Alphabet. Netflix. Shopify. Amazon. Meta. Microsoft. These are just a few of the leading tech companies that recently laid off thousands of employees.

Slashing jobs, because it is often one of the biggest expenses for tech companies, may seem like a quick fix, but it can be counterproductive, especially when it impacts experienced engineers.

So, what are the specific reasons tech companies are cutting jobs? And what are the alternatives to layoffs?

Table Of Contents

The Real Reasons Tech Companies Are Laying Off Employees

By understanding what’s causing the layoffs, we can evaluate what alternatives exist. Most companies that announce sweeping layoffs give a reason or more in their internal memos and public briefings.

Amazon

In a January 2023 email to employees, CEO Andy Jassy announced that Amazon would be cutting jobs in Amazon Stores, People Experience, and Technology Solutions.

That made sense. As more people ordered essentials online during the pandemic, Amazon nearly doubled its workforce to meet demand.

Today, Amazon has seen its sales slow down as normalcy returns. A weak economy and rising interest rates further complicate the company’s situation. In addition, Amazon froze hiring for corporate staff, limited warehouse expansions, and canceled some of its experimental projects, notably its telehealth and video-calling projector for children.

Reuters found an internal Slack message in which Elon Musk instructs Twitter’s team to reduce infrastructure costs by $1 billion in a year. The message noted the cost reductions would target resource consumption in Twitter’s cloud services and extra server space.

The company also cut 3,700 jobs in late 2022, saying it was bleeding $4 million a day.

Alphabet

Google’s parent company announced it was cutting 12,000 jobs because it had “hired for a different economic reality than the one we face today”. CEO Sundar Pichai also noted that the layoffs meant to retain people and roles that “align with our highest priorities…”

Zoom

Zoom’s workforce increased considerably as people exponentially used video conferencing for work and personal interactions during the pandemic.

CEO Eric Yuan linked an uncertain global economy to the decision to lay off over 1,300 Zoom employees. But it appears that decreased demand for video conferencing services post-pandemic may have also contributed.

Microsoft

In a memo to employees, CEO Satya Nadella attributed the decision to lay off 10,000 people to a decrease in digital spending post-pandemic. He did add that the layoffs were part of Microsoft’s cautionary step in light of a pending recession.

SAP

Europe’s largest software company said in its earnings report that would cut just over 2,800 roles from its 112,000-strong staff to invest “where it really matters” for the company “to be competitive in the future”.

Shopify

Like Amazon, Shopify doubled its workforce in the past two years to handle its booming e-commerce business.

In a memo to employees, CEO Tobi Lutke said a pullback in online sales meant it had to cut jobs in roles that were nice to have but “too far removed from building products”, duplicates, and overspecialized ones.

Netflix

Streaming titan Netflix has seen its subscribers decline for the first time in a decade following a massive boom over the past three years. Netflix revealed it would lay off about 450 employees to align costs with revenue growth.

Meta

Facebook’s Meta also increased its staff by 60% due to increased usage and ad spending during the pandemic. The return to post-pandemic life has reduced ad spend and Meta’s revenues. In a memo to employees, CEO Mark Zuckerberg said that competition and a “macroeconomic downturn” also contributed to laying off the 11,000 employees.

Salesforce, Lyft, IBM, Coinbase, PayPal, Stripe, and Snap have all laid-off workers recently.

Interestingly:

- Those laid off had been in their new roles for an average of 2.5 years but had a median experience level of 11.9 years, according to 365 Data Science, suggesting big tech had poached them from smaller companies.

- The most affected people were in HR and recruiting (27.8%). Software engineers made up 22.1% of laid-off employees.

The good news is that smaller companies, which are less affected, may be able to re-absorb the laid-off talent.

But Are Tech Layoffs Necessary?

Considering the reasons above, most tech companies are laying off staff because their growth rates have since returned to pre-pandemic levels.

Tech companies went on a hiring spree and paid lavish perks to attract top talent. These companies are now returning to normalcy (sort of), but with bloated payroll expenses, they want to correct.

Some fear a possible recession. Others are restructuring to keep only the most necessary people and roles. A rise in interest rates in the US, intended to curb inflation, is also causing companies to hold off on borrowing for investing.

Still, companies like Apple, Airbnb, LinkedIn, AMD, and Palo Alto Networks have not announced job cuts. How did these companies manage to stand out from the crowd?

10 Alternatives To Laying Off Tech Workers

The companies found alternative ways to keep costs under control and profitability high. You can also compete without damaging employee morale by following these 10 tips.

1. Think: Optimization — not necessarily reduction

The challenge for leaders is to get more done, with less. The remaining team at Twitter, for example, must reduce server and cloud service costs by $1 billion a year.

This move could prove successful if Twitter can reduce unnecessary costs and keep its users satisfied.

