits solution

Gusto packs a ton of payroll features, including talent, employee benefits, and time/attendance management. The payroll processing platform also tracks, files, and pays related payroll taxes.

Gusto’s auto calculations eliminate errors, and its integrations with major accounting software help financial leaders review, analyze, and plan their finances with precision. Moreover, your team can create reports on tax credits and deferrals to track savings.

Pricing: Core ($39/month + $6 per person), Complete ($39/month + $12 per person), Concierge ($149/month + $12 per person)

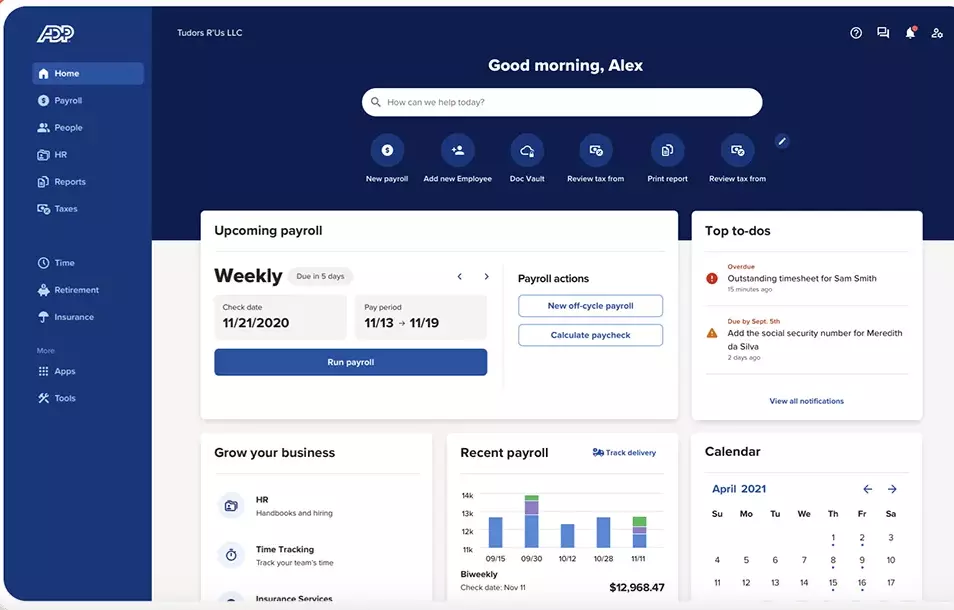

20. ADP – Advanced payroll platform for FP&A work

ADP Payroll is an online platform that offers payroll processing services to small, medium, and even large-sized businesses.

ADP also tracks taxes and relevant credits available on behalf of employees. In addition, ADP Payroll includes tools for computing and planning retirement, insurance, and professional employee organization (PEO) tasks.