Otherwise, cutting engineering costs indiscriminately could hurt the social media platform’s usability, its ability to launch new features to remain competitive, and therefore its user base, revenue, share price, and market valuation.

A simple method for maximizing ROI is to measure where your costs are going through unit cost analysis. By measuring cost per message, per feature, or per API call, you can see how much you spend supporting each item, user, or feature.

Comparing the item’s returns can also help you decide whether you want to invest more in the areas that perform best. Or, you may choose to reduce allocations for areas that are underperforming.

2. Be more strategic about team makeup

Tech industries are extremely competitive, so hiring and keeping good engineers can make the difference between releasing user-requested features in time or losing users to the competition. Next, you must proactively evaluate performance from a cost standpoint.

How?

Among other things, you can measure your cost per project, per team, or per feature a specific team develops. With these insights, you can compare your team’s efficiency to others in your niche or to others in different branches.

3. Ensure you get full tax credits by applying for ERC

You can still claim a 100% refund of payroll taxes you paid to your employees during the Covid-19 pandemic.

Your company may be eligible for the IRS Employee Retention Tax Credit if you encountered substantial difficulties during the COVID-19 crisis but retained W2 employees on your payroll. However, you’ll have to file the ERC claim by either of two deadlines, depending on your quarterly payroll tax filings:

- April 15, 2024, for all quarters in 2020

- April 15, 2025, for all quarters in 2021.

This means you could review the wages you paid after March 12, 2020, for the entire duration ERC was active, to see if your business is eligible. You may receive up to $26,000 per employee, so it’s worth looking into if you haven’t already.

4. Move to the public cloud

Adopting a cloud-first policy can reduce your IT costs compared to building, running, and maintaining your own systems.

- The transition from an in-house database to the Amazon Web Services operations model enabled Netflix to scale immensely and keep costs low.

- Airbnb recently switched from its own backup system to AWS’ “almost free” backup system.

You’ll need tight cloud governance, though. Otherwise, infrastructure and application costs may rise with overzealous usage.