Pricing: Upon Request

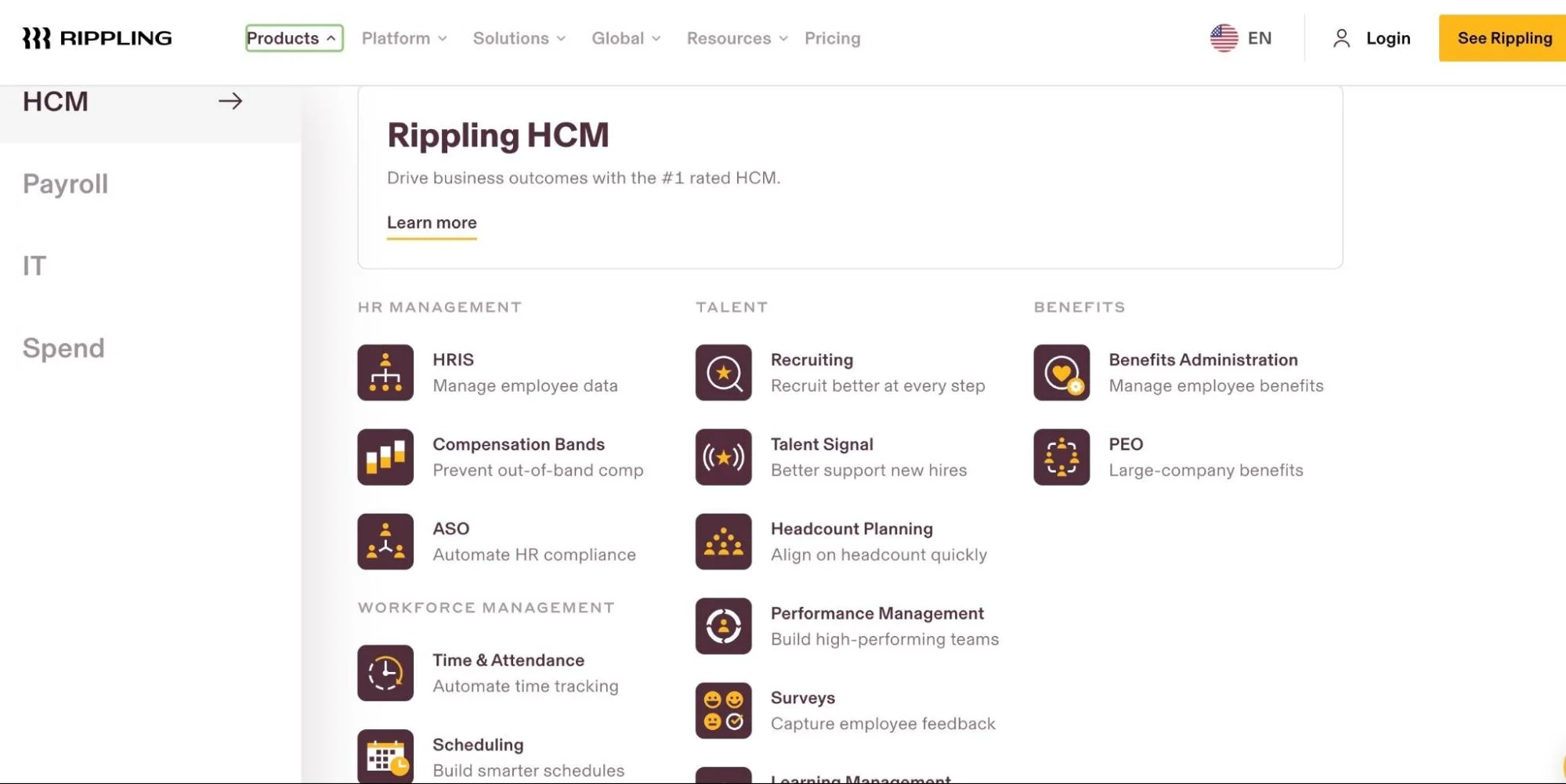

21. Rippling – Payroll and HR management

Rippling manages payroll processing with real-time calculations, ensuring timely payments. It also tracks, files, and pays taxes accurately, keeping the business compliant.

Rippling also integrates with HR and IT systems to ensure smooth employee onboarding, benefits administration, time and attendance tracking, and compliance monitoring.

Pricing: Upon Request

Understand And Optimize Your Cloud Spend – The Easy Way

As today’s business environment becomes increasingly turbulent, you need to be able to adapt quickly based on data — not speculation. It’s hard to keep up with cloud financials when you have no idea what, who, or why your costs fluctuate.

Instead, you want to know precisely where you could be losing money. It’s also essential to identify what could happen if you increase or decrease investments in a particular area.

Few cloud financial management systems can do that since most just show your total costs and averages, not precisely what you spent on each service, customer, team, product feature, project, etc. But CloudZero does – across AWS, Azure, GCP, Snowflake, and more platforms.

to see how CloudZero can help improve your FP&A program in days, not months.

to see how CloudZero can help improve your FP&A program in days, not months.