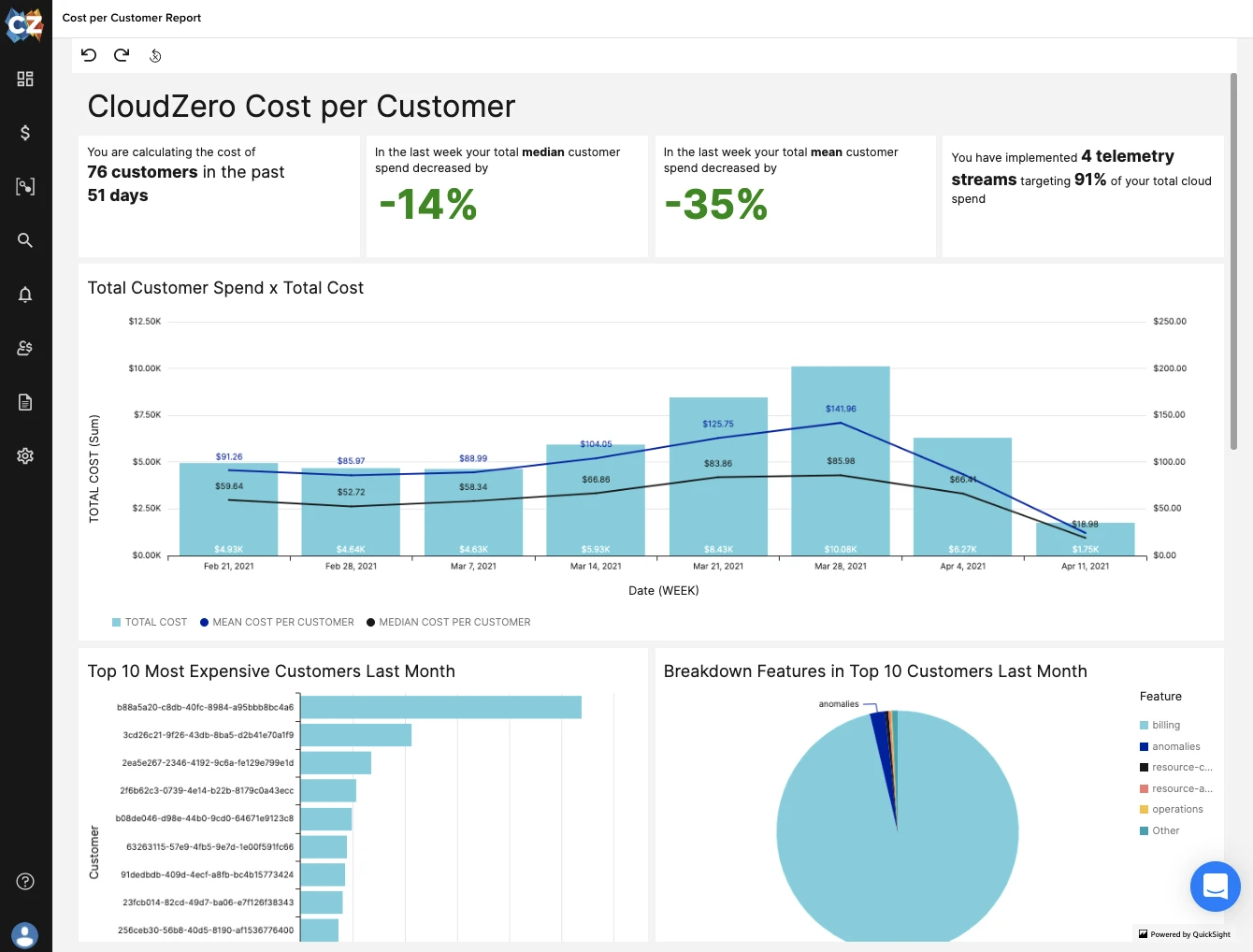

5. Review your cost per customer

Many organizations and cloud cost tools calculate the Average Cost Per Customer (ACC).

However, this is an inaccurate measure of how much a specific customer costs to support.

ACC equalizes everyone, even if you are losing money or earning a thin margin on specific contracts with customers.

Cost per customer, on the other hand, reveals to you how much you are spending to support a particular customer, in turn revealing how much you earn per customer. You can also analyze how your margins vary per customer.

This level of cloud cost intelligence is powerful because it can help you tell the following:

- How to set pricing for your SaaS product or service to protect your margins

- How much discount you can afford to give a specific customer at renewal

- What types of custom quotes you can offer to specific customers

- What customer segment(s) are most profitable so you can focus your marketing efforts

- How your costs might change when you onboard a specific number of customers at any time

Measuring cost per customer can help you find out if you are charging your worth or not, so you won’t leave money on the table.

See how ambitious companies like SmartBear, NinjaCat, and Upstart are measuring cost per customer here.

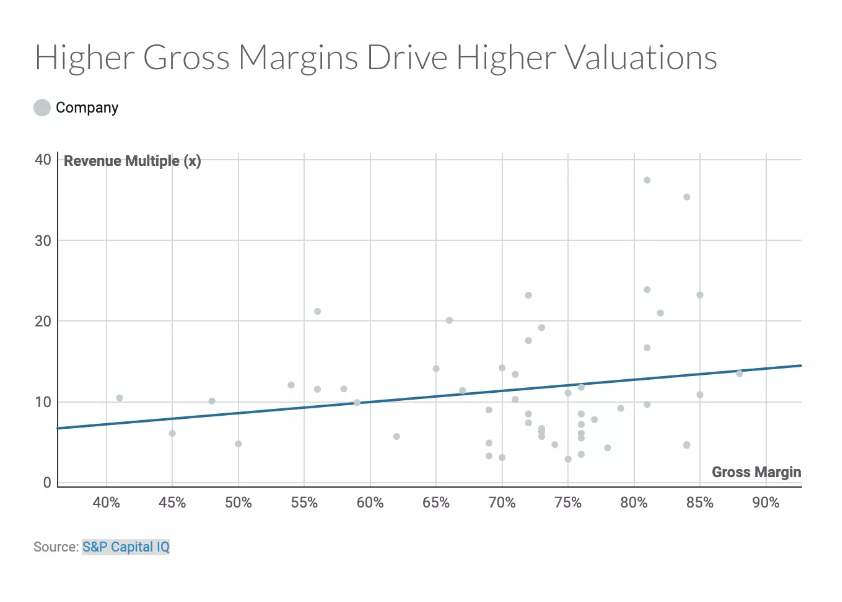

6. Prop up your gross margins and profitability to attract funding

As investors hold back fearing a recession, financing has become harder to acquire. High-interest rates have made borrowing expensive. Stock prices are also falling because companies are reporting weaker margins than expected.

Share prices for companies like Meta, Zoom, and Shopify have been declining since Q3, 2022. The companies’ stock prices dropped after they announced weaker profits and revenues than expected.

Other companies are lowering their internal valuations. Stripe, for instance, reportedly lowered its internal valuation from $95 billion in 2021 to $74 billion in July 2022.

Maximizing your gross margins is a better way to boost your market value, attract investors, and get funding to boost your growth. But how?

The place to begin is to measure your cost of goods sold (COGS).

Could you be over-reporting your COGS, for example?

Perhaps you are padding your COGS because you are afraid of misrepresenting to investors. Or, you may be applying a default percentage that feels “safe”, so in case you’re audited, it won’t be an issue. That might look something like this:

Whatever it is, it could be hurting your market cap — and your ability to attract ideal investors, borrowing affordably, and, ultimately, growing despite a slowed economy.

7. Stop bleeding with real-time anomaly detection

A real-life example of the importance of real-time cost anomaly detection occurred when an Adobe engineering team accumulated $80,000 per day for an engineering job on Microsoft’s Azure platform. A week passed before they detected the bleeding, costing them over $500,000.

It took Milkie Way just a day to burn through $72,000 on testing Firebase + Cloud Run. A payment waiver from Google saved the company from going bankrupt.

At CloudZero, we recently prevented a $70,000 annual cloud cost increase driven by a single customer in four clicks. We caught the issue before it ate into our profit margin thanks to CloudZero’s real-time cost anomaly detection.

Here’s the deal. Overspending often begins with a technical issue that engineers identify first. However, because they aren’t as cost-conscious as finance, they may not stop or report the bleeding immediately. By the time finance receives the bill, it’s often too late to make any changes.

8. Make finance and engineering speak the same language

Speaking of engineers and finance, it’s crucial you help engineers understand how their technical decisions impact your entire company’s finances and competitiveness.

Often, engineers strive to create high-quality solutions and release them frequently, sometimes at the expense of cost control. For example, engineers typically allocate the maximum amount of resources possible to accommodate peak traffic.

Meanwhile, finance may want to cut costs to stay under budget, which could impact engineering velocity, innovation, and even security unintentionally.

With actionable cost insights they both understand, you can help them break down silos and prevent overspending together. For engineers, that can mean understanding their cost per feature, cost per project, cost per deployment, and cost per environment, whereas finance would need to know the cost per customer, per tenant, per project, etc.

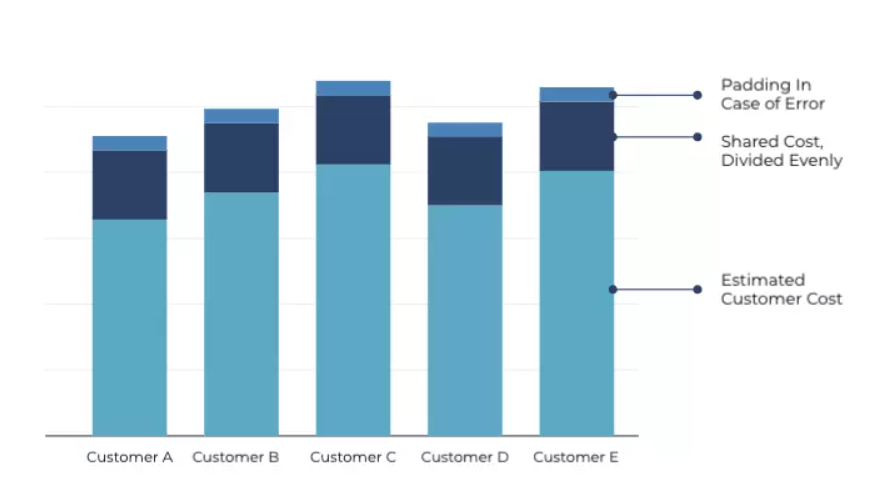

9. Implement shared services

Using shared services across business units can help you reduce costs by 15% to 30% within 18 to 36 months. The highest cost reductions can reach 25%, according to Gartner.

Perhaps you’re wondering: Isn’t sharing services going to obscure my unit costs?

Well, that depends on the cloud cost platform you use. With CloudZero’s code-driven approach, you can identify your costs per tenant in a shared, multi-tenant architecture.

10. Consolidate where possible

Gartner also estimates that consolidating enterprise data centers can help you achieve savings of 10% to 20% on data center spending. To save money, the firm recommends switching from traditional data centers to data-center switching architecture.

What Next: Stop The Bleeding With Cloud Cost Intelligence

Automation, Artificial Intelligence (AI), and virtual assistants can help you save on staffing costs. You can also augment your employees’ capabilities with bots.

If your goal is to keep your people, there are other cost-saving options you can pursue besides layoffs. With CloudZero’s Cloud Cost Intelligence platform, you can:

- Analyze your unit costs, including COGS, cost per customer, cost per feature, cost per project, and cost per team. By setting your prices to reflect the value you deliver, you can increase your revenue and profitability.

- Foster a cost-conscious culture that optimizes cloud costs by aligning engineering and finance.

- To protect your margins, review your contract with your most expensive customers at renewal.

- Identify the people, products, and processes driving cloud costs with reliable chargebacks and showbacks. Then see where to cut costs and where to invest more to maximize returns.

- Keep your budget on track with noise-free cost anomaly alerts sent to your Slack or email.

You don’t have to take our word for it. Using CloudZero, Drift, Obsidian, and ResponseTap reduced their annual cloud costs by $2.4 million, 25%, and 18%, respectively.  to see how CloudZero can help you too.

to see how CloudZero can help you too